Now Santander instead of DKB Visa Card?

Exactly at the time when the DKB cancelled the refund of foreign fees for withdrawing cash, the Santander introduced it with the 1Plus Visa Card!

Back then, I thought that this was a bad joke! I thought it wouldn’t last. I was wrong!

About two and a half years after this absolute improve of condition (for us customers, at the expense of the bank), this option still exists!

Switch or complement?

The time has come for a comparison of both credit cards! At the end of this page, you will know, whether switching is worth the trouble!

DKB Visa Card |

Santander Visa Card |

|

| Annual fee | free of charge! | |

| Opening of a linked current account? | yes (free of charge) |

no |

| Application | ► online | ► online |

| Credit line | ||

| initial credit line (immediately after card application) |

Euros 100 up to 1,000 (without proof of salary) |

Euros 2,000 (without proof of salary) |

| maximum credit line | Euros 15,000 (up to 3 times the salary) |

Euros 10,000 (with proof of salary1) |

| Can the line by increased through deposits? | yes (millions are possible) |

|

| Credit card payment | ||

| Fee for payments in Euros | free of charge | |

| Fee for payments in foreign currencies | free of charge | |

| This is a big difference to almost all other credit cards. Usually, there is a foreign transaction fee in the amount of 1–3 per cent! | ||

| Cash supply | ||

| at every ATM around the globethat accepts Visa-cards | free of charge | |

| Foreign currency fee | free of charge | |

| Daily limit | Euros 1,000 | Euros 300 |

| Monthly limit | Euros 30,000 | Euros 2,000 |

| Minimum withdrawal amount | Euros 50 | – |

| Interest-free period | ||

| concerning all transactions | up to the 22nd of the following month (maximum of 4 weeks) |

30 days after billing (maximum of 7 weeks) |

| Loan interest | ||

| … if you cleverly comply with all requirements … | 0 per cent | |

| … if you do not settle the account on time | 6.90 % from the day of the settlement with the current account (overdraft facility interest rate) | 13.98 % from the day of the card transaction (only when using the partial payment feature) |

| How can I avoid the loan interest? | having enough balance in the current account on the day of settlement (22nd of the month) | transferring 100 % of the card transactions until the due date (only 5 % are automatically directly debited) |

| Service and extras for smart bank customers | ||

| telephone customer service | yes Mon–Sun around the clock |

|

| Emergency card within 48 hours around the globe | yes (free of charge) |

– |

| Emergency cash (immediately possible to pick up at Western Union) | yes (3 % counter fee) |

– |

| Online vault (for important documents) | yes (free of charge) |

– |

| Partner cards | yes (as a joint account or up to 2 authorized persons) |

yes (unlimited number of partner cards possible!) |

| Refund of withdrawal fees | no | yes (see description for details) |

| Card application | ||

| Place of residence | Germany, Austria, Switzerland + German citizens abroad | Germany |

| Apply for the credit card: |  www.dkb.de |

www.santander.de |

| Please give me feedback through the comments feature about what credit card you have decided for. Also the reason why. This way, we can better tackle the smart usage (tips + tricks) in further articles. Many thanks for choosing DeutschesKonto.ORG for your research! |

||

Details about the optimal use

Santander refunds foreign fees – Instructions

There are quite a lot of people, who got the Santander 1 Plus Visa in the past two and a half years in addition to the DKB-account, because it is the …

only credit card that refunds the foreign fees when withdrawing cash!

How it works:

- Gather all invoices of the journey,

- scan them or take a photo and

- send the document with a short text that you ask for the refund of the fees to the e-mail address karteninhaberservice@santander.de.

- Done. You can look forward to the refund – visible on your next credit card billing.

Reader feedback by Robert:

12 days later, I had about Euros 60 in the credit card account.

DKB offers you two variants

More than 90 per cent of our frequent readers, who are simultaneously DKB customers, are active customers. That means that they have a monthly incoming money flow of Euros 700 or more in the account. The conditions mentioned in the comparison apply to those people.

