Rahmenkredit (Framework Credit) ► How I got 25,000 Euro – immediately … and how you can do that, too!

In this article I will show you, how I have received – despite a not particularly high income[1] – a framework credit in the amount of 25,000 Euro immediately after the online-application.

Excerpt of the letter (PDF) confirming the credit

You will learn how to do this as well, and why the set-up of a framework credit (in German: Rahmenkredit) makes sense.

The Best:

The set-up of the framework credit is completely free if charge and non-committing (for you, not for the bank!)

What exactly is a Framework Credit (Rahmenkredit)?

A framework credit works like an overdraft facility: You receive a credit line, up to which you can have your account in a minus. Only if you do that, interest will need to be paid, otherwise not.

With the provider I have chosen, this interest even is particularly inexpensive – much less expansive than with the most banks that provide giro accounts.

More good news: You do not need to open another giro account. You can get the overdraft facility/framework credit, even if you do not have a giro account there and do not intend to open it there.

In addition, these 25,000 Euro – and you will be surprised, how easily you can get them – much more than what you generally get as an overdraft facility on your giro account!

Just so you know and can be on the safe side: The framework credit can also be applied for with smaller amounts: starting with 2,500 Euro in increments of 100 up to max. 25,000 Euro.

A framework credit is like an overdraft facility without a giro account – but the credit line is higher and the interest rate better for the banking customers!

Which bank is exactly the right one for this?

There are not many banks that offer this kind of credit line (and at such very good conditions, on top of that). I have made own experiences with four banks, though two of them I would rather not recommend.

Regarding advertisement and procedure, all four banks were good, but at two providers, the credit line was not permanent, if one did not use it from time to time … and what we want to organize, is a permanent solution!

If you currently want to retrieve money up to 5,000 Euro, then the special offer of Volkswagen Bank (www.volkswagenbank.de) is better.

In all other cases I would choose the framework credit of ING-DiBa (ING-DiBa Rahmenkredit) and have done so at the beginning of the week, as you can see in more detail later.

The most important info of ING-DiBa in summary: The credit line works like an overdraft facility (only that no giro account is required). The application is possible in the amount of 2,500 to 25,000 Euro.

Further info and application ► www.ing-diba.de/rahmenkredit

Can anyone get 25,000 Euro at ING-DiBa?

Naturally, not anyone meets the requirements for getting a credit line, because for that the following is required:

- Income from a regular, steady job

- No negative Schufa entries

(the Schufa has to respond to the bank’s query with a relatively positive credit evaluation).

If these both requirements are met, one has a very good chance that the credit line will be granted.

The amount of the maximally possible credit line results from the calculation of household budget + interest.

The household budget consists of your net income minus the living expenses. ING-DiBa does not calculate with the actual costs, but with lump sums.

For example: A single earns 1,650 Euro net. Several lump sums for house/apartment, car, general living expenses amount to 1,400 Euro. Therefore, a freely available amount of 250 Euro remains.

There is one particularity that is hardly known!

If they now wanted to get an installment credit in the amount of 25,000 Euro, the application would be rejected, because even the most advantageous provider in the comparison calculates for a 84 months duration – provided the highest credit rating is granted – a monthly installment of 318.45 Euro. Okay, they could aim for a longer duration.

Screencap from the credit comparison for installment credits.

I would like to draw your attention to a very interesting fact:

For installment credits (you get the full amount after the credit is granted, and the credit installment is debited monthly from your giro account abgebucht) the creditworthiness is calculated as an answer to the question, whether you can take care of the monthly installment.

For an installment credit the monthly installment consists of interest + repayment. Matter at hand is the repayment of the credit within a contractually agreed upon duration.

For a framework credit the monthly installment consists only of the interest. Whether and when you repay the credit, is not important, since the credit line is set up permanently. The repayment is flexible, exactly like with an overdraft facility.

The differences for you at one glance:

| Installment credit | Framework credit (Rahmenkredit, like overdraft facility) | |

|---|---|---|

| Disbursement | Complete credit amount on the 1. day | You log into the online banking yourself and start disbursements when, as often and in which amount you want |

| Repayment | Per debit of a monthly installment in which interest + repayment are included , potential additional special repayments |

You decide on the time and the amount of the repayment, only the interest |

| Credit end | with the last installment | credit line is set up permanently |

| Please leave the comment in the comments feature at the page end, in case the overview is not totally clear and comprehensible. | ||

Fact: With a framework credit (Rahmenkredit) you can get a considerably higher credit amount!

