TransferWise as current account

TransferWise is no current account like we are used to by DKB or ING. However, TransferWise can take services for people, who want to create an alternative or supplement for themselves.

Very practical: Modern account with card and app without monthly fees.

Easy account opening ► https://transferwise.com/en/borderless/ ✅

Why TransferWise?

This article appears in our series “German-speaking alternatives abroad”. The kickoff has been made by the article Securities account for wealthy people in Liechtenstein. In contrast to Germany, there are no German-speaking providers abroad where you can get everything or at least in an appropriate form of it.

One can compile the own individual account system like in a module design. Our special portal is helping you as a research and implementation tool.

TransferWise is presented to you in this article as an option for cheap payment transactions in, with and outside Germany. You can get more modules by e-mail.

This is what you get at TransferWise (free of charge):

- a SEPA-capable IBAN

Currently, there are BE-IBANs (Belgium) for Euro-accounts. - optionally further international account numbers

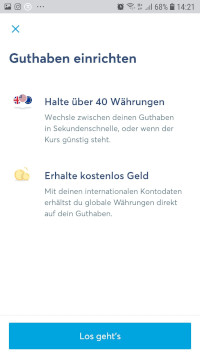

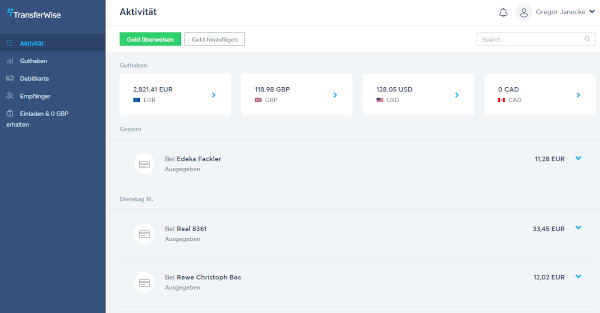

For example in Great Britain, the USA, Poland and Australia (foreign currency accounts) - Possibility of holding 40 currencies

TransferWise has not been a direct participant of deposit insurance systems. It is no optimal place for keeping asset, but for the payment transaction in Euro and other currencies. - Debit-Mastercard

The Mastercard always debits directly from the account in which currency you pay. Therefore, the foreign currency fee does not apply. Except for the case of an empty account, then you have an automized internal transfer. There will be a small exchange fee, but the card can be used. - Desired PIN

The PIN of the Mastercard can be changed at ATMs that permit it. The participants of our seminary in Florida took a lively advantage of it. - Withdraw cash free of charge

TransferWise does not charge fees for the first (converted) 200 British Pounds per month that are withdrawn from an ATM. Above that, you pay a 2 per cent fee of the withdrawn amount.

Account and card are inconditionally free of charge and also the cash withdrawals for the first aprox. Euro 230 per month. There are fees for transfers. Within the Euro-area, it is a lumpsum of 63 cents. It this a tolerable downside for you?

If yes, then you can start with the account opening:

Free debit Mastercard

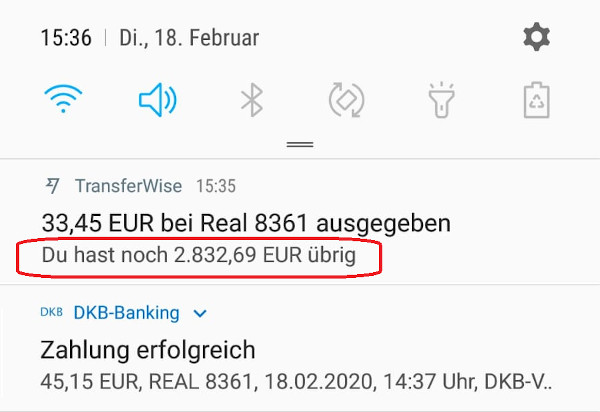

The green Mastercard with the small curve (Does remind of Apple?) looks fresh and also feels like this when paying. Contactless payments are, of course, possible and you receive a push-notification immediately when having an Internet connection:

In contrast to my DKB-main account, you are always notified about how much money is available. I consider this practical. There are also push-notifications, if money has been transferred into the account.

The Mastercard is automatically linked to all your optional currency accounts.

