N26 ► Recap

Will N26 ascend again into the exclusive circle of our top banks? Take a look at the new smart details of this Smartphone-bank that Martin has prepared for us and please supplement it with your ideas, wishes and experiences. A heartly thanks!

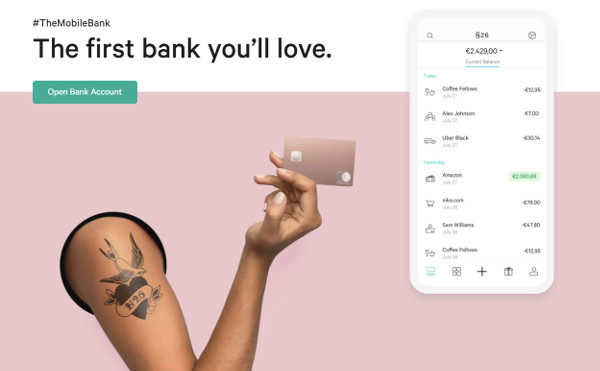

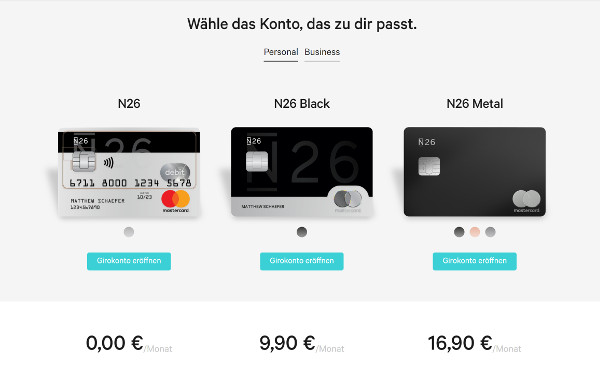

N26 initiated in 2015 in Germany as a pure Smartphone-bank. There is a ► free base account and a ► premium-variant, which is subject to charge! Moreover, ► N26 can be used as a business account too!

The banking world changes more and more and this even in Germany. One can hardly believe it. When doing my groceries, I pay attention to how fellow people pay, because it interests me.

Of course, this is different in the rural areas compared to the urban areas. Whereas private banks are more frequent in the city, on the countryside, the good old Sparkasse, the Volksbank and Raiffeisenbank are prevalent.

However, something is changing. When I was shopping some days ago, I noticed quite several N26-cards. This fits to the notification that N26 has acquired more than 400,000 new customer in the past 6 months, but more on that subject later on.

More than 2,000 people apply for a N26-account day after day!

Well, I have often thought about it, whether N26 is the bank of tomorrow. This question cannot be answered equally for all people, let alone be affirmed. And I wanted to observe the German market, which is difficult and interesting at the same time, especially because of the “I-stay-with-the-same-bank-for-50-years”-mindset that is now changing little by little after all.

N26: Bank of tomorrow?

It is thrilling to be part of this change and support it, because it helpes people to take control of their money and to take advantage of it.

Simply smart.

We often compare the area of FinTechs, meaning the new banks, with what is highest possible at the market, e.g. technologically. Who has the best app? Which are the most modern features? On the other side, we see the classic direct banks often with other IT and classic banking offers, transformed for the Internet and equipped with very good conditions.

N26 unifies something of both in it and it perhaps could be regarded as a transformation into the world of tomorrow.

There are many people, who prefer to have just one banking-app on their Smartphones with which they can control everything. They do not want to deal with every single details, concerning the investments in ETFs, they want to be able to manage all their insurances through the app and want to have a transaction movement as modern as possible.

N26 perhaps is the best “Fintech-allround” bank, because everything is covered with just one app and all procedures take place completely paperless.

I would describe it similarly to the description at Apple. Now and then there are new features that technically go even further than now, but they are only introduced as soon as they are stable and really offer added value. I have come to this impression of N26 in the past months.

N26 is perfect for you, if …

- you want to withdraw cash free of charge up to 5 times a month (everywhere)

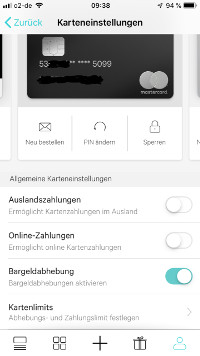

- you want to control the Mastercard completely through the app

- you desire a high security at card payments

- you want to manage all your insurances within the banking-app

- you do not want to look for ETFs yourself when investing

- you do not only want to go through the banking-app, but additionally use the browser

- you value real-time banking with push-notifications

- you want to analyse your transactions statistically in the app.

