Become a customer at the ING guaranteed ✅

Perhaps you found this blog article after your application on account opening of the ING current account or the setup of the wonderful credit line has been rejected.

If you are searching for a solution, then you are at the right spot. This article has been written for you!

Initial situation: The strainer!

A bank that offers one of the best conditions at the market since long, cannot accept every customer. If it would do that, it would necessarily slip down to being average out of economic reasons.

Account rejection as a protection for existing customers

Why?

One does not earn through every customer. In fact, banks only earn through “good” customers. The others cost money, cause losses.

If a bank strives for having one of the best conditions at the market permanently, then it has to filter who it takes as a customer and who not.

The bank strains.

Of course, the customer selection procedure has to be fast, efficient and cheap and this is why one uses different calculation tools. They calculate a total score based on data of the applicant in the account application, the assessment ratios of creditworthiness evaluation agencies (the best known is the Schufa), bank-internal data and possibly publicly-accessible data records.

In a total score, there is a “red” line. If you are above, then the applied for account will be opened or the loan will be granted. If you do not reach the scoring, then the application will fall short.

Now you have the choice (again)!

You could think: Alright, if this bank does not want me, then I just go to another one. This often works quite well, because banks have different ideas of their desired customers.

Or you say: I want to make every effort in order to become a customer of this bank, even if I have to make several attempts!

This article has been produced for the second case. We also have somebody in our community, who was granted the credit line at the fourth attempt (!).

Would you also have tried it four times?

Solution on how to become a customer of the ING today

Consequently, you can read about an immediately usable strategy on how to become a customer of the ING today – with a product that does not require a crediworthiness assessment.

Then you do things that improve the bank’s internal score and apply for the other products, such as current account and credit line. Agreed?

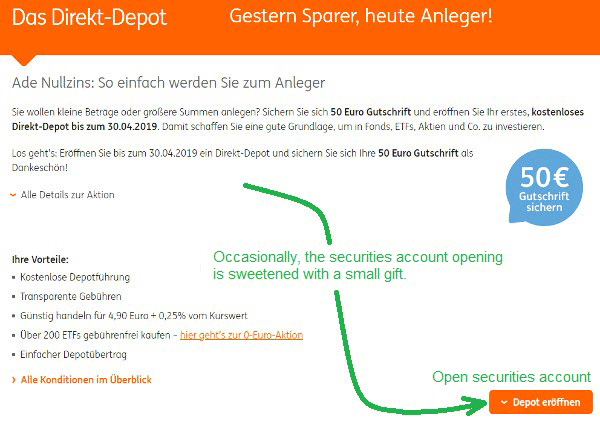

Apply for the ING-Depot (securities account)!

Apart from the fact that the ING offers a really very good securities account, the best thing about it is …

… that there is no creditworthiness check at the securities account opening!

Why?

The bank assumes that it will earn money through you. There is no possibility of overdrawing the account and moreover, the Schufa and the like are aimed at showing the debts. There is no external creditworthiness assessment for balances.

Why not become a customer through the call money account?

Yes, this sounds tempting for a lot of people, because the account application is a lot shorter and there is even interest for you. You can become a customer of this bank also without a creditworthiness check, but you do not build the important internal evaluation score!

Background: With the call money account – a daily available savings account, which is called “Extra-Konto” (extra account) by the ING – the bank loses money on a daily basis. It makes losses! New customers currently get 1 per cent interest and the bank has to pay a penalty of 0.4 per cent. The European Central Bank currently charges banks a negative interest!

However, only having customers like these, the bank could not survive! This looks different with owners of securities accounts.

Just with the opening of a securities account, you invigorate your internal score at the bank. You take advantage of the positive image of a securities investor!

Securities account opening invigorates the score!

Becoming a ING customer step-by-step

1. Open the depot application

► https://www.ing.de/lp/direkt-depot

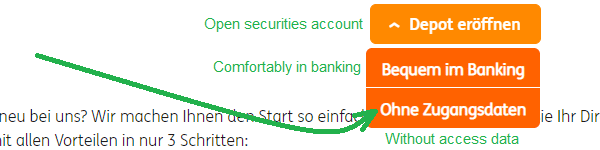

Currently, there is a step in between at which you have to choose “Ohne Zugangsdaten” (without access data) being a non-customer:

Fill the online application (page 1)

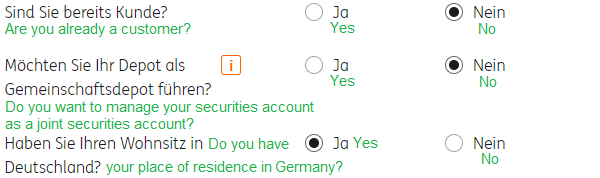

Requirements for the opening of a joint securities account is the same address. For the securities account opening, you generally have to have an address (place of residence) in Germany.