Who cannot or do not want to transfer those Euros 700 get a free current account with a free Visa Card anyway. Also withdrawing cash remains free of charge. Only the otherwise usual foreign transaction fee will also apply and the loan interest rate is 0.6 per cent higher.

We have summarized the exact differences between active and non-active customers for you here.

I personally use the DKB-account since the year 2004 and were always an active customer and were happy to be a customer in 99 per cent of all contacts with the bank!

Oh yes: You are an active customer anyway during the first 12 months. This way, you have enough time to test, whether you want to use the bank and cards more intense.

Fair deal, isn’t it?

Tips for the optimal application

DKB Visa Card

You have read articles from me about the DKB very often. So I just embed these two links in this article:

Please note that you get a free current account automatically with the account opening at the DKB. Whether you use it or not is up to you.

Depending on where you are a current account customer now, the DKB can be a new complete solution for you or provide you with a secondary account.

You start the online application by clicking the button “Jetzt DKB-Cash eröffnen” (Open DKB-Cash now)on ► this page.

Santander Visa Card

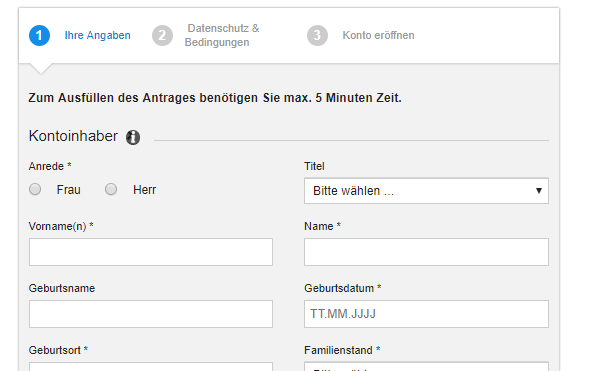

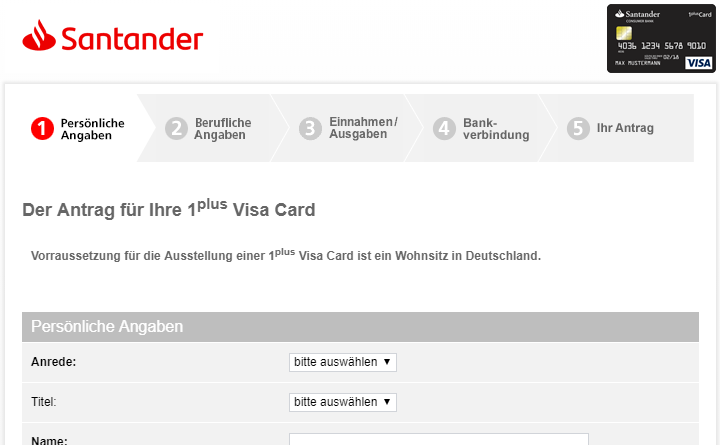

Start the online application by clicking the button “Jetzt online eröffnen” (open now online) on ► this page.

The card application at Santander is quite self-explaining. You can post questions through the comments feature at the end of this page or you can ask a staff member of the bank to accompany you by telephone during the filling of the online application.

By the way: During the online application, you can apply for an additional card for a second person. You can also state a different address for the shipping!

Increase of the credit line

Santander Visa Card

In contrast to the DKB, it is meaningful to think of an increase of the credit line already at the application procedure at Santander. There is an initial credit line of Euros 2,000 by default. You do not have to do anything, but filling the online application, then print, sign and send it.

Euros 2,000 at the first day is not something usual for a credit card. This is a comfortable advantage of Santander!

However, you can get immediately more, if you ask for an increase on the application form in handwriting and send the last three salary slips attached to the application. The higher limit is checked. If it is alright, you will get it. If not, it will remain at Euros 2,000. According to our experience, the bank currently does not bargain.

If you want to try the new credit card at first, then it is recommended to go with the Euros 2,000. If you then want to pay something more expensive – for example a journey abroad – you can recharge the card through a transfer at any time. Everyone gets an own IBAN to the own Santander credit card account.

After the expiration of six months, you can still apply for an increase.

