Framework Credit (Rahmenkredit) vs. Installment Credit (Ratenkredit) in Germany

Some of our recurring readers are very familiar with the differences and advantages. Please help to complete this article via the comments feature.

To all (potential) credit seekers: This article is for you. We hope it will help you to get the best financing form at an advantageous interest rate.

Before you conclude the credit contract, please pay attention to the important condition design possibilities that have been especially highlighted for you in this article.

1. The most important differences at one glance

| Installment Credit Rahmenkredit |

Framework Credit Ratenkredit |

|

|---|---|---|

| Credit Amount | many banks between 2,500 and 50,000 Euro, occasionally also 500 to 120,000 Euro | 2,500 to 25,000 Euro |

| Credit Disbursement | • immediately or at a determined date in full amount | • credit line is made available immediately in full amount; when and how much is accessed (disbursed), that is your decision • you can make transfers from your credit account to your giro account yourself |

| Credit Repayment | • monthly in installments of equal amounts per direct debit from the giro account • special repayments possible at many providers |

• your responsibility, the credit interest is debited monthly from your giro account • an individual plan for repayment can be set up • special repayments of optional amounts possible anytime |

| Duration | is determined in the credit agreement as applied for, mostly between 12 and 84 months, some even up to 120 months | credit line is set up permanently (no determined duration, can last the whole lifetime) |

| Credit End | • when the credit has been repaid in full customarily at the end of the duration • earlier in case of special repayments |

• credit ends when it is cancelled, otherwise credit line is always available • whether you use it or not is your decision • if it is not used, it does not incurr interest – just like with an overdraft facility |

| Permanent Top Providers (editor’srecommendation see below) |

www.dkb.de | www.ing-diba.de |

| If there is anything unclear, please use the comments feature at the end of the article for your questions. | ||

2. Which Credit for which Kind of Use?

2.1. Installment Credit / Ratenkredit

The installment credit is especially suitable, if one has a concrete project to finance, for example the purchase of a new computer with high-end accessories. One needs a certain amount of money and is able to repay monthly fix installments.

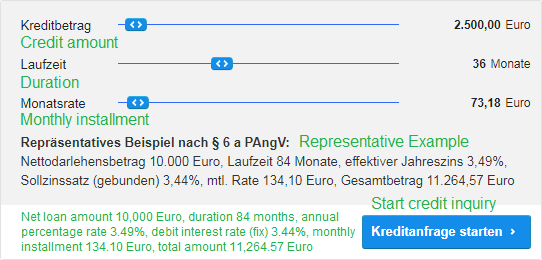

Example Installment Credit

Price of the computer: 2,500 Euro. At the time of this articles creation, my house bank had this offer:

monthly installment: 73.18 Euro

duration: 36 months (= 3 years)

effektive yearly interest: 3.49%

With an installment credit it is clear from the beginning, how much money is needed and how much one is willing or able to pay back on a monthly basis. From that, the duration results. At the end of the duration, the bank has gotten back the monay as well as the interest, and the credit is paid back.

An installment credit is very well plannable “business” for a bank. That is why very advantageous interest rates are often offered for installment credits.

We will elaborate further on the potential different amount with one and the same credit in the paragraph „Interest depending on credit standing”. But first, let us talk about the framework credit.

Installment credits are good business for banks

Framework Credit / Rahmenkredit

The framework credit is quasi an additional overdraft facility. One can set it up, while actually not needing any money yet, something I also emphatically recommend here, in order to be financially flexible.

In case one suddenly does need money, one can at once and without further trouble (no request, no application, nor anything else along those lines) access (“call”) the credit line, either completely or in part. Therefore, it used to be called “callable” credit.

Framework credit = credit line that can be used anytime

(and also durably)

When you apply for and have set-up a framework credit, you receive an online access to your personal credit account. From there, you can make disbursements by yourself onto your giro account and in reverse also make deposits yourself, in order to repay the credit.

A framework credit is set up, for example, in order to quickly buy a washing machine, when the old one is broken, or in case a sudden car repair is neccessary. These things happen every now and then, but one does not know when. Such incidents are hardly plannable.

One way we can prepare/plan in advance is with the application and set-up of an additional credit line for emergencies, one that does not cost us anything, as long as we do not (temporarily) use it. This you can also use as an alternative to the – almost without interest – savings account (reserve account for repairs, this money could instead be used as productive capital and let grow).

3. Requirements (Credit Standing)

At this point we come to the commonalities of installment and framework credit, because the bank is not to consider you a risk. A bank wants to earn money (your interest payments), but not lose it (credit default).

In Order to Successfully Obtain One of the Two Credit Forms, You Need:

| installment credit Rahmenkredit |

framework credit Ratenkredit |

|---|---|

| Regular income as an … | |

| employee, pensioner, with some banks also as a self-employed person | employee, pensioner |

| No negative credit assessment by Schufa | |

| Residence in Germany | |

| Giro account in Germany (for the disbursement and direct debit of the installments) | |

What are the recommendable providers?

4. Recommendable Providers

(where I myself have a credit)

Framework Credit

The framework credit is then the credit of choice, when there is no concrete current financing project, but one wants to secure a credit line for later cases.