- you want a depot in order to be able to buy ETFs yourself

- you absolutely need a bank branch office

- you want to have a contact person (salesman) in the bank.

- In Germany and around the globe, I can withdraw cash at every ATM 5 times per month free of charge, if at least Euros 1,000 are transferred to the account per month. It does not have to be salary.

- Or 3 times per month free of charge, if that is not the case.

N26 is not for you (at least as a stand-alone solution), if …

Further details comprehensively observed for you:

When I came in touch with N26 for the first time about 2 years ago, it already had achieved its independency from Wirecard and was an independent company. It already had finished the partially difficult transformation procedure, one or the other customer was lost.

Looking at it in retrospective, some might got upset because of leaving, because N26 had worked consequently at its offer and is possibly the most oustanding Fintech at the German market.

In the beginnings of N26, it was about push-notifications, so that one was shown e.g. card transactions and incoming money transfers in real-time. This was – and one can hardly believe it – and still is something rare at the German bank market. Traditional German institutes with their usually old IT have a hard time to implement something like that. I have never ever understood that entirely.

N26 real-time banking

We live in the year 2018 and real-time banking is still something rare. One of the biggest plus points of N26 is that you do not only get push-notifications of transactions. They are immediately shown to you, when they occur and not days later.

This makes banking with N26 extremely transparent. Also reservation notes, e.g. security blocking at fuel terminals can be seen on the account.

You can go into the transactions and see them with a second-exact timestamp. This is genious. Moreover, you can assign every transaction to a #category. This is helpful, because N26 offers a full housekeeping book. You can evaluate all income and expenditures. This is a great solution.

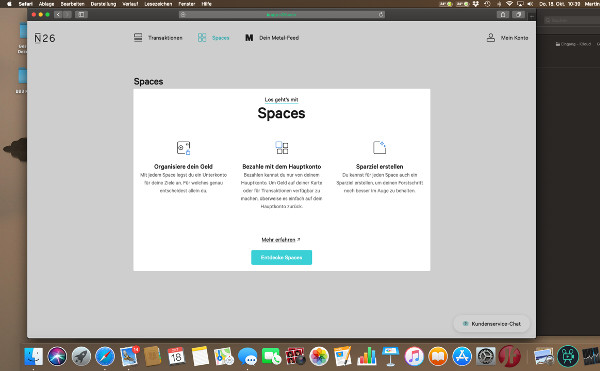

Banking can be operated by the N26-customer through the app or browser. Additionally, extremely individual with the setup of virtual subaccounts for savings goals (spaces)

N26 cards

N26 delivers consequently the Mastercard in all 3 card models and if desired a fancy (in the meanwhile transparent) Maestro card.

N26 cannot be mislead, the Giro-card (colloquially EC-card) does not play a role globally and I assume that through the new paying-variants Google Pay and Apple Pay it will be extinguished in Germany too.

No later than that.

By the way, N26 is part of the market introduction of both providers. Google has already started, Apple should initiate this winter.

For this, I have to briefly add that the Girocard is a special German solution of a group of German banks.

You can only pay in Germany with it. The fact that it is useable in the EU-abroad is thanks to Vpay (Visa) and Maestro (Mastercard), which logos are on every Girocard. Only through this cooperation, payments outside Germany within the EU are possible.

N26 offers variations from transparent to “black” up to metal!

At the use outside Europe, even every small house bank says nowadays, “You need a Visa or Mastercard”. They are right. Life would be so much easier, if we could finally toss that “EC-card”.

Herein, N26 walked down the global path and offers primarily the Mastercard.

NFC-payments are gaining ground everywhere and of course, all N26-cards are NFC-able. The feeling of only needing 3-4 seconds for a payment transaction at the cashout is priceless.

With this, perhaps the argument that cash payments are faster will die at last. It is not. And it is a true anachronism, so it is from another time.

Today, nobody would want to pay in kind. Pulling out dirty cash, especially coins that convert the money pouch into a weapon because of its weight? We live in the year 2018. Okay, in Germany. By the way, how do we obtain cash at N26?