Increase possible after 6 months

Note to the partner cards: Owners of partner cards can “only” access the credit line, but not additionally transferred balance, if applicable. The security limit is recommendable for some people. 😉

Moreover, the partner card is not entered into the Schufa.

DKB Visa Card

One can apply for an increase of the credit line at the DKB at any time and distribute it individually to several cards. Every card has an own credit card account.

However, the application for an increase is only meaningful, when you have arranged to have the salary transferred to the DKB. Then, the credit line is possible up to 3-times the salary, maximum of Euros 15,000.

Increase with salary transfer

If you do not want to have your salary transferred to the DKB, you can use the Visa Card as a prepaid card. You just deposit the money to the account and transfer it there or let it automatically be transferred. Compared to classic prepaid credit cards, the DKB has two decisive advantages:

- no annual fee, neither monthly fees

- fee-free cash withdrawals.

If you have a incoming money flow of at least Euros 700 per month to the account, then you are regarded as an active customer and can take advantage of the exemption from the foreign transaction fee outside the Euro-currency area (like presented above in the table, otherwise 1.75 per cent).

Idea: If you are a customer of both providers, you have two credit lines and can combine them in their use.

Summary of DKB and Santander

You have seen it in the table: at some points, the DKB is better, at others Santander!

It is always a good idea to ask yourself: Which services will I actually use?

If you are only rarely in countries with additional withdrawal fees (direct customer fee), then it is not important to have an option of refund.

However, if you are often in the USA, Canada, Mexico, Paraguay, Thailand – my assessment is that further countries that will introduce this fee will be added in the coming years – then the 1 Plus Visa Card is really meaningful!

Santander has the advantage that you do not have to open a current account. In the technical language, you speak of a “stand alone credit card”. You can just add it and keep your further account system or current account just as it was.

Even being a DKB-customer, you can just get the Santander Visa Card as a secondary card without worries.

The advantage lies within the combination!

Ready for an account opening?

Still have questions?

If you are missing details for the application or card use, please use the comments box at the end of this page. You will receive help through our team, which includes now a growing number of smart bank customers of our community!

Please also make sure to leave a positive feedback, if our comparison and the detailled descriptions have helped you to take a decision and one of both banks will now enrich your life. Many thanks for that!

Video about the card comparison:

- DKB Visa Card:

www.dkb.de/privatkunden/dkb_cash/index.html - Santander 1Plus Visa Card:

www.santander.de/privatkunden/konten-karten/karten/1plus-visa/

Hi,

I want to order santander 1plus visa card, But In the application part 4″Bank-Verbindung”, I am confused to what checkboxes to select(please note : I want to pay of my credit 100% at one go without interest) Can you please guide me on what to select and what not?

It is rather confusing and looks like trap.

Thank you

Hi Sushant,

If you want the 100% payment and of course without interest, than select full payment checkbox. You need the “bank-verbindung” because Santander needs an account to settle the open invoice every 4 weeks.

No worry, its not a trap.

DKB seems to support contactless payments, whereas Santander does not.

Dear all,

Santander Bank has recently introduced contactless payment.

Unfortunately, Santander Bank has started charging 1,5% on payments outside of the EURO zone. Also, the number of free of charge cash withdrawals outside of the EURO zone is now limited to four.

New conditions: https://www.santander.de/privatkunden/konten-karten/karten/1plus-visa/.

Hi,

Thanks for the information.

For the first 4 cash withdrawals, is Santander still crediting you the additional withdrawal fees (direct customer fee)??

Hi Stefan,

My understanding is that Santander does not charge any fee for the first four cash withdrawals per month.

FYI, support center of theirs advised me that these new conditions are applicable only to their new customers while there is no change for the existing customers.

Take care and best regards, Nemanja

Unfortunately, yes. Since posting of this article, we have hardly come across a bank that has improved their conditions. If they have improved something, it’s more regarding their app and usability. Regarding the pricing the conditions are rather declining.

Dear DK community,

I am an user of 1Plus Visa Santander bank. The conditions and pricing have been recently changed with new ones available here: https://www.santander.de/privatkunden/konten-karten/karten/1plus-visa/

The product itself is no longer that attractive, still worth considering.