It also is an option, when one only needs a “small” amount, see further below at “Minimum Credit Amount”. The flexible replacing of other (more expensive) credits is a good purpose as well!

Top recommendation (due to own experiences, of course) is the framework credit of ING-DiBa – direct link to the bank’s credit page ► www.ing-diba.de/rahmenkredit

Tip: In 5–10 minutes you know the amount, in which you may expect a line of credit ► www.ing-diba.de/rahmenkredit

Installment Credit / Ratenkredit

If I want to finance a particular project – which of course can also be the replacement or dept restructuring of older (more expensive) credits –, then I use the installment credit.

If I knew my credit standing as “good” to “very good”, I do my credit application directly at DKB bank ► www.dkb.de/privatkredit (which I have also done, which you can read about in some of my further articles).

In all other cases it is recommendet to use the ► credit comparison, because here that bank is determined from a multitude of banks, that is best suited to you financingpurpose.

4 Things to Please Keep in Mind when Selecting the Credit

a) Special Repayment

It is recommended to ascertain that your Kreditbank allows special repayments. You then have the greatest flexibility, whenn special repayments are allowed at any time and in any amount. Then you can pay back your installment credit quicker (before duration end).

With the DKB credit, maximal flexibility is the case.

With a framework credit you do not need to ascertain the option of special repayments, because you already have the option to deposit any amount at any time onto the credit account anyway.

b) Interest Depending on Credit Standing

With interest independant from credit standing, all customers get the same interest rate. Period.

With interest dependant from credit standing, borrowers in differrent credit standing classes have different interest rates. This means: If you have (built up) an excellent credit standing, you pay less for the same credit than somebody with a less good credit standing.

But interest rates that are depending on credit standing have a positive side effect as well: People who might not get an approval when it comes to a credit depending on credit standing, have chances at these providers to get a financing with the payment of a higher interest rate.

Rule of thumb for an installment credit:

- If you have a top credit standing, go via credit comparison

- If you have a “good” up to “very good” credit standing, you should directly take a provider independent of credit standing, like DKB.

- If you have a less good credit standing, you use the credit comparison, in order to find a provider at all to finance you

- If you do not know your credit standing and have some time, get yourself a Schufa check. If you have less than 3–4 weeks time, use the credit comparison.

.

Framework credit: The interest rate is the same for everyone. The differences lie only in the amount of the credit line, or in the question whether one will be granted at all.

The obstacle to overcome in order to get a good credit line is not especially high, which you can read about here: Setting up a framework credit cleverly (German article).

c) Schufa Markers: Credit Inquiry or Conditions Inquiry Credit

When you apply for an installment credit or a framework credit, the bank will always check your Schufa, in order to review your credit standing and credit history, if applicable. When performing such Schufa inquiries, the bank states a reason: either “credit inquiry” or “conditions inquiry credit”.

The difference here lies in the detail: When a credit inquiry is noted and afterwards the credit is marked as not concluded, this has a (potentially) negative effect, because it gives the impression that the bank’s further review has resulted in you not being considered credit-worthy by this bank.

It is different with the marker “conditions inquiry credit”. Here it is clear that the inquiry is only being done in order to create a credit offer. You can accumulate any number of this marker in your Schufa; they do not affect your score value.

Other banks can only notice within the first 10 days after the entry of this marker, that there are further inquiries being done by other banks. When performing a Schufa self-disclosure, you as the subject of the Schufa entry can see these inquiries for the duration of one year.

All providers named here at DeutschesKonto.ORG, use – without excemptions – the neutral marker “conditions inquiry”.

d) Minimum Credit Amount

Often, computers are not as expensive as in our example above. In order to ensure that the granting of installment credits are still profitable despite the current especially low interest rates, the minimum credit amount has been increased several times during the recent years.

For the installment credit of ING-DiBa one has to take 5,000 Euro or more. 2,500 Euro at DKB is still relatively good.

This means, if you only need 1,000 Euro for the new computer, those credit amounts are too high. Here the framework credit is an excellent alternative. Due to the flexibility you are getting as a customer, the interest rate is a bit higher – but if you, for example, apply for the minimum credit line of 2,500 Euro, you can still afterwards decide to only use 1,000 Euro.

When and how much you use, that is always your decision. Since you only pay credit interest for the 1,000 Euro instead 2,500 Euro, this option would be significantly less expensive for you!

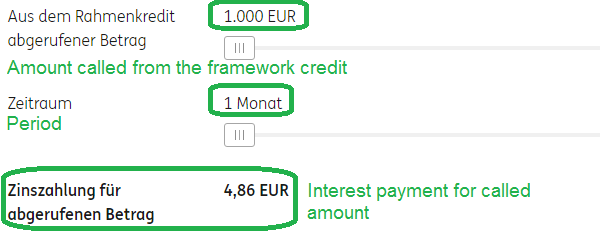

The great advantage of the framework credit: Even though you might have agreed on a credit line of 25,000 Euro, you are free to use – for example – only 1,000 Euro. Currently, that would cost you 4.86 Euro monthly cost (Screenshot ING-DiBa). You can do your own calculations here ► www.ing-diba.de/rahmenkredit

Questions regarding the use of the installment or framework credit?

Use comments feature at the end of the article. My team, our smart community or I myself are happy to help.

Leave a Reply