Open the DKB account from the USA

On my last trip to the USA, I have met a German-American married couple, who wanted to open a bank account in Germany soon … and this gave birth to the idea of recording this video:

Do not want to miss any helpful videos? subscribe for the Youtube channel ✔

At the beginning of our conversation, they did not know yet that they (have to) open an account in Germany, because at first, it only was the purchase of a property in Germany. Germany has many nice places, where one can still buy houses or apartments today.

For the sole purpose of purchase, you do not necessarily need a German bank account … but for the debit payments of the ancillary costs, such as electricity, water and other utilities. And if the property will be rented, then, of course, for the payment of rent.

Open the DKB bank account from the USA

The free DKB checking account with the also free Visa credit card is the most famous German bank account, as it can be opened via the Internet from other countries.

An overview of the most important features:

- free account management (no minimum deposit or the like)

- free Visa credit card with credit line depending on your creditworthiness and usage

- free cash withdrawals around the globe through all Visa ATMs

- free Online-Banking in German language

- telephone customer service around the clock

- free transfers within the Euro-area

- German bank details with IBAN and BIC

- free account opening through the Internet

- free delivery of the credit card to the abroad

Direct link of the bank: www.dkb.de/privatkunden/dkb_cash/

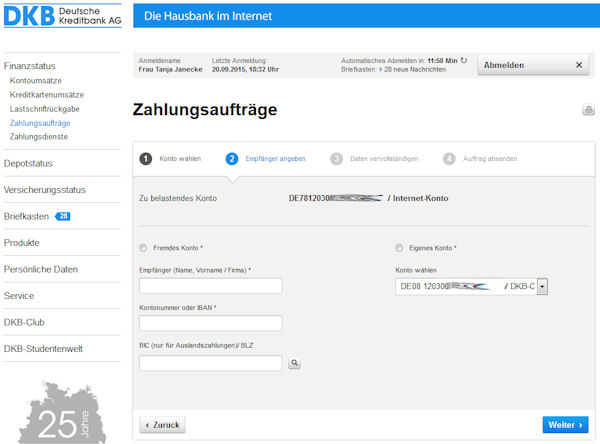

Online-Banking of the DKB

Thanks to the Online-Banking, one can perform payments easily and comfortably. Transfers and standing orders are free of charge within the Euro-area!

Before we go into detail, there are two important facts to clarify:

-

Citizenship / Nationality

In order to open the account from outside Germany, you need a valid German ID-card or passport. This includes, with very few exemptions, that you must be a German citizen.

In the case of the German-American married couple, either

- the German partner opens the account

- or a joint account is opened by both of them. At a joint account, the nationality of the second person does not matter. However, a legitimating beyond doubt must take place.

-

Creditworthiness check

The DKB account is an account with a true credit card (no debit card) and a credit limit. Even if this is quite low in the beginning, a creditworthiness check is implemented during the account opening.

Please note the tips of the article How to not mess up the DKB account opening ;-).

There is no guarantee on account opening. The chances on a successful account opening are between 60 to 65 per cent. As the effort is not too much, it is always worthwhile to apply for the account. You cannot lose, but win a great bank account!

… and as the account is free of charge independently of the usage, you can keep it forever. Also in times, when you have less banking business in Germany.

Several cards can be issued per customer, which dispose of a separate billing account. Therefore, one can separate travels and savings. Find details on this subject in the article about joint accounts (even if a single account can have several cards, we have bundled the information there).

Note for US-Americans in Germany

US-Americans, who are in Germany and have their place of residence or secondary residence here, can also apply for the DKB account. It could be that the bank asks for a registration certificate (“Meldebescheinigung”, available in the city hall) as a proof.

Note for people, who are taxable in the USA

An account opening (checking) with Visa credit card is no problem.

The opening of a securities account, however, is not possible. US-taxable persons do not get a depot account at almost no bank in the European Union. The reason is the harsh foreign laws of the US-American government in financial matters. Perhaps this could change again within the TTIP-agreements?