What does one have to do to get 25,000 Euro?

The trick is very simple: You only need a freely available income (i.e. your net income minus the living expenses and other fixed costs) in the amount of the monthly interest payment that would be due if you made full use of the credit amount.

How do you find out about that?

Even easier: You use this link ► directly to the framework credit (Rahmenkredit) page of ING-DiBa and move the control of the „Rechner“ (calculator) completely to the right.

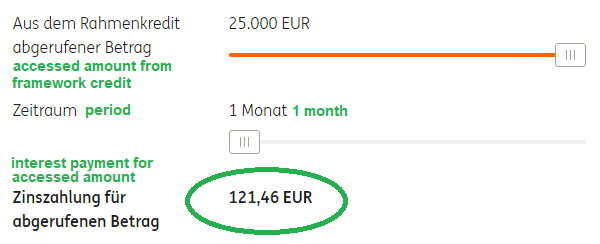

At the time of the article production, it looked like this:

If you are going to recommend this idea, then please do this with this article as well … we enjoy producing smart instructions for smart banking customers, that helps them getting ahead! You should find that the reading of our Sonntagsmail (Sunday Mail) is of great use in the long run as well!

The maximal interest burden, if you used the whole 25,000 Euro the whole month, would be at 121.46 Euro.

This means: If your freely available income is more than 121.46 Euro, then you should get a credit approval of 25.000 Euro.

Simple and logical, right?

Application step by step

1. Switch to …

… the Rahmenkredit / framework credit internet page of ING-DiBa ► www.ing-diba.de/rahmenkredit.

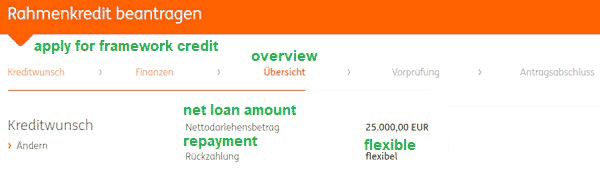

2. Fill in online application

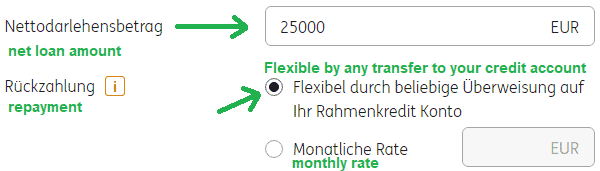

Enter an amount of 25,000 Euro or less. In case you enter 25,000 Euro, but your freely available income minus the lump sums „only“ allows for a credit line of 15,000 Euro, this is what you will get offered from the bank. You sehen, it does make sense to start at the top. 🙂 In order to follow our idea please choose the flexible repayment.

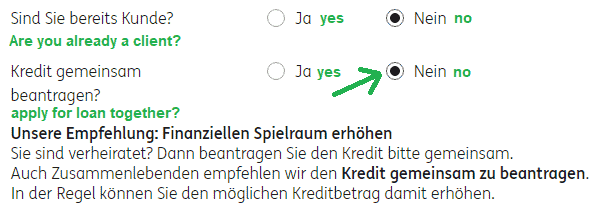

The bank would recommend to apply for the credit with two persons, because then the bank has two persons who are responsible for the credit line. As an „advocate for smart banking customers“ I advise to the exactly the opposite! Otherwise you would loose the chance to apply for 2 × 25,000 Euro (50,000 Euro in total) as a credit line, and the neccessary freely available income of 121.46 is manageable, after all. In case the application for the installment credit is not accepted – e.g. because of an unfavorable Schufa entry – you can do the online application again after 28 days, this time with two persons. It is true, after all, that the chances for success are higher, if two persons apply together. Most of the time though, one person suffices completely. Comprehensible?

