How I improved my Schufa with a loan!

The Schufa-ranking should actually worsen when taking a loan – so the general opinion and I thought so too. Until yesterday!

You will learn in this article how my Schufa-ranking has improved by taking a loan at the Deutsche Kreditbank (DKB).

How the Schufa-ranking works (base score)

The German Schufa (credit investigation company) collects data about all of us, who participate in the economic life in Germany. It provides this data – often in the form of the base score – to its contractual partners, who pay charges.

The base score indicates the assessed probability that the assessed person meets the payment obligations on time.

You can find out how to get your base score free of charge from the Schufa reading this article: Schufa-query: sample letter.

Meaning of the Schufa base score

- > 97,5 %

- very low risk

- 95 % – 97,5 %

- low to manageable risk

- 90 % – 95 %

- satisfactory to increased risk

- 80 % – 90 %

- significantly increased to high risk

- 50 % – 80 %

- very high risk

- < 50 %

- critical risk

You can see that one can no longer speak of a „good Schufa“ at a rating below 90%.

The result is:

- that one has to pay higher interest rates at loan providers that work with interest rates that depend on the creditworthiness.

(these are the top providers in this comparison: Loan comparison with calculation tool), - or that the loan application is rejected.

Advice: Find out your base score before you apply for a loan!

Smart approach:

How to find the right bank for your loan

A) Top creditworthiness

If your Schufa score is higher than 98%, it is advisable to choose a bank with an interest rate that depends on the creditworthiness. See: calculation tool.

B) Good to very good creditworthiness

With a base score between 95 and 98%, we recommend the DKB personal loan. Every customer, whose loan application was approved, will pay the same low interest rate.

It is not the best loan rate. One can only obtain this at loan providers that depend on the creditworthiness.

However, the truth is that most customers of loan providers that depend on the creditworthiness pay a more expensive interest rate than at the DKB, because only very few people have a Schufa score of more than 98%.

C) Medium to low creditworthiness

People with a Schufa rating below 90% should take a look at the points 2 and 3 of this page: Getting a loan in Germany. There, alternatives of a direct loan application at the bank are presented.

Experience shows that this is a viable option for people with medium to poor creditworthiness. And it is definitely better than receiving two or three loan rejections from the providers with the lowest interest rates.

As this would lower the Schufa ranking even further and the loan approval would become even more difficult!

Find out your Schufa-ranking!

Crazy: Improvement of the Schufa-rankings through a loan

Logically, the likelihood of the timely payment of the interest rates should decline and thus the Schufa-ranking, if one slips further in debt.

This is probably also the case, if one takes multiple loans. I write “probably” with caution, because:

- the Schufa does not provide information on the score calculation,

- my own loan led to a better ranking, rather than worsening it.

However, this can be explained logically

If someone has a fairly good creditworthiness and obtains the loan at the first bank at which one applied, then this is a very good word for the borrower.

Finally, the bank has assessed the applicant more accurately than the Schufa can. The bank has further financial data of the person, such as the income, the relationship status and home situation.

As at (almost) every loan request a query of the Schufa-data takes place, the Schufa will know, if you have applied for a loan. If then the second message on the loan takes place – at only one creditworthiness request – the Schufa will know that the first bank has granted you a loan.

It only does it, if the bank assesses you so that you will repay the loan on time.

Perhaps there is even another “plus point”, depending on which bank will finance you. The DKB, for example, is considered very good loan bank. Not everyone will obtain a loan there. People, who are credit customers of the DKB have a positive reference!

How my Schufa-creditworthiness has developed

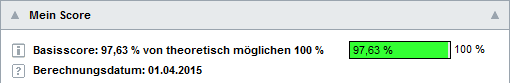

On the 1st of April 2015 – before the application on a DKB loan – my base score was 97.63 %.

Screenshot of the Schufa-score before the loan application.

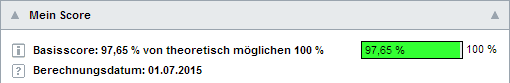

The score is updated every three months. At the next query at the 1st of July 2015 – after the application and payment of the loan – the score was 97.65 %.

Source: Online access to the Schufa – possible for everyone paying a small fee.

Although this is only a minimal increase, however, in contrast to the expected worsening of the Schufa ranking, this was a positive surprise.

What experiences did you make?

In order to substantiate this theory, that one or the first loan increases the Schufa-ranking a little (in any way, it does not lower it), I would be glad, if you could contribute with your experience.

This will help everyone, who wants to finance smartly, and you too, as you have dealt intensively with this subject.

If one applies for a loan blindly, one can get lucky.

The probability that one can achieve a better result (loan approval, favourable interest rate, good Schufa-ranking for the future financial life) however, is higher, if one approaches this subject skilfully.

I wish you a happy financial knack and thank you for your commitment!

Leave a Reply