Also US-citizens, who permanently live in Germany, cannot open a securities account, as the USA – in contrast to almost all other countries – bind the tax obligation to the nationality. US-Americans are therefore always taxable in the USA, no matter where there live or get their earnings from.

Fortunately, this does not matter for the checking account opening at the DKB, so we can proceed with this subject …

3 steps towards your new account in Germany

1. Online application on account opening

Start the online application form and fill it out completely. Here is the direct link to the online application form ⇒ https://cash.dkb.de/ch/app/cash?execution

You can find an English translation of the most important points on this page: DKB account application.

After you completely filled it out, the application is then sent automatically and electronically to the DKB.

You only need 5 – 10 minutes for the account application

Background information from our experiences

Now you will have to wait. It can take a few minutes up to several days. During this period, the bank proves your application and at first it is an automatic process (it is a free direct bank, so it has to work efficiently!).

If the result should be clear after the automatic process, you will get pretty fast an e-mail with the invitation on identification or the account rejection. At an account rejection, one can still present the reasons, why one wants to open the account. Best is to write a few lines about the planned usage in order for the bank to see that you plan to actively use it.

You do not have to state the usage at the first application. In some cases, the feedback of the bank takes some days, as the application will be proved manually. Seldom, but it still happens that the bank asks for a confirmation of income. This is a positive sign!

2. Legitimating

Just like in the USA, there is a law in Germany too that stipulates the identification of bank customers beyond doubt. Nevertheless, one cannot go personally to a direct bank and show one´s ID-card – this is not quite meaningful at an account opening from the USA – but you can do it from abroad.

At the DKB, there is the WebID-procedure in which you can hold your ID or passport in front of the webcam during the video chat.

Through this video procedure, the data on the ID-document, as well as the authenticity features are proved by a staff member of WebID. Additionally, a photo of you will be taken.

How the WebID-procedure works

Most often, you will receive an e-mail of the bank including the link and the instruction for the WebID-procedure. If only the coupon for the PostIdent-procedure is included, which is popular in Germany – this happened to one of our readers – then ask the bank in a friendly manner, if it is possible to complete the legitimating through the WebID-procedure.

E-mail to the DKB (only if necessary)

Sehr geehrte Damen und Herren, vielen Dank für Ihre Einladung zur Identifikation. Bitte senden Sie mir den Link zum WebID-Verfahren zu, da ich mich im Ausland aufhalte. Vielen Dank und bis bald

3. Receiving the credit cards and the access data for online banking

The account opening is actually finished with the legitimating. However, a 2-step-instruction is far too short 😉 … and therefore, you will now learn what happens afterwards.

You will receive several letters of the DKB within 1 to 3 weeks, depending on the post delivery. Included are:

- Welcoming letter with account number and access data to your online banking

- PIN for your online banking (has to be changed out of security reasons)

- DKB Visa credit card

- PIN of the DKB Visa credit card

- optional DKB Girocard

- optional PIN of the DKB Girocard

If you mainly stay in the USA or in another country outside Germany, you do not really need the Girocard. Unless you want to confirm your transfers in the online banking with the chip-tan-procedure (Chip-Tan-Verfahren). Alternatively, you can use the push-tan-procedure (Push-Tan-Verfahren) through an app.

What else do you need to know for an account opening?

“Alright, open the account now :)”

The worldwide most attractive bank account!

Why German citizens in the USA estimate the DKB that much …

The following descriptions are based on the personal exchange with German emigrants and businessmen, as well as own experiences in the United States.

1. Telephone customer service around the clock (even on weekends!)

The DKB offers its customers telephone contact to the bank via a German landline number +493012030000 around the clock. You can also ask for recalls on a weekend or during the German night hours. We are 6 to 9 hAours ahead of the USA-mainland, so it is difficult, if you are customer of another bank.

A German emigrant told me that he had a problem with his credit card at the supermarket on Friday afternoon. He had to wait until Monday morning in order to be able to reach someone in the branch office of the German Sparkasse. This can be unsatisfactory, especially in urgent cases!

