Turn Revolut into main current account?

Also available in German language for private and business customers ► https://www.revolut.com

Guest article by Martin

In our country, most people recognize N26 as the epitome of Fintech. Push-notifications, real-time settings of the cards and more. Revolut can do all this since long.

Revolut is some kind of international N26 – which is what N26 wants to be since long

Revolut qualifies itself by a lot of features that N26 does not even have – features, which are cross-borderly important for travellers and entrepreneurs. Let’s take a detailled look at them together today …

I use Revolut since about 2 years and have experienced almost all further developments of the features. Revolut has now more than 3 million customers and since this week, the bank licence is approved in the EU.

This makes it clear: A bunch of advantages will be added in 2019. Revolut can now also grant credit lines and loans and the deposit protection applies. This perhaps does not sound thrilling. But do not forget that Revolut made something special out of every common bank service.

Revolut makes something special out of banking!

One of many features that I highly estimate at Revolut!

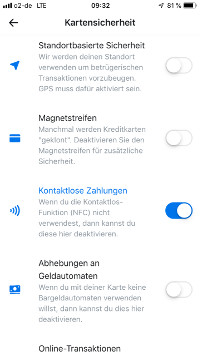

Card settings & security

It becomes more and more important and it has been reported frequently about it. Revolut has the most extensive card settings available at the market.

In detail:

- the card limit can be set

- the magnetic stripe can be activated and deactivated

- contactless payments (NFC) can be activated and deactivated

- cash withdrawals can be activated and deactivated

- online transactions can be activated and deactivated

- location-based security: card only works, if the Smartphone is close to it

- card can be blocked and unblocked, also in real-time.

These features are sublime beyond doubt. I have put them all to the acid test.

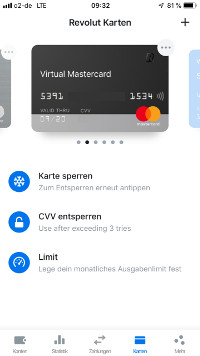

Virtual cards

Revolut has something that is ahead of N26 and all other presented Fintechs to this moment: virtual credit cards.

Virtual credit cards can be created for different purposed and can be deleted again.

I can create them in real-time within the app and also delete them again. And I can give a name to every card. So it is possible to create a virtual credit card only for Amazon. This way, the transactions can be assessed better.

Create and delete virtual cards

I personally do not use any of my physical cards on the Internet and have always deactived the online payments out of security reasons. I have set up a virtual card solely for Internet payments at reknown merchants.

You can also assign limits to the virtual cards; any transaction beyond will be safely rejected.

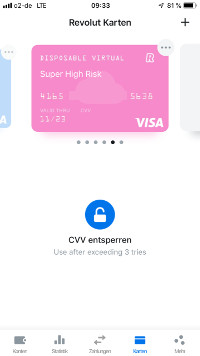

However, everyone knows a third kind of online shops, little trustworthy, perhaps little known. But I necessarily need an item sold by them. Now what to do? I would never reveal my card data and Paypal is not accepted either. Solution:

Disposable cards

This is an extra-variant of cards. They change the card number after each payment. They are only useable once. More security is impossible.

What do you think of the idea of the disposable credit cards?

By the way: every payment reimbursement is safely assigned to the cards. I have tested this live too. Works flawlessly.

Therefore, Revolut is my No. 1 in the area of Internet payments and security at card payments – long before N26 and other providers.

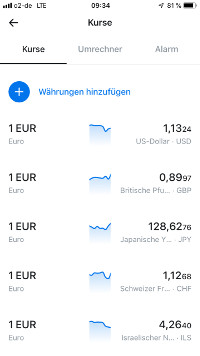

Currency accounts

The feature that turns Revolut absolutely into the favourite for travellers. In the premium-variant, you can manage up to 25 foreign currency accounts without extra costs. Think about how much that would normally cost at a bank, if it would be offered.

The exchange from Euros into the corresponding foreign currency works flawlessly within the app and this is done using the interbank exchange rate without surcharges nor fees!

An own IBAN is assigned to every account

This way, you can receive money in other currencies through transfers without currency exchange disadvantages.

Paying in foreign currencies is possible at Revolut anyway: through transfer or also with the card.

Real-time currency exchange: very practical for travellers

If I have e.g. enough British pounds in my foreign currency account and pay in England with the card, then the amount is debited 1:1 from this account.

Are currency accounts potentially helpful to you?

If the balance in the foreign currency is not enough, then Revolut debits from my EUR main account and exchanges the amount in real-time using the interbank exchange rate. I get the best possible exchange rate during week days.

On the weekend, there is a surcharge on the foreign currency rate of up to 1.5 % due to security reasons (for Revolut).

Advice: make a transfer at a good exchange rate before the journey

But: You have to compare here too. Also with the surcharge, the calculation is often better than with a normal main bank credit card, as it does not use the interbank exchange rate and most often charges a fee of up to 1.75 % of the transaction.

During weekdays, Revolut is in every case always the first choice when paying in a foreign currency.

In the app, you can always see the current real-time exchange rates and set rate alarms, if you want to get notified, when a certain rate is reached.