N26 cash

The cash supply of all N26 account models is the same:

This should be enough for most people.

Moreover, I can use Cash26 in the shop and let cash be paid to me directly at the cashout. Deposits are also possible this way, even if quite some cashier is looking pretty surprised.

I have tested it several times. Rewe, Penny and also DM are on board. You generate a barcode in the N26-app, this is scanned and then you can withdraw or deposit your cash. There are 9000 sites that accept Cash26 in Germany, so you are well supplied.

N26 safe in the Internet

A huge strength of N26. Many want to use Paypal in order to buy goods and services. Others run through Amazon or at least Amazon Pay.

Can your current bank do that too?

However, there are still merchants, who do not offer that and then you are required to use your credit card in the Internet. I admit that this thought gives me shivers. An open credit card that I cannot block or set myself?

N26 makes it easy for you to keep the control!

Many smart bank customers have limits of far more than Euros 10,000. Revealing the card data? No, thank you!

Of course, you can get your money back in the case of fraud, after being at the bank, at the police, having to wait for weeks. Been through all that. But you can save yourself from all that trouble.

At N26, I pay with my card and deactivate the setting “Online-Zahlungen” (online payments) afterwards in the app. That was it. You also get Mastercard 3D Secure on top, which is integrated in the app by N26.

Purchases at participating merchants must be manually activated in the N26-app. Other banks often have an extra app for that. Even this is solved exemplary by N26.

N26 has a big advantage compared to the other Smartphone-banks.

It also has a true online-banking through the Internet browser, wherein you also can undertake all settings. This is missing at most other Smartphone-banks.

N26 international transactions

Herein, N26 pulled Transferwise into the boat. It is also directly integrated into the app, so you can currently transfer in 19 currencies to the abroad with an up to 6-times cheaper exchange rate than of traditional banks, says N26.

I have applied it twice and must say, very smart. Transferwise is known by some people. If desired, I can show you soon my view of this special provider …?

N26 added values

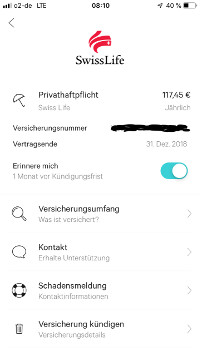

Besides the transparency of transactions, the real-time setting of the cards and the push-notifications, N26 has built different added values into the app. For example the cooperation with Clark.

Clark is a Fintech from the insurance industry. You can digitalize all your insurance policies. That means that they are managed through Clark in the future. For me, being a N26- and Clark-customer, that means that I can get reminded of the expiration of an insurance not only within the app, but I can cancel it within the app and Clark takes care of everything.

Very advantageous: You can really learn about your insurances through this way.

Practical?

Through Clark in the N26-app, you submit a digitalizing query to Clark. For this, you need the number of the certification of insurance, your name and date of birth. And of course, the name of the insurance. Then, Clark contacts it and assumes the management.

My experience shows that some insurances do not react at all or 6 months later. Let’s be serious, “Who wants to be customer of such thing?”

Alternatively, you can mail the insurance certificate, so scan it and send it to Clark, then it will be faster, at least on the part of Clark.

However, I have asked myself after these experiences, whether I want to work with an insurance that cannot even answer to simple queries within a reasonable time.

If it works then, it is great. All data of my insurance is also visible in the app. Even new insurance contracts should be possible in the future. All this is possible through Clark in the N26-app. With this, N26 is becoming more and more some kind of financial control center. In the middle, I have my payments, on the left my insurances and by swiping to the right I get to loans and investments.

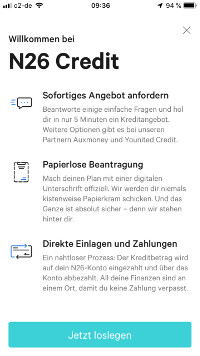

N26 Credit

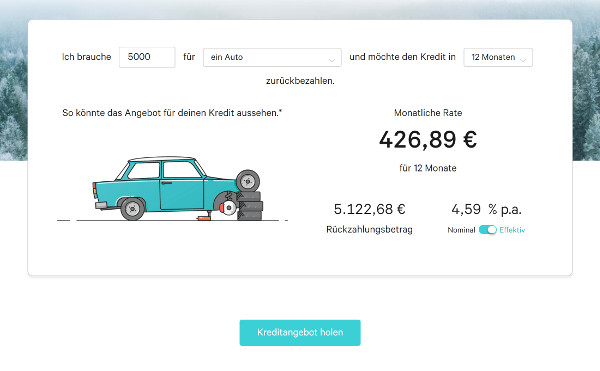

At N26, the overdraft facility can be set up within the app in real-time. Through an overdraft line, I immediately get a notification, if I go into the red. Below, I am shown, how much interest it will cost me. This is a refined solution.

