Tomorrow: Open the free current account for a better future

Tomorrow is a German banking-app with Visa Card, interesting as a secondary account for personal payments (current account) and completely free of charge – except if you wish to pay an account management fee voluntarily to support future projects.

Open Tomorrow in the ► app store or ► open the start page or ► Open the account comparison ✅

Tomorrow’s current account in an overview

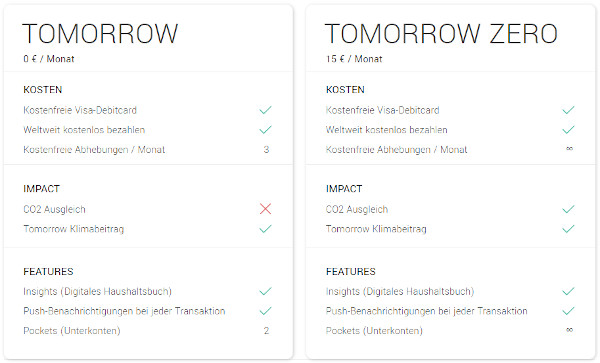

- free account management

You can voluntarily pay € 15 monthly account management fee, if you want to support future projects - free Visa Card

- free cash withdrawals

3 × when choosing the free account management or unlimited number of withdrawals when choosing to pay a monthly fee - no foreign transaction fee for card payments in foreign currencies

- possibility of setting up free subaccounts (Pockets)

2 at a free account management, otherwise an unlimited number of subaccounts - further features are in development

- account opening through app from any place of the world possible, in German or English language, Schufa-free!

Tomorrow-app: pretty easy!

Procedure of account opening

-

download and open the app

-

fill the account application (very easy)

-

legitimating through video call

-

activation of the banking-app including notification of personal IBAN

-

immediate use of the app (e.g. transfers)

-

wait up to 5 days, until the Visa Card arrives by mail

-

activate the Visa Card in the app

-

Done!

“Negative-list” – Is this secondary account okay for you?

There are currently some features that we are used to from our favourites, such as the DKB, that do not (yet) exist at Tomorrow.

Please ask yourself the following question:

Do I need that at my free secondary account?

You know: The focus of our smart bank customer mindset is not complaining about everything, but to assemble the best features of different providers individually.

- no browser-banking (however, it is in planning) = You can currently only do the banking with the app

- no “EC-Karte” = Debit-Visa-Card (the Girocard-system seems to be an obsolescent model anyway)

- no credit card = the Visa Card is directly linked to the current account and can only be used with balance. Therefore no indebtedness is possible and neither is a Schufa-query nor Schufa-entry necessary.

“Positive-list” – 100 % sustainability of a bank

Many banks or related providers at the financial market support negative things in our world with their actions. For example, loans are granted to companies that buy “water rights” with it and privatize natural assets (Nestlé). Or a leading pension fund of US-American teachers invests money in weaponry production companies. I have consciously chosen two examples from abroad in order to keep things in Germany cool.

Tomorrow would never do this.

In any case, this is their statement.

They currently cannot do it technically, because they are not offering commercial financing nor investment products.

However, they offer to neutralize the own CO₂-footprint with a voluntary monthly account management fee – there are two account models and one is free of charge:

After the “ice age” accounced in the 1970s, the predicted “German forrest dying” in the 1980s and the conjured rise of the seven seas of one meter or more from the 1990s, the chemical combination “CO₂” is now used to push a political agenda.

People, who have read the ever valid strategy in “The Crowd: A study of the popular mind” by Gustave Le Bon (1895) understand, why the huge mayority reacts, like it reacts.

The through and through positive intention of Tomorrow as a bank, which is being a part of what is improving our world, is what counts for me personally.

Tomorrow wants to help to improve the world!

Tomorrow states to invest their revenue (account management fees and fees from internal settlements of card payments) in projects that improve the world.

With my very first payment, already 94 m² of rainforest is protected?

What they do, they do according to the current state of knowledge. At a retrospect in the year 2025, we will be able to better evaluate, whether every wind turbine had a good outcome for people, animals and nature. 😉

How can we support that being bank customers?

By redirecting some payments from formerly used cards and accounts. By doing so, the other bank earns less through us and Tomorrow more.

Let’s assume that Tomorrow really does good things, then we have contributed with our payments.

If millions of bank customers contribute with a drop, then a whole flood of positive things is the result.

Agreed?

How will it continue?

Being the editorial, we have added Tomorrow to our list of frequently observed banks and will accompany the further development – critically or praisingly, depending on the course. You will be updated, if you are already subscribed to our Sunday Mail.

Questions and experiences on Tomorrow?

We are very happy to exchange with each other about the development of Tomorrow through the comments feature at the end of this page. Tips, ideas and experiences are as welcome as questions from the circle of our smart bank customers. A hearty thanks!

Leave a Reply