3 Secrets for New Customers of the DKB

Sometimes you may read in forums that some new customers of the DKB are not satisfied, because their Visa credit card initially only has a small limit or a temporary block occurred, when paying with the credit card.

Gregor, author and profound expert of the DKB.

Therefore, the assumption arose that there are two classes of customers at the DKB. Some banks – as for example Comdirect – have First-customers and normal customers.

Cortal-Consors divides its customers into different classes. This is also done by other companies besides banks.

The DKB does not do that! At the DKB, there are no superior or subordinated classes of customers. The only division at the DKB is for bank account holders with their residence in Germany and bank account holders outside Germany. The reason for this is the complexity of the bank account application and finally also the tax background (german).

Here you will learn about proven strategies to show your bank that you are a “safe” customer.

In order to become one of the happy customers of the DKB, I reveal my “secrets” about the DKB to you. These are proven strategies to assure the bank that you are a “safe” customer.

Barely known to the public …

There is one fact that is barely known to the public: banks (not only the DKB, but also other German direct banks) are regularly a target of criminals. The task of the bank employees and of the technical systems is to differ between a real customer and an attempted fraud.

Especially during the first time, in which the bank has no experience with the customer and his/her payment behaviour, the bank has to be careful and a high level of sensitivity is required. The bank surely does not want to scare new customers off.

Through its continuity, the DKB shows its success in this area: Since 1998, the bank account DKB Cash is offered as a free Internet current account with free worldwide cash withdrawals – it is the absolute pioneer in the industry and even without the new customer campaign permanently at the top position.

Case 1: Susi wants to withdraw cash in her vacations

Susi plans to have long vacations together with her friend. Her friend recommends the DKB Visa credit card and the free cash withdrawal. Being a student, her application for an account is approved quickly and without questions and she is happy to receive her credit card and PIN in her mailbox.

Often, the DKB account is applied for shortly before the holiday trip or the usage starts with a journey abroad.

She takes her credit card with her on the vacation destination. She pays for the first lunch at the Plaza de Sol with her Visa credit card and is happy that everything works out well. Also, there was no problem when withdrawing the first cash at the airport.

However, when she wants to pay for her rental car to make a day trip to the north coast, the payment is rejected. At the second try as well, the transaction is not executed … her disappointment replaces the initial joy!

Case Background

Before each account opening, the DKB performs a credit assessment. Just like any other German bank, it requests Schufa-data (credit investigation company). A student, who does not appear a lot in the economy (bank accounts, credit cards, credit loans, contracts, such as mobile phone contracts), does not provide a lot of information. Therefore, her creditworthiness is difficult to assess.

The DKB sets up a bank account for her with full functionality (all customers are treated equally), but sets small limits. Initially, these could be e.g. Euro 100 credit card limit and an overdraft limit of another Euro 100. Other banks generally do not provide students with credit lines!

Maybe Susi went on her vacation, thinking that it is a credit card of which payments can be paid afterwards. If you do not deposit money on your account, then this credit limit is reached quite fast. Moreover, the early warning system for frauds may become active, as the credit card was sent to Germany, but was used in Spain first.

Advice: When you plan a journey abroad, especially to exotic countries like Mexico or the Ukraine, then you should notify the bank per phone or mail. This information is saved for the vacation period and reduces the risk of a temporary credit card blocking.

Solution

… the ideal credit card for your vacation, but the account and credit card should be set up accordingly in advance.

If you have applied for the DKB Visa credit card at short notice to take advantage of the feature of withdrawing cash free of charge, then it is useful to deposit money on the credit card.

This works similar to prepaid credit cards. You transfer the amount you plan to spend on your DKB current account and within your online banking system, you transfer this amount to your credit card. You should plan for each of the transfers 1 – 2 business days.

You can always dispose of deposited money on the credit card. If you have an initial credit line of Euro 100 as a new customer (you can check the credit line at any time through online banking) and you deposit Euro 2,000, then your available funds are Euro 2,100.

Please see our overview with the maximum available funds in German language.

If Susi would have checked her credit card limit before her departure and eventually made a deposit, she would probably be the happiest DKB customer. Free cash withdrawals as often as she wants and of course the problem-free payment of the rental car, as well as the rental deposit on the DKB credit card would have been possible.

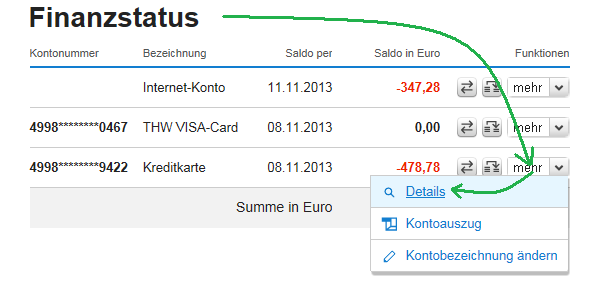

A short login into online banking helps:

Log in and in the area of “Finanzstatus” in the column “Funktionen” click on “mehr” and then click on “Details”. A new site will open:

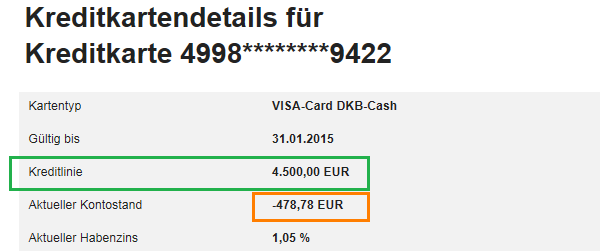

In this example, a salary entry is the case; one can see it on the credit line of Euro 4,500 (green). Euro 478.78 were already spent (orange). The customer may still use more than Euro 4,000 this month.

