Switzerland

Switzerland is situated in the heart of Europe and enjoys a respectful reputation all around the globe. It is specially known and notorious as a haven for international assets.

Contents

| Currency | 1 Swiss Franc = 100 Rappen |

|---|---|

| Abbreviation | CHF (officially), FR or SFR |

| Exchange rate (21.02.2025) | 1 EUR = 0.9397 CHF 1 CHF = 1.0642 EUR 1 CHF = 1.1136 USD 1 USD = 0.898 CHF |

On this page, you will find special banking and financial information on Switzerland.

Please do not hesitate to contact our editors by using the comments box at the bottom of this page, if the information that you are looking for is not mentioned.

Currency Converter

=

Course of the exchange rate over the past two years

This price development over a period of two years is for your visualization of the course of both currencies to each other.

Payments and currency exchange

Card payments

In Switzerland, the German bank cards (Maestro and V-Pay-Card) are accepted everywhere. The acceptance of the credit cards Visa and MasterCard is also greatly widespread.

Cash at ATMs

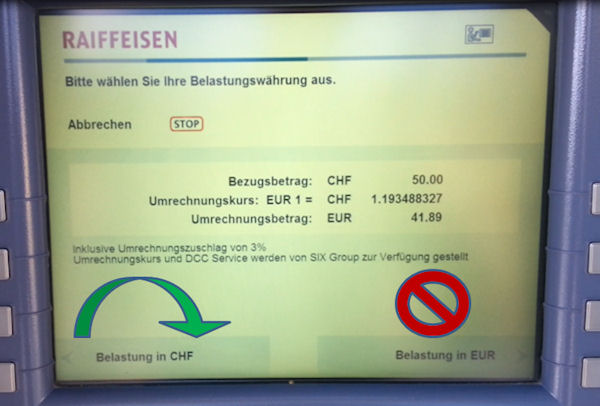

ATMs (Swiss German: Bancomat) are abundant in cities and on the countryside. At withdrawing, quite often the question appears whether the card account should be charged with CHF or EUR. Please always choose CHF, because the ATMs charge a foreign exchange fee of 3 up to 3.25 % for the conversion. Most German banks, however, do not charge any extra fee for the conversion.

Cash withdrawals with the following German bank cards are free of charge: top-reisegeeignete Bankkarten (the best bank cards for journeys).

Please always choose „ Belastung in CHF“ (Charge in CHF), as shown in this photo. Only then, your (main) bank will bear the currency exchange and this saving alone provides you with the better rate. When withdrawing CHF 250, the financial difference is EURO 6.53, if you opt for the other button. Please be careful at such or similar-looking queries.

Traveller´s cheques

Traveller’s cheques are hardly accepted in Switzerland.

Currency exchange offices

Although Switzerland is surrounded by the foreign currency Euro, there are surprisingly only very few currency exchange offices. You can find them at the airport and in major cities (e.g. Western Union). However, almost every bank branch office changes Euro into Swiss francs. Even at international hotels, one can change money, but this is not the most favourable option.

Experiences and recommendations

On a trip to Switzerland, one does not have to supply oneself with additional travel money. It is sufficient to bring along the existing bank cards, in order to

- pay cashless, and to

- withdraw cash.

Please note that some banks charge an foreign transaction fee when paying cashless in Swiss francs and/or cash withdrawals at ATMs.

We recommend DKB-customers to withdraw cash from an ATM and pay in cash to avoid the foreign transaction fee, as this fee does not apply to cash withdrawals.

Some public toilets or parking machines accept Euro-coins. The exchange rate is not always the best option, but it works.

Entering Switzerland

Travel documents, Visa-requirement, Duration of stay

As a German citizen, you need a valid ID-card or passport when entering Switzerland (even if this is barely controlled due to the common Schengen-area).

For a stay of 90 days over a period of 180 days, you do not need any further permission. If you want to stay in Switzerland for longer, you will need a residence permit, which can be applied for at the cantonal migration office.

Declaration of cash

Cash can be transported in unlimited amounts into Switzerland.

From an amount of CHF 10,000 or the equivalent in other currencies, it is subject to declaration. The declaration has to be submitted directly on arrival at the lakeside or at the airport or at the border checkpoint by land at the Swiss customs office / immigration control section (Grenzwachkorps).

The declaration includes the identity and address, the amount, information concerning the origin and purpose, as well as details of the person, who owns the money, if it is transported for somebody else.

Die Daten werden zentral gespeichert und dienen der Bekämpfung von Geldwäsche und Terrorismus.

Securities and cheques (but no precious metals; they are considered a commodity and must be registered as such at the customs) are treated as cash and must also be declared.

This declaration must be made at the entry as well as at the exit. Missing the declaration is an offense. Legal basis: Article 130 of the Schweizer Zollgesetz (ZG)(Swiss Customs Law) and the Regulation on the control of transboundary movement of cash.

Opening bank accounts

Opening a bank account in Switzerland

Maestro-Card for the Swiss bank account

For generations, Switzerland has been known for being a discreet haven of small and larger assets. Its customers include war criminals, drug lords, dictators and relatively respectable people from politics and business up to the less important tax evaders.

However, there are also plenty of (tax-)honest people, who would like to open a bank account in Switzerland. There are no formal conditions established to open an account. In recent years, it has become more difficult to get a decent bank account, if you do not intend to deposit a couple of millions.

The best way to open an account is to visit a cantonal bank personally. Here, one can also rent a deposit box at moderate Swiss conditions.

There are unnamed bank bards at Travel Cash.

The times of numbered bank accounts and bank-overlapping post are gone for new account openings. Account openings are now part of the new white-money strategy of Swiss banks, which implies that account holders agree with the abolition of the bank secrecy and data exchange with the home country.

Im Allgemeinen sind die Konditionen von Schweizer Banken nicht so gut, wie man es von deutschen Banken gewöhnt ist.

Opening a bank account in Germany from Switzerland

The challenge when opening a bank account in Germany through the Internet is the identification of the customer according to the rules of the Money Laundering Act. This requires in § 4, clause 3, number 1 the place of birth. This is not stated on Swiss ID-cards and passports, thus makes the legitimating through the new video-chat procedures difficult.

The DKB is the most requested German bank account by Swiss people.

There are cases in which Swiss people have crossed the German border and stated their place of birth in the PostIdent-procedure in another way. That this may work at any post office is uncertain.

The DKB accepts the procedure with the ID-form of Swiss citizens as described here: DKB Legitimation (DKB Legitimating).

International Transactions

When you do bank transfers between Germany and Switzerland, you must distinguish whether you transfer from a Euro account to another Euro account or whether the counter account is a CHF-account. As Switzerland is surrounded by the Euro-area, there are many accounts in Switzerland, which are managed in Euros.

The transfer in Euro from a Euro account to another Euro account is processed in the SEPA-procedure and does not cost more than a domestic transfer. Therefore, it is free at many banks and takes from 0 to 1 day.

At transfers in Swiss francs or to or from a CHF-account, a currency exchange takes place. This is a classic international bank transfer and, depending on the price list of the bank, expensive fees will be charged.

If you want to save money, then TransferWise (German site) can be the intermediate. This saves the fees of an international transaction – because TransferWise creates two national transfers – and the exchange rate of TransferWise is usually even better too.

Tips and additions

Please feel free to add your knowledge and experience to this page via the comments box for the benefit of all readers. Also questions can be asked here … we thank you for your commitment!

Leave a Reply