For installment loans, there is an intermediary offer by Auxmoney and Younited Credit. Everything is paperless too. However, no smart bank customer is a friend of installment loans. And you are right.

Currently, you can apply for loans of up to Euros 25,000 very easily through the app ► https://n26.com/de-de/kredit/

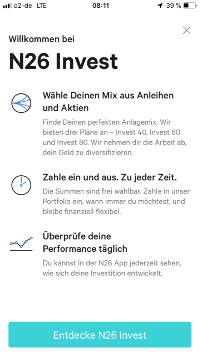

N26 Invest & N26 Savings

Another wipe to the right and you arrive at N26 Savings and N26 Invest. An additional app is not necessary. Everything is well integrated in just this one N26-app.

Kept super simpel for the beginner!

With N26 Savings, I use the European offer of fixed deposit including the deposit insurances.

The minimum amount currently is at Euros 2,000 and the interest was at the best offer at almost 1 per cent today morning. For this purpose, N26 has a cooperation with ► WeltSparen, which then intermediates the best offers within Europe.

Capital savings for “dummies”?

N26 offers in cooperation with Vaamo Finanz AG, the Dimensional Fund Advisors Ltd. and the FIL Fondsbank GmbH the product N26 Invest. You have the choice between 3 risk classes and your receive a ETF portfolio, depending on the risk propensity. You can invest once and/or monthly. Additional payments, as well as payouts are possible at any time. The flexibility is exemplary.

Quite some people prefer to have the own ETFs in his/her depot, no question about that. But if it is about making it comfortably and simple, then N26 is the leader.

The explanations about the risks, the expected final result and the savings calculations are kept so uncomplicated that really everyone can invest in ETFs with N26. For those who want a solid solution without having to deal a lot with the subject, N26 Invest is ideal.

N26 … my bank of tomorrow?

This is the case for a big and growing group of the population. According to own statements, N26 has now 1.5 million customers. This is an absolute triumphal march in Europe. The US-market introduction is near.

Of course, there are banks that are different in one or the other solutions and is perhaps better for the individual person. N26 is the perfect bank for very transparent transactions, genious card settings and perfectly integrated solutions for loans and investment portfolios.

Many people won’t need anything else but the complete solution by N26, which is, by the way, presented in a very modern manner. The app altogether is outstandingly programmed.

N26 is among the first of new payment methods, such as e.g. Google Pay and also Appel Pay, which will be introduced this year in Germany.

For whom is N26 the perfekt bank?

A case sample:

A young woman or a young man, let’s say 30 years old, with a good job at a German company, but with global subsidiaries, travels twice a year occupationally to the abroad, goes twice year privately on a trip, has little time to take care of the finances, but does not want to assign the branch office around the corner, because he/she has read in different financial blogs that you get bamboozled by them. And he/she is a smart bank customer, but just has little time.

So he/she becomes a customer of N26. Everything runs paperless through the app in a few minutes.

The salary is now transferred to the N26-account and no longer to the groups or Sparkasse, let alone at a private salesbank.

The overdraft is set up for emergencies in only seconds.

The Mastercard is sent in a sophisticated black package to your home address, instead of glued to a paper letter.

For a monthly fee, you can get the Mastercard in metal instead of plastic. The credit card number decently disappeared – which looks very sophisticated. Moreover, you can enjoy a preferred customer service and a Allianz-insurance package. However, the most-ordered account is the ► fee-free variant with oustanding app, but without bells and whistles.

He/she has decided for the N26 Black, because of the international health insurance, travel cancellation insurance and some other insurances and because he/she does not pay any currency exchange fees and gets an exchange rate that is always better than at the bank counter or in a shady exchange office.

Thanks to the integration of Transferwise, global transfers through the Smartphone are immediately possible and paper and expensive bank fees can be avoided.