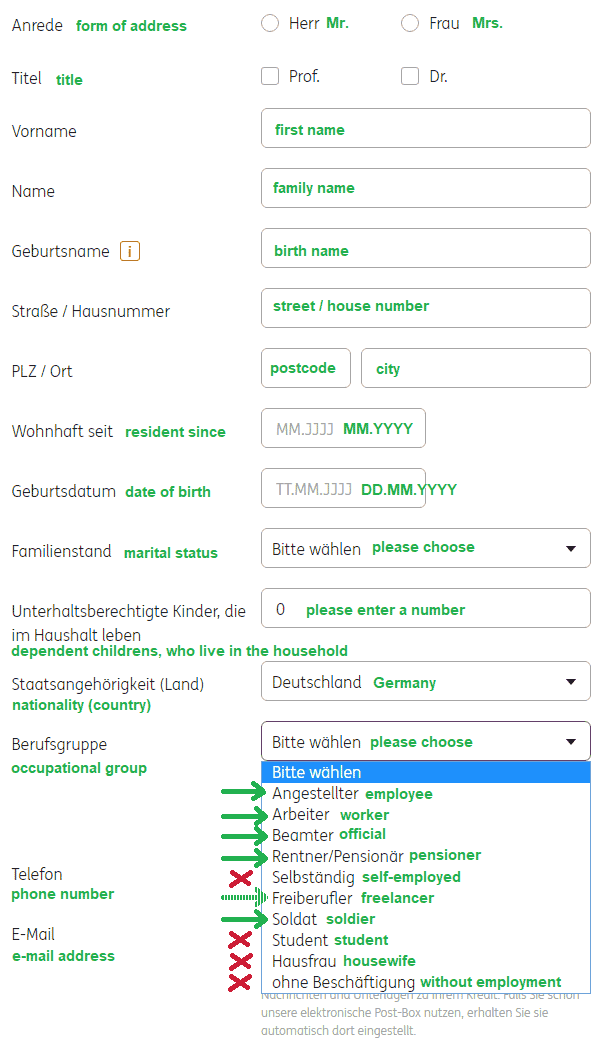

You need of course fill in the personal information… Regarding the professional group it is advantageous to know the business policies of ING-DiBa. In case you currently have the professional status with a red X, then ING-DiBa is not the right bank for you regarding the framework credit. Freelancers who are not subject to trad registration (e.g. physicians, tax consultants, non-medical practitioner), have good chances in comparison to other self-employed peopel. As proof of income, copies of the two most recent tax reports are required. All other professional groups are exactly the bank’s target group!

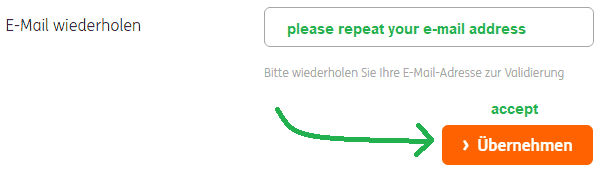

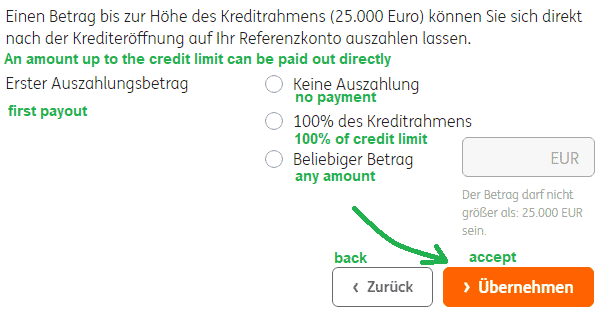

Once you have made it here, click on “Übernehmen”, and with that you will get to page 2 of the credit application.

Page 2

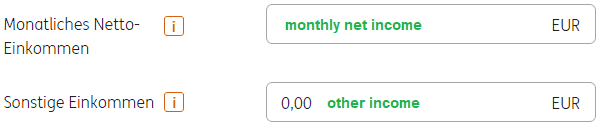

The second page is about your personal finances. This information is important to evaluate your creditworthiness.

Income

You will find the information for the field “Netto” or rather “Netto-Verdienst” on your pay slip. employer allowances for children go here as well, but not the child benefits (which are for the child, and because the child uses up money as well). Christmas bonus, hoiday pay, allowable expenses and other single payments do not enter this calculation.

