Open a DKB Joint Account

There are two possibilities to set up a joint account at the DKB:

- 1 bank account with two account holders

- 2 individual bank accounts and 1 joint account that both can access.

Both possibilities will be presented in this article, so that you can choose the ideal option for you. If anything should remain unclear, please ask at the bottom of the page using the comments box of our editors. Thank You.

Classic joint account: 1 account, 2 account holders

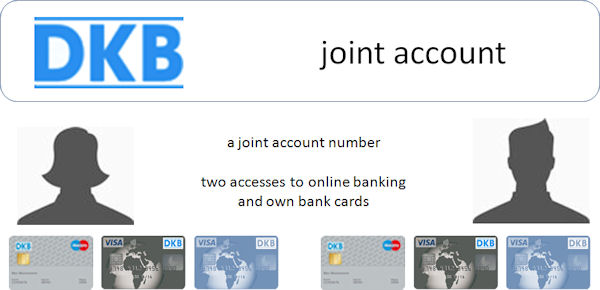

This classic joint account is known by couples and families since long. At the bank, only one bank account is opened. The account holders are both. Each one receives an own bank card. At the DKB, by choice, one or two Visa credit cards per person can be added.

Each person can access the account without restrictions, withdraw money, set transfer orders, redeem cheques or make other orders to the bank. Only the account closure must be signed by both account holders.

The account structure of the DKB joint account looks like this:

For completeness, it should be mentioned that both account holders jointly and severally are liable. That means, if one of the account holders sods off with the credit card, settles abroad, withdraws money with the credit card until reaching the limit and finally disappears … then both are legally obliged to fund the account. If one account holder is untraceable, the bank will call the remaining holder to account. This should be considered constantly.

Vorteile eines klassischen Gemeinschaftskontos:

- Clarity: everything on one account

- no need for transfers between accounts to offset balances

- eventually a higher creditworthiness through two salary payments and a higher limit on the credit cards, as well as a higher overdraft facility of the joint account

Advantages of the DKB joint account:

- free bank card and Visa credit card for every account holder

- free second Visa credit card (usage as savings account – Visa Savings possible)

- another bank and Visa credit card free of charge for each authorized person of the account (e.g. relatives, roommates, business partner).

- each person receives separate access data for online banking of the joint account

- account management absolutely free of charge

I almost forgot: Any cash withdrawal from an ATM using the DKB Visa credit card is free of charge, all around the globe!

2 individual accounts and 1 joint account

As the current account at the DKB is anyway free of charge for each customer, there is also the possibility of a clever account system with a joint account in the middle.

How to set up the account at the DKB:

First of all, each partner applies separately for an own current account at the DKB and waits until it is completely set up. Each one will receive seven letters after the account opening with all access data and cards.

The link to the account application for an individual account at the DKB:

In the second step, both apply for the joint account. Here you can find the link:

www.dkb.de/privatkunden/gemeinschaftskonto/.

This approach has the following advantages:

- everyone will have an own personal account with own cards that the other account holder cannot access

- the joint account appears for both in online banking as an additional account (both have an overview of the common expenses)

- only one login for all accounts (later, one can possibly add junior accounts for the DKB Cash u18)

- the identity verification is only required once (the joint account will be opened very quickly, because the DKB already has all required data)

- everything described here, is free (also the countless bank and Visa credit cards; please keep in mind: you can open joint accounts also with further people, such as a shared apartment or extended family, as there is no predetermined number of people!)

PS: Tips for the usage of a joint account in combination with individual accounts

Each of you can, for example, transfer the salary payment to the individual account and set up a monthly standing order for the common expenses – like rent and insurances. From this account, the common costs will be deducted. If you want to give your partner a gift, just use the card of your individual account, so that he or she cannot see this special payment.

… what ideas do you have for the clever use of joint and individual accounts? Let me and other readers know through the comments box, thank you!

Further DKB topics

Images head: Pekchar, fotolia.com

I would like to receive an answer on the following questions:

1. I have read the terms for opening a Gemeinschaftskonto at DKB, and different interest rates seem to apply a) in case of a DKB-visa account (0,9%) and b) in case of an Internet account (0,1%). Is this correct? Can someone open an account without being obliged to have the VISA card, but still enjoy the same annual interest (0,9)?

2. Since there are no costs for maintaining the account, is there a tax imposed on the interest, and if so, what is this percentage?

Thank you in advance

Visa Card is the saving account

If you put money on Visa account you get more interest as on current account. So the Visa card can be used as a saving account. You get the card automatically by open this account.

If you do not live in Germany, there is no reason to pay taxes here. This article shows how the tax exemption is established: https://www.deutscheskonto.org/de/dkb/steuerauslaender/

The tax rate is 26,375% (Abgeltungsteuer + Solidaritätszuschlag)

Thanks for the reply.

However, I would specifically like to know what is the interest rate for an Internat account (Gemeinschaftskonto), i.e. 0,10 or 0,90 (for amounts up to 300000 Euros according to your site)?

Furthermore, how many co-benificiaries may join the joint account.Is there a limitation? I am intersted in opening a family joint account (1 owner and 3 co-beneficiaries).

Is it preferrable to open a joint account, or is there another alternative (Laufzeitkonto) with better interest?

And one more question please:

I understand the procedure for opening a joint account, but what is the case if we decide to close it after 1-2 years. What are the steps for closing an account and is there any charge in doing so?

I have a account in DKB. How can I include a partner in this account?

There are two possibilities

– For an already existing account, you can give account authorization to another person. This person can then also get their own cards and online access.

– Opening of a new/additional joint account. You’d then have a single and a joint account.

A change of a single into a joint account is not possible.