2. Free bank transfers

In the USA, bank transfers are expensive. Very expensive. Therefore, still a lot is paid by cheque or credit card.

With a bank account in Germany, you can make bank transfers within the whole Euro-area free of charge. This is useful for the management of the real estate in Germany or other hobby online stores, like eBay.

Note, for the sake of completeness: The DKB is a pure private customer bank. If you need a commercial account in Germany, then please take a look e.g. at this article: business account in Germany.

3. Foreign Currency Account (Euro account)

At US-banks, one has to search long before finding a foreign currency account in Euros on acceptable terms. However, the DKB account is completely free and is held exclusively in Euros.

You can transfer money to the account at the DKB in times of good exchange rates – for example, for your next trip to the Euro-area. Thanks to special providers, such as TransferWise, transfers are no longer expensive between USA and Germany.

Using TransferWise, you will not only get an excellent exchange rate (the exchange rates of DKB are generally considered pretty good), but also save the expensive fees for outgoing international transfers on the USA side and the international bank transfer fee on the German side! Through TransferWise, it looks like a pure national transfer.

Which point is most important for you?

When writing this article, a lot of great things come to my mind that speak for the opening of the DKB account. Such as the refund of local ATM-charges, which incur in the USA on a regular basis. Withdrawals with the DKB Visa credit card are always free of charge at the DKB, no “asterisks” implied!

… and in order to continue with the married couple, who wants to buy real estate in Germany: you can withdraw the rent, which has been transferred by the tenants to your DKB account every month free of charge using your DKB Visa credit card. There is even a special “Vermieter-Paket” (landlord-package) at the DKB, in which you can deposit the security deposit, among other things. That is a topic for yet another article on this Special Portal!

Eventually, this site has to end, so that you can proceed with the application on opening the DKB account:

“Yes, start now with the account application!”

Of course, you are welcome to ask questions about the account opening and the usage anytime you want!

The comments box is activated for you. We would be happy to receive your feedback and experiences or features that you like about the DKB and for what you use the DKB account. Many thanks!

The most important pages about the DKB account opening:

- DKB account and variants of usage

- Further information about account opening

- Legitimating through WebID

PS: This article about the account opening in Germany from the USA can be applied analogously to other countries too.

Hi, thank you for writing this article! I am a US citizen planning on moving to Germany to study. I would like to open a German bank account and transfer fund to the account prior to my departure. Is that possible?

This case is currently not possible at the DKB. We are working to find a solution that enables US citizens to open an account in Germany from the USA. We will report about this on our blog!

PS: Do you have an address in Germany already?

I am a US Citizen with friends in Germany who I visit frequently. Would I be able to get a German bank account and debit card before I visit again? I do not have a German address but could provide the address where I will be staying if they need to verify that I plan to visit (and to establish legitimacy).

Hi there – does DKB advise whether the account application was successful or unsuccessful via email, or only via post? I am a German citizen in the UK. I submitted the application online, and a few hours later completed the WebID-procedure. Just wondering how soon I can use the account, if the application was successful.

Thank you!

Hello Anna,

After the WebID, the next step is a letter (or several letters) by regular mail. The production of your card(s) is initiated, and the cards as well as the PIN(s) and your access details to your online banking is sent to you, for security reasons – divided into separate letters and sent at separate times. Your account should be ready for use after about 2-3 weeks, though you might have to take into account a slightly longer time for the letters from Germany to arrive in the UK.

There are a few exceptions, when the Bank has an additional question regarding your application, but that only happens in about 5% of the applications.

Hello,

I did it otherwise. I went from Germany to the States having a DKB account. Now it is really hard to find a similar American bank account in the States. Bank of America is charging 3$ per eletronical transfer to another bank what is unacceptable.

Do you know and can you recommend a similar bank in America?

A real credit card is not needed. I can live with a secured credit card.

Thx

René

Oh, thank you for your trust. Sadly, we are the special webportal for Germany and don’t know the best checkings in US.