Transfers

Transfers are always international rapid transfers in the premium-variant. My experiences are the following: The money is on the same day in the account within the EU.

I have made experiences outside the EU with Thailand and Japan. The transfers arrive latest on the following day. You receive a confirmation of the execution and also a confirmation of the receipt at the receiver. Absolutely outstanding!

With this, you also have a proof in your hands, if there should arise uncertainties in the payment. The filling of DIN A4 big international transfers and the expensive fees are left behind.

Direct debits

They are now also possible. This was not a matter of course, as Fintechs without bank licence have to use other banks for their infrastructure and cannot offer certain services.

Send / request money

Also Revolut has its own “moneybeam” as we know it from N26. You can send and receive money in real-time, no matter where on earth you are – just like with messenger. At Revolut, you can even assign an animated picture (GIF) to that. This is quite funny.

This feature can be used very well among friends and family. One pays the restaurant, then the bill is divided internally. For this purpose, Revolut has implemented the feature “Share bill”. Simply enter the total amount and the receivers, and everyone is shown the amount to pay within the app and only has to enable it.

This also works outside Revolut through a payment link, which is sent by SMS or e-mail.

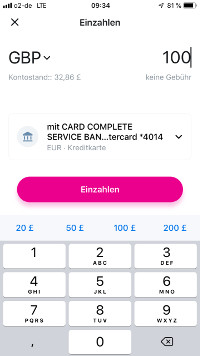

How is the money sent into my Revolut-account?

On the one hand, through transfer. But I recommend something else. Revolut can be charged with credit cards in real-time, a so-called top up. This is free of charge! I have submitted 3-4 cards, among them my Miles and More credit card. This way, I receive bonus miles for every charge.

You can even charge fee-free with Google Pay.

Here we add the point that we have already mentioned at Curve: No merchant ever gets my real card data. This is only possible at Revolut. And I only pay with the Revolut-card. Never ever trouble because of card fraud – truly a great feeling.

Revolut: costs

In the basic version, Revolut does not cost anything but the card shipping. This is understandable, otherwise Revolut would only generate loss. You can try all important features and I really recommend this to everyone.

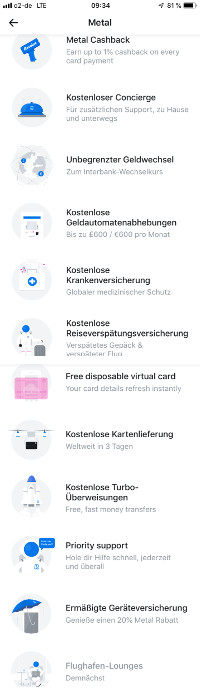

Moreover, Revolut offers the already mentioned premium-variant and a metal-variant with a true metal card, as known by N26, and a concierge-service that also makes reservations at hotels and restaurant, and you get a cashback of up to 1 % of your transactions.

I recommend the premium-variant in any case:

Paying only Euros 7.99 per month (again with a discount when paying the whole year), you receive the 25 free foreign currency accounts, up to 3 physical cards, unlimited exchanges of 24 currencies using the interbank exchange rate, an international health insurance, luggage and flight delay insurances and worldwide free express shipping of the cards.

The services are so extensive that this article should be a PDF to mention all points.

Take a look for yourself here:

I do not exaggerate when I say: A Fintech has only rarely convinced me in a way like Revolut does, with its features and the things to come.

Could Revolut be super-thrilling for you?

If you:

- search for the maximum of what Fintechs can do today

- have contact with other currencies on journeys

- want to have a better “N26” 😉

Full program, isn’t it?

- want maximum security for payment transactions – online as well as offline

- want to be live on board on the fastest-growing Fintech.

Conclusion

Revolut has so many features and services that one article is not enough to describe them. Especially the many incorporated details show: Someone has really thought about it well.

The possibilities of use are much more comprehensive than at the competitors and the customer growth at Revolut confirms it.

Through the given bank licence, a whole bunch of new services will be added next year.

For me, Revolut is definitively better than N26

In the premium-variant as well as in the metal-variant, you receive a lot more services for less money than with N26 Black or Metal.

What are your experiences? I am looking forward to the exchange through the comments feature. A heartly thanks!

Recommendation of the editorial

Inspired by the guest article of Martin, Gregor makes experiences with Revolut in Austin, Texas, USA.

If you do not want to live in the past, then get yourself at least the free basic version and make your first experiences with it.

If and how extensively you will use Revolut later on, will develop by itself. You can get our help and inspiration through the Sunday mail.

Perhaps also interesting for you?

- Apply successfully for the ING loan in Germany

- Open a business account online in Germany for an abroad company

- Is the N26-bank worthwhile for foreigners?

Dear Martin, thank you for such a comprehensive article. However, one moment is not covered here. Revolut’s IBANs start not with DE but GB. Is there any problem of receiving salary on a Revolut account for a Beschäftigte im öffentlichen Dienst? What about Staatsbeamte?

That depends on the salary office (Besoldungsstelle). According to EU law, they should not have a problem, in practice it shows time and again that there are companies (from civil servants we do not get that much feedback) who do not want to make transfers to a foreign account number.