In the pension provision or any middle-term savings, he/she knows that insurances are absolutely overcharged and inflexible, but searching and buying shares and ETFs yourself?

No time nor desire to do that. However, you have to do something. So he/she decides for N26 Invest, chooses a model for the pension provision, one for middle-term savings and one “just for fun” and the according risk class.

This is well explained in the app through a graph. He/she can pay more or payout or change the savings rate at any time. And of course, a self-chosen ETF-solution would be cheaper, but then you would have to do everything yourself.

N26 Invest is in any case cheaper, more transparent and more flexible than an insurance, a Riester-contract or a branch bank solution. Everything easily done through the app. Thanks to the Smartphone, I have it always with me. This is global and modern lifestyle.

He/she will then take the old insurance folder to hand, submits all insurances using the insurance certificate numbers or a scan to mail to N26/Clark in the app and then you can manage, cancel etc. all insurances in the future. The old insurance folder can be tossed.

Fast loan through app – super, isn’t it?

It becomes very clear in this example, that there is definitely a high number of people for whom N26 is the ideal way. Modern, paperles and very comfortable.

Everything in only one app!

Everything important is directly integrated into the app. You can solely work with N26, if you would assign yourself to the described target group and save yourself a whole lot of fees compared to the traditional banking.

For the lifestyle of this target group – we can all agree to that – N26 fits perfectly. It is a comfortable Fintech solution, which won’t need supplements in many cases.

But also for us smart bank customers, who use several banks, N26 has its eligibility. The control of the insurances in the app or the settings of the Mastercard are a very meaningful supplement to other banks, also direct banks that do not offer the like.

I am convinced that N26 offers something for everyone that is not yet convered. This is smart bank customer thinking ‐ combining advantages.

Especially for the German market, which still requires a German IBAN despite the judgements of IBAN-discrimination that prefer a seat in Berlin to one in London and is still very dominated by cash also in the year 2018, N26 is perhaps the bank that will push the modernization forwards.

The N26-headquarters in Berlin is visited by aged bankers, because they want to see how it can grow like it does and can make everything paperless and how their IT makes it different from theirs.

More than inconspicuousness: N26-heardquarters in Berlin. At least N26-user do not pay for the otherwise usual palaces made of glass and steel.

Moreover, the world of aged banks tries to link themselves to this “happy banking“-feeling, the customer should have fun when using the app. N26 has set the bar high, because it really is fun to use the app.

There is even an own fanclub for MoneyBeam. It remains thrilling to see how Google and Apple-Pay is further implemented in N26 and what projects it will meet in the future.

From my own experience, I can say that it is an incredible nice feeling to see how even elderly people get to know this new possibility in banking and do not want anything else after a short time.

One thing is sure: As soon as you are customer of a FinTech, then there is no way back. No complicated thinking anymore, no paper and no complicated procedures anymore. Everything is easy and uncomplicated, literally in the own hand, on the Smartphone.

Welcome to the world of tomorrow, which also prevails in our country.

Questions about N26?

Martin would be very happy to answer questions of interested parties, customers and returners about N26, N26 Black, N26 Metall or N26 Business.

Advice: Start with the free variant and if you like it, upgrade! Start here and now ► https://n26.com/de-de/

You are welcome to provide tips and report about your experiences with N26 to give readers a smart help. A heartly thanks to you!

Gregor with the author of this article in a conversation about N26:

Listen to the video as an audio:

Hello there!

Is it possible to open an N26 account from abroad? I do have a German passport & ID, but my current address is not in Germany.

Best regards,

Luis

N26 is being used in several countries. A simple “abroad” is is a bit too general. If it is a country outside of Europe, might postal routing be an option?

Good day! Is it possible to obtain a bank statement of the N26 account balance in order to present this document to the authorities (in Italy)?

Many thanks in advance.

If you mean a bank statement printer, then no. N26 is a pure online bank and does not have such a thing.

But you can log into the N26 online banking and print it by yourself.

I kindly ask for information on whether a savings account belongs to the N26 account and whether this really brings about 1% profit? Is the savings account also accessible in Poland?

Yes, there is a cooperation between N26 and “Weltsparen” within the app. There you can currently really get up to 1 percent interest. However, the investment has a duration of several months or years.

Currently, N26 is not offered in Poland. However, who opens the account in Germany and then “moves” to Poland, but can keep it.