The field “andere Einnahmen” is for everything else, you earn in addition and that can be proven (side job). Earnings from trade, renting and leasing are not taken into consideration.

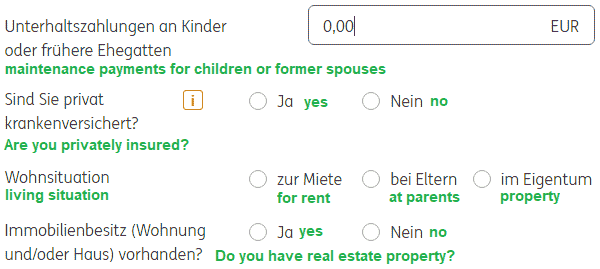

Expenses

Fill in the information as it is. With my credit application, a proof was not required.

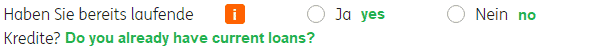

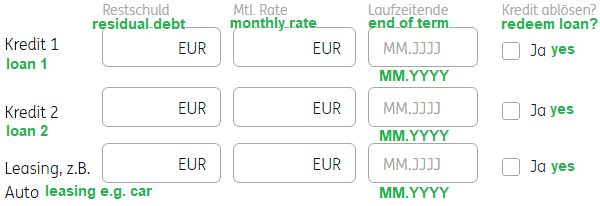

Which credits do already exist?

Mark nein (no), if you have no credit. Overdraft facility and credit cards credit lines do not count as credit for this question. What is also not considered in this question is real estate financing (building-society loans, KfW credit, other real estate loans), because it is connected with a countervalue.

If you have any consumer credits, zero-percent financing, installment credits, other framework credits (also called “call loans”) or leasing contracts (e.g. for a car), then mark ja (yes) and new fields of the form open:

State the “aktuellen Saldo” (residual debt), the monthly installment as well as the “Ende des Kreditvertrags” (duration end). In case you want to redeem another credit with this framework credit (Rahmenkredit), place a check mark in the last column. In case you have more credit agreements, you can find additional lines to fill in.

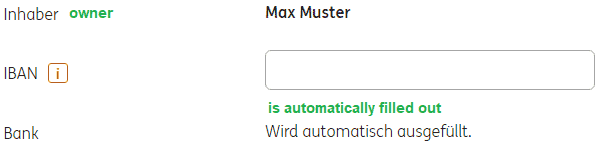

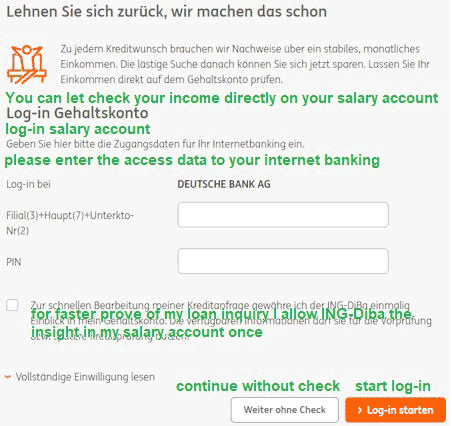

Salary Account

Here you enter the IBAN of your giro account with incoming salary. If it is an online account and are lucky, there is the possibility that you can grant ING-DiBa access to log in and chack you imformation. Incoming salary can be recognized by a special SALA code.

In case this is not offered, you will be asked to submit the last three salary statements (for employees/workers), the last pay not (civil servants/ soldiers/judges) or the last two income reports (Freelancer).

Optional: The Income Check

You save time and effort. I would do it, if it is being offered.

Instand Disbursement

You have the possibility to get disbursement for the full credit line, a part of it or for the time being nothing at all. If you want a disbursement, tick off the corresponding option. The disbursement will be done to the account, which you have stated one field above (reference accoung). There the monthly interest will be debited as well. The reference account can be edited in the online banking area afterwards.

As we smart banking customers are obtaining the credit line just in case, we tick off – for the time being – “keine Auszahlung” (no disbursement).

Page 3

On the third page you can find the summary of your information and requests.

… check your information once more while scrolling down.

Afterwards, click “Übernehmen” again.

