Withdrawing money in Ukraine

You can see in the following clip how the withdraw in Ukraine works.

Please watch this clip to the end, because in the second half, a peculiarity is shown that scares many foreigners at the ATM …

Sorry, this video is with German audio.

Which is the best bank card for withdrawing money?

The Ukraine is a country, where still a lot is paid with cash. You absolutely need cash to keep going.

Many taxis have no possibility to accept payments with electronic cash, and it is currently completely inconceivable in public transport. The tickets on the bus or tram cost depending on the city 2 to 3 Hryvnia (UAH). These are the equivalent of 8 to 14 Euro cents!

That makes any credit card payment uneconomical. Note: Wherever it is expensive, you can pay by credit card. 😉

I have brought the currently best credit cards on this special portal to Ukraine for testing. Here you can see the evaluation of the cash withdrawal on 06/27/2015.

Comparison of exchange rates when withdrawing cash

| Provider | Components of a cash withdrawal at the ATM | Link to the provider | ||||

|---|---|---|---|---|---|---|

| Withdrawal amount | Exchange rate | Amount in home currency | + International service fee | = Debit from the account Difference to the best provider |

||

| Top provider of this special portal | ||||||

Number26 |

5.000 UAH | 23,49072 | 212,85 € | 0 € (0 %) | 212,85 € +/-0,00 € |

|

DKB |

5.000 UAH | 23,44517 | 213,26 € | 0 € (0 %) | 213,26 € +0,41 € |

|

Comdirect |

5.000 UAH | 23,2258 | 215,28 € | 0 € (0 %) | 215,28 € +2,43 € |

|

Conclusion of the test and recommendations for action

DKB Visa Card (free)

This test, of course, is a snapshot, as the exchange rates can be quite different today. Since this was not my first withdrawal test abroad, I can assure you that the DKB Visa credit card is often (but not always) the best or is one of the best possibilities.

This time, it has reached the respectable second place. And the expensive cards of the Sparkasse, Volksbank, Barclays and American Express were not included. Here, the difference would have been even greater.

DKB: is still my favourite credit card for journeys, but …

Number26: You should definitely have a look at this one!

Cool: partly transparent MasterCard at Number26

For people, who want to get an additional credit card for journeys abroad, the free MasterCard of Number26 is a highly interesting option because:

- the account opening and card issuing takes place without credit check and Schufa (credit investigation company) entry,

- one can only dispose of money, which has been transferred to the account in advance (prepaid/security aspect!),

- its entire use is free of charge!

- the usual international service fee does not apply (not even at card payments)

- the account usage and account opening is possible completely and easily via a Smartphone.

Got curiosity?

Then take a look at the 12 most important facts about Number26 before you open the account.

“Get the prepaid MasterCard now”

Note: The MasterCard will arrive within 1-3 days after the account opening in your mailbox. This is a huge time advantage over the DKB and Comdirect. At the latter two, the shipping takes around 14 days. This can sometimes be too close before departure.

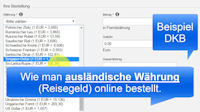

Get the cash before the departure

Video is available in this German article

If this is for your peace of mind, you can get the cash in the local currency before you arrive in Ukraine (this also applies to many other countries). How easy this is for DKB customers, you can see in this article + video: Crazy: the fastest travel money service (Article is in German).

Ordering cash is slightly more expensive than if you withdrew it directly from the ATM at the airport, because of the cost of postage.

However, it may be useful in the following cases:

- You do not arrive at an airport,

- You are familiar with the exchange rates and order the foreign currency at a good rate.

In my case, the ATM in the arrivals hall upon arrival at Kiev-Zhulhany Airport was broken. This was still the case at my departure 5 days later. Admittedly, I was able to find two further ATMs in the departures hall.

Tip: Prepare the cash for the taxi drivers

If you make use of the possibility to order cash in advance, then order at best “small bills”. As a foreigner, you will stand out quickly in Ukraine. There are almost no tourists there, even less since the conflict in the Crimea and eastern Ukraine.

Therefore, it happens sometimes that the taxi driver friendly makes you understand that he/she unfortunately does not have any change …

The most expensive taxis are the ones waiting for their passengers in front of the airport, train station or in the city. Often, you only pay 1/3 of the price, if you order a taxi through the hotel or ask a local to do it for you. As the highest saving, I was able to save as much as 80% of the price!

Safety instructions for withdrawals at ATMs

ATMs are often hanging on the wall outside of bank branch offices of busy streets. There is actually no problem of safety, because it is customary to withdraw money like that.

Nevertheless, the following basic rules should be followed in Ukraine:

- Cover the keyboard with the other hand when entering your PIN,

- Pay attention to additionally attached equipment,

- Do not withdraw the money late in the evening or in a drunken state,

- Withdraw money if possible accompanied,

- Do not forget your credit card in the end, because, unlike in Germany, the credit card will be ejected after the cash and the receipt.

Even if you have chosen the English language at ATMs, it may happen that a screen will suddenly be presented in Cyrillic letters. As you have seen it in the video clip, this is an additional safety note.

No matter what option you select, the safety note will disappear and your credit card will finally by eject.

The note explains that the bank will never contact you by telephone to ask for details of your credit card. This is rather a note for locals, as there is also the possibility to make transfers at such an ATM with card and without card, and lately, a lot of fraud has been committed.

As mentioned, this does normally not apply to foreigners.

Currency exchange in exchange offices and banks

Of course, one can exchange Euro-cash in banks and exchange offices. Since there are almost no tourists, a bank branch office will be your contact point for currency exchanges. Do not be surprised, if you are asked for your ID-card or passport and if possibly a copy is made of it.

Due to the current crisis situation, there were quite a number of legislative changes regarding the “foreign exchange trade”. I do not want to describe this in detail, as it is anyway subject to changes. As long as you exchange from Euro to Hryvnia, it is good for the country and the maximum daily limits are likely to play a smaller role than in the reverse direction.

Nevertheless, you should give it a few minutes for the exchange, until all formalities have been completed.

The exchange from EUR to UAH is gladly made, but it is not an every day task and the bank employees may have to reinsure by phone on the current state of applicable law due to the frequent changes. This, at least, applied to my currency exchange in Kiev.

Questions, additional information or suggestions?

The comments feature is ready for you as a smart bank customer. Please use it for any questions, additional information or suggestions. If important information should be missing, I will do my best to get it through my network in Ukraine.

Thank you for reading this article to the end and possibly giving it a good rating.

Many thanks to Aljona, who was an excellent assistant to me in Vinnytsia.

PS: What happened to the withdrawn money?

Find the corresponding video in this German article

During my visit in Ukraine, I have originated the project Bücher statt Krieg (books instead of war). Do you still have time to take a look at it?

The cash withdrawals (DKB/Comdirect) from this test went in the purchase of books on the same day and in the purchase of a printer and router in the following week.

My friend id stuck in Ukraine (I don’t know the city) He tried to withdraw money from 5 banks with no luck.

He asked me if I can send him some cash. Is it a goo idea to send the money and what suggestion you may have about his problem so I can pass it on to him via E-mail?

You can use Western Union. So he can withdraw money on every WU counter he find 🙂

What’s the maximum you can withdraw in a single transaction from a ATM?

Thanks.

At the time of writing the article it was 5,000 UAH per procedure, but one could withdraw several times in a row. We do not what the status is now, because since then weh ad not been to the Ukraine