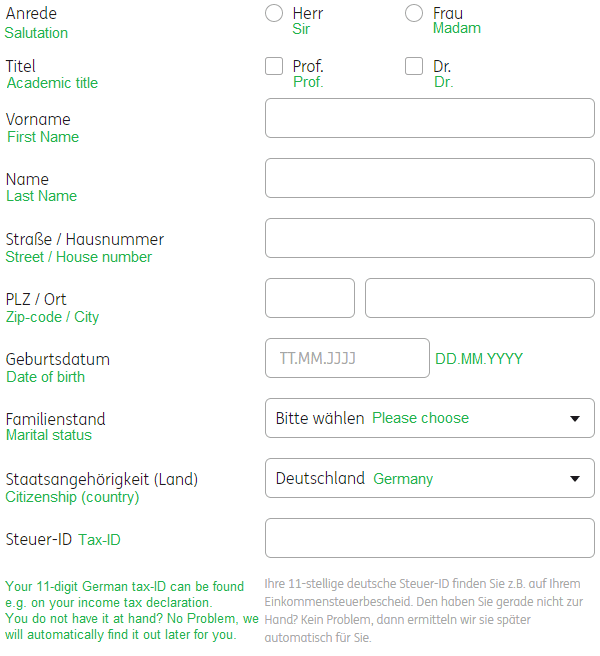

Personal data

The personal data should be self-explainatory. For the securities account opening, a German citizenship is not necessary. If you do not have the tax-ID at hand, you can submit it later on.

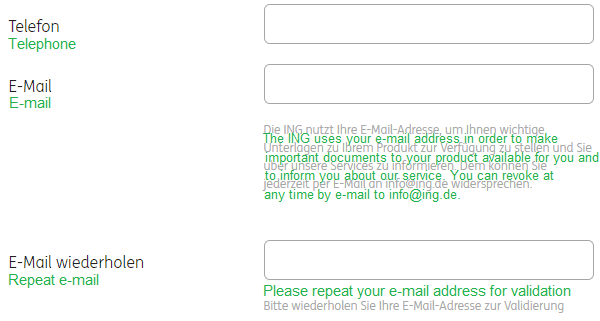

Contact data

Also self-explainatory.

Tax liability abroad?

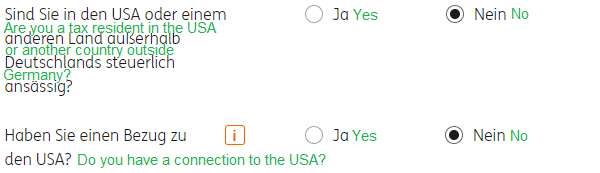

If you are income tax liable in another country but Germany, then please state it. If you have a connection to the USA (US-citizen, green card owner, place of residence in the USA), then you do not have to further fill the application. The ING does not open securities accounts with US-connection – as almost all banks in the EU.

Fill the online application (page 2)

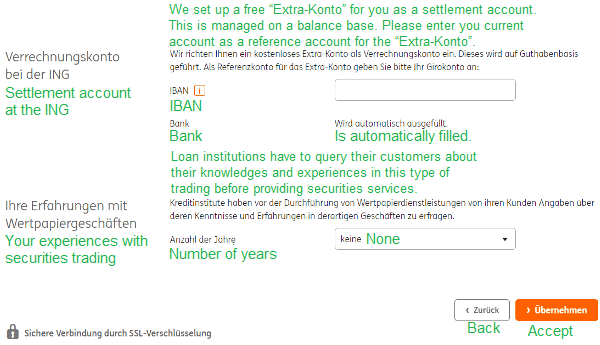

In the first step, you state the IBAN of your former current account. You can change this data in the online banking at any timer later.

Due to the legal requirements, your securities knowledge is queried. If you do not yet have any experiences with securities, then leave it at “keine” (none). If you have some knowledge, then please state it.

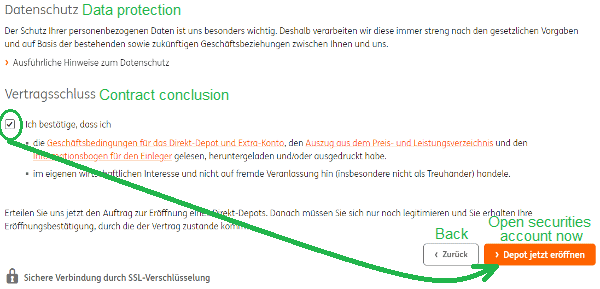

Confirm the contract conclusion

By ticking the box, you accept the conditions of contract conclusion with the bank. Then you click on “Depot jetzt eröffnen” (open securities account now).

Completed, done: You have become a customer of the ING!

Now you have to make the usual legitimating through PostIdent or VideoIdent and then you will receive a mailing from the bank with the access data and the welcoming letter a few days later.

What are the following steps?

It is recommended to set up a fund, ETF or shares savings plan soon after the depot opening, before you apply internally for further services, such as the current account or loans.

Further articles about the ING:

- 2 cards with the current account and the cash supply

- How to above-average successfully apply for an ING loan

- How to deposit cash free of charge at the ING

I thought this article is about helping people open an ING bank account when they do not have any record of creditworthiness (as in my case, I have recently moved to Germany and do not have any previous bank accounts here). However, the last page asks for an IBAN for the checking/current account with ING, which makes this whole process a catch-22: without a creditworthiness record, I cannot open a current account, and without a current account I cannot open a securities account in order to obtain creditworthiness record.

Do you have any advice about this issue? I was unable to use my IBAN from my UK account.

When opening a new depot ING does not check the customer’s creditworthiness. With the depot, you build “internal” creditworthiness with the bank and follow up with the giro account at a later time. If you only need a giro account without creditworthiness, this article can help.

After opening the securities account, how long would you recommend waiting before applying for the current account?

It depends on how urgently I need it. If I wanted it right away, I would apply for the currentaccount immediately after the opening of the securities account – while still being logged in at the online banking. That way, I’d save the bank and me the legitimization process. Is that your plan?

I’m new to Germany and was rejected by ING for current account (even though I didn’t request a credit line). So I opened a securities account like this article suggested and set up some investment funds. Now I’m wondering how long to wait to try for the current account again.

Thanks for your help!

Please have a look here.