Page 4

Click on “Vorcheck starten” (start preliminary check), and within just a few moments you will know, whether the credit line was approved. Everything else will only be a formality.

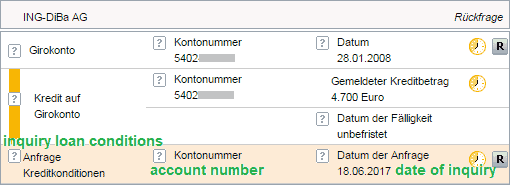

For the credit check a data query at Schufa will be made. ING-DiBa does that in an exemplary neutral way that does not have any impact on your credit standing by marking it „Anfrage Kreditkonditionen“ (query credit conditions). You will be able to see this comment in the Schufa file for a few years, other banks only for the next 10 days. This rating query has no impact on the Schufa score. If the framework credit does not work, the query disappears again from the Schufa database without any trace.

If you monitor your Schufa entries as exactly as I do, then you will see it like this as well:

For this article, the last line applies. The other two lines have already been covered in this article .

Page 5 (last page)

On page 5 you are notified of the result of the preliminary check. In case the result is not positive, we recommend our programm for asset building (German speaking programm), and to use it even more intensively. In month 4 we will discuss the subject of Schufa and improvement of the Schufa score with attorney Julius Schoor. It is the current score that often causes a negative result.

Has the check turned out positive, then the rest is a formality. You will be invited to go through the legitimization process, in case you are not yet a customer of ING-DiBa. In addition – at least that iss currently the case – the credit agreement needs to be manually signed and sent per regular mail to the bank.

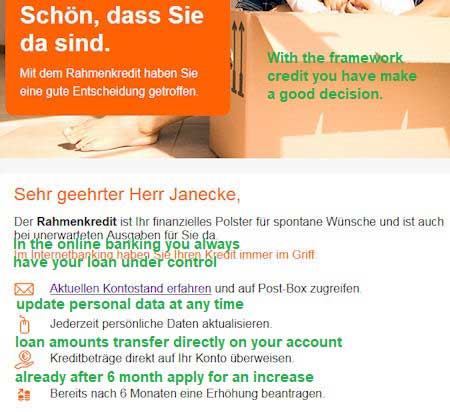

Your Welcome E-Mail (after sending back the credit agreement) could look like that:

This was my Welcome E-Mail that I received from the bank.

Implementation Report to Schufa (that is positive!)

The approved credit line will be noted in full at Schufa. There will be no updates about the current balance. According to my own experience (and the experiences within our family) I have been able to note that credit line entries either have no particular impact, or otherwise have a slightly positive one. I have been monitoring my Schufa score already since 2008. At the time of the check for the approval of the framework credit / Rahmenkredit at ING-DiBa there were additional credit line entries (without real estate financing) with a five-figure value in total in my Schufa information.

Personal Statement to today’s Article

You might be wondering why I discuss Schufa ins such detail. (Most credit pages on the internet more or less blank out this subject!)

The answer is important!

I do not want to “sell” you a credit, my esteemed readers, dear smart banking customers (though I am happy, when my instructions are deemed interesting, are implemented and recommended/linked). This is about more!

I am here to help smart banking customers like you to improve your relationship with money and banks – to increase financial potency, so you have the means to lead the life that you deserve. In general, banking customers are being kept in only a little knowledge on purpose; even all those EU regulations regarding leaflet supplements are not of much help there.

Some of you might know the saying: „As above, so below.“ I a broader sense it means: If you prefer to stay within your balance area, you should still have some knowledge about the credit area. Both areas are – in total – of the same size and need each other.

Some readers already know this: You can build up the upper area more quickly, if you use the lower area as well. With this speciality portal and the annexed program you will have some great support!

Summary of the Possibilities

- additional credit line in the amount of 2,500 to 25,000 Euro

- can be set-up today without a disbursement being neccessary

- no disbursement = no costs

- costs only in the form of interest, when money is received

- can be repaid in parts or as one complete amount

- only monthly debit of the credit interest (currently, 25,000 Euro would only cost 121.46 Euro per month)

- the credit line is set-up permanently and remains, even when it is not used (cue: emergency credit line)

- the application is simple and possible online.

Ready for a high credit line?