This has the advantage for you that it always debits from the currency balance with which you pay or in which you withdraw money, so the foreign currency fee is omitted. When you use the ING-Visa-Card, you will be charged 1.75 per cent foreign currency fee.

If you should not have enough balance in this corresponding curreny, the card will still work. It will be debited automatically from the account with the lowest exchange fee. In my case, it was 0.41 per cent on a US-trip. Bearable, isn’t it?

Withdraw cash

Cash can be withdrawn with the Mastercard. A minimum withdrawal amount like at the DKB and ING does not exist. However, only the first 200 British Pounds or the countervalue in another currency per month are free of charge. In Euros, this would currently be about Euros 238. This is even enough for many people!

Withdraw € 238 per month free of charge!

Of course, you can withdraw more. The maximum daily limit is at British Pounds 1,500 – so about Euros 1,785. You can withdraw per month a maximum of converted Euros 4,760 using the card. The fee is then 2 per cent of the withdrawal amount.

Especially, if you have already exchanged the money in the account at a favourable point of time before starting the journey, it is very comfortable to withdraw it free of charge using the TransferWise-Mastercard … just like I did here in my secondary home.

Direct debits

Direct debits are especially for us efficiency-loving Germans a blessing and therefore, the desire for adding direct debits has been presented to TransferWise repeatedly. Since the end of 2019, the switch to the Belgian IBAN (BE-IBAN) is possible. You can consign your TransferWise-account number as your current account at energy provider or telephone provider of your choice. This works flawlessly!

Likewise, Instand-transfers to the TransferWise-account with the BE-IBAN are possible. So you can e.g. get the incoming money transfer at a business account use within seconds and then send the product. Very practical.

Standing orders

Programming of standing orders has also been a desire of German people towards TransferWise. This has not yet been implemented, but you can assume that this will be available in the future.

Currency accounts can be added fastly and for free.

You can conveniently consign payment receivers and so you can transfer to domestic or foreign bank accounts with only a few mouse clicks.

Online banking and banking app

In contrast to quite a few other FinTechs, you can use TransferWise through its app, but also and to the same extend on the PC or notebook using the classic online banking.

Other currencies

You can manage more than 40 currencies with (your new) TransferWise-account. You even receive a local account number for some of them, so that others have an easier time to transfer money to you or so that you can transfer money easily to the specific regions of the world.

For example, I really love to conclude property purchases in the USA using TransferWise. Otherwise, this would be cumbersome and expensive.

Besides a US-account number, you can add accounts for Poland, England, Australia and New Zealand.

The other accounts are held without a personal account number. However, you can assume that regional account numbers will be added little by little. There is a particular interest in Canada, Switzerland and Norway. Russia would also be interesting in the future.

TransferWise is a multi-currency-account, if you choose to add further currencies completely free of charge. This can be done with only a few mouse clicks and offers a comfortable overview.

International transfers

Cheap international transfers are the origin of TransferWise and I must admit that I myself like to use this feature since many years. I have sent transfers to Poland and to the Ucraine (small amounts) and bigger amounts to Canada and the USA.

It is convenient that you can also transfer from Canada and the USA back to TransferWise, because TransferWise is well linked to the local banking system. This has even surprised bankers in North America, because international transfers are a complicated and expensive matter there.

TransferWise is an internationally functioning multi-currency current account!

Open TransferWise as a business account

This is good news and an advantage compared to many other neo-banks: You can open the TransferWise-account in the name of a legal person, such as a UG (business association) or GmbH (LLC); also legal forms of other European countries, like a Limited from England or Cypres are possible.

Even an account opening in the name of a US-LLC or corporation is possible, which could possibly be interesting for the owner of a vacation home in Florida – of which we talked about in the previous article.

Moreover, a debit Mastercard can be ordered as a business card (in Germany, but not yet available in the USA).

Questions about the account opening or usage?

Please use the comments feature at the end of this page. You are welcome to exchange your experiences and tips with us and our community. A heartly thanks for your smart commitment.

Further articles about TransferWise:

- Comparison: DKB and TransferWise

- TransferWise for international transfers

- International transfers for real estates (purchasing/selling)

PS: TransferWise has confirmed to me yesterday again that the Borderless-account – which is described here in the article – is used by a growing number of Germans as their secondary and main account. Interesting. How about you? Would you like to add TransferWise to your life?

Leave a Reply