New customers at the DKB could be here: credit line Euro 100 – current account balance Euro 2,000 (at a corresponding deposit). So, there would be Euro 2,100 available credit.

The initially low credit card limit can be increased by making a deposit/transfer.

Case 2: Michael wants to change his current account immediately

Through our German account comparison, Michael has discovered that he pays relatively high fees for a worse performance at his current bank. He wants to switch completely to the DKB and to cancel his old current account with credit card as soon as possible.

Michael travels a lot privately and is used to pay large amounts of money with the credit card. As soon as his first salary deposit has arrived at this DKB-account, the bank computer automatically adjusts the credit line for his current account and credit card.

If other credit criteria (credit investigation company query!) are alright, one may count with about twice the salary amount. At request, this can be increased to up to three times the salary amount.

Case Background

As the bank account and card are free of charge, the DKB has only two possibilities to earn money from the customer:

- the customer pays with the credit card (the bank earns from the fees that the merchant has to pay for the service)

- the bank earns through the overdraft interest (this is relatively low for the customer, however, much higher than the credit interest rate, so the bank earns when you are in the red figures)

This is perhaps also a reason, why the DKB cash account has a credit line. However, nobody has to use the overdraft credit. It is also possible to lower the credit line by contacting the customer service.

Solution

Michael wants to immediately replace his old credit card with the DKB Visa credit card. He does not want to wait until the personnel office transfers his salary next month to the DKB account and his disposal limit will then be adjusted automatically.

Michael works as a helicopter pilot. After having sent his proof of salary to the DKB and announced that the salary payment will be changed starting next month, he immediately obtains a disposal limit with which he will have more than enough until his next salary payment.

In our experience, one has a great chance to receive an appropriate disposal limit immediately for this bank account and credit card, when enclosing a copy of the last salary statement to the application for the account opening or sending it via E-mail to the bank.

When someone decides to have the DKB as a main bank account with salary entries, then the DKB will make the change and establishing of an appropriate disposal limit as easy as possible. In any case, we know about a positive experience in which the limit was raised already on the next day …

… not yet to three times the salary amount, but in a way, that the account could be used just like the old one.

Case 3: Frances and Alex need a lot of cash immediately

Frances and Alex love to travel to the Allgäu (in South-Germany). They go there for about a week in summer every year since their honeymoon. At a car exhibition for vintage cars, Frances fell in love with one of these old vehicles and could make Alex promise to buy it. However, the seller, being an elderly man, only accepts cash. How on earth should they get Euro 4,900 in cash?

Can Frances and Alex buy this well-preserved oldtimer with the help of the DKB in cash on that same day?

Solution

Simply call the DKB. The DKB is available via phone at all times. Explain your situation and ask it to raise the daily limit in order for you to withdraw Euro 4,900.

In the case of Frances and Alex, it was possible, because Alex uses his Visa credit card as a savings card. The credit on the Visa credit card is paid interest fairly. This interest is even credited monthly. Being a customer, you can dispose of your savings at any time.

The customer service could set up a temporary daily limit of Euro 5,000 for the usage at ATMs for the following two days. So it was possible for them to withdraw the Euro 4,900 in cash on the same day.

Although, they had to use

As a DKB customer, it was no problem to accomplish this spontaneous car purchase in cash.

Summary

The DKB is one of the best German direct banks, maybe even the best of all! The bank account opening is quite easy. However, the credit lines – that do not exist at all or only after an appropriate security check at other banks – are low in the beginning.

Initially low credit limits.

This is part of the risk management of the bank and is in interest of all customers. If the bank would have too many loan losses, it would be impossible to offer such a great free bank account with worldwide free cash withdrawals.

With your usage behaviour, so using your account and credit card regularly, you can show the bank that you are a “safe” customer.

For a quick start, it is recommended to deposit money first on the credit card (= increasing the credit limit) or to transfer the incoming salary deposits on this bank account.

Of course, the DKB account may also be used as a secondary account, so e.g. just for holidays, and otherwise remain unused. However, you should check the credit limit beforehand and if necessary deposit the amount your will need.

“Apply now for the account DKB-Cash”

… the worldwide most attractive bank account!

More about DKB and account opening:

Problems or questions about the DKB account? Please post them here. The answers will follow soon!

Hi.

What do you think about consors credit card?

Cash withdrawals and payments are also free?

There are about 2,000 banks in Germany. We have decided on dealing with just very few, but really really great banks – however, to such a detail that you won´t find anywhere else!

Hi Gregor,

So with this account, I can withdraw cash that is in my current account with Visa credit card as well as the Giro card?

I assume there will be a restriction on which ATM I can use if I use teh EC / Giro card. While Visa will work everwhere. But since its the credit card, how will the transaction work? How much interest free credit period do I have with DKB card?

Thanks in advance for the help 🙂

Regards,

Mayur Gondhaleakr

If you want to withdraw money, please use the DKB