If you are ready for a high credit line in your live that does not oblige you to anything and does not cost you anything (unless and then only for the duration you make use of it), then you can find the start button here:

“Start Button for the Smart Credit Line”

I wish you much success with the set-up!

Why does it make sense (even when you do not need it), to get a framework credit?

Maybe you have heard this saying before: A bank gladly loans you money, when you don’t need it – but not once you do.

… and I would like to add: … and if the bank does, then it is going to be expensive (high interest)!

Of course: Banks, particularly credit departments, want to avoid risks. They work painstakingly to refine their systems that are supposed to protect them from losing money (refined credit worthiness checks).

At the same time, banks aim at earning money.

This is easy, if you loan money for interest to somebody, if they repay you at the agreed-upon time.

The one thing that is even better is receiving interest payments on a permanent basis (passive income), because the debtor keeps paying interest, does not repay the credit amount, but still has the creditworthiness to be able to do it at any time. This is something we find example with the debt financing of the State of Germany.

The smart Point to it all

If you follow that thought, you might arrive at the idea that it is a great strategy to agree on a credit line with a bank, at a time, when you do not need any money. This money can then be used – without any further checks – once you actually need it!

This strategy can be implemented via the framework credit / Rahmenkredit of ING-DiBa.

Footnotes:

[1] Why my income that is of importance for the bank is so low, you can learn in the Programm for Financial Freedom, when we discuss the four different kinds of income.

A little preview: For a credit approval up to 1 million Euro, the best kind of income from the bank’s point of view is income derived from a job. If you are an employee or civil servant, that is the easiest way to obtain a very good framework credit (or other financing forms).

Further Articles for Smart Banking Customers:

- Experience with the Framework Credit / Rahmenkredit of ING-DiBa

- Overdraft Facility Lines in Comparison

- ING-DiBa in General

For all that like to get their information via video:

Link to the Framework Credit (Rahmenkredit) ► www.ing-diba.de/rahmenkredit

Many thanks for sharing and linking this article!

Dear Gregor,

I am a British citizen and I live in the UK. I am interested in getting a 25k EUR loan to invest in real estate. Could you let me know if it would be possible, and if yes, how I could get a German credit card with this sort of overdraft.

Regards,

Ivan

The requirement for the framework credit are residence, income and current account in Germany. Thus, you can save yourself the application. Incidentally, other German banks are not very interested in financing what you intend to do. The best way would be to find a solution within the UK 🙂 I am writing this with a friendly and helpful intention, so that you might save yourself a lot of time and disappointment.

You write somewhere above that other banks can see for 10 days that I applied for a loan (Anfrage Kondi)?? In some other articles/websites I read something else, that only the bank, where you applied, can see this and don’t see other applications???

Please let me know what is correct…

Thanks

When you apply for a loan, the bank asks SCHUFA for a credit check. If you then go to a different bank afterward and apply for a loan there, that bank will do a credit check themselves, and though they will not be able to see your previous application as such, they will see that a different bank in recent days has done a credit check on you, too. I hope this helps.

Hello,

in my loan agreement, there is this sentence:

Neukredit (Nettodarlehensbetrag) über € 25.000,00 (mind. € 2.500)

Erhöhung (Nettodarlehensbetrag) auf € (um mind. € 1.000)

Gesamtbetrag € 25.789,48 (gemäß gesetzlicher Vorgaben)

Please explain the difference between „Neukredit” and „Gesamtbetrag” to me. Are the Euros 789.48 a fee for the credit line?

Yes, that is funny! All the EU- regulations for „consumer protection” have not made it easier to understand loan agreements, on the contrary!

Here it is stated what the „debit interest” costs, if you fully exploit the total amount of Euros 25,000 for a full year.

The funny thing about it: In fact, you do not pay the debit interest, but the „annual percentage rate” (effektiver Jahreszins).

The worth of the information in the legally prescribed version is zero.

To comfort you: It is not an no additional fee. If you actually use the credit line for 30 days in the amount of Euros 25,000, an interest of Euros 121.46 incurs. It can’t become more!

However, if you only use Euros 500 for 10 days, it is Euros 0.81.

If you do not use it at all, but keep it as a reserve, you pay nothing at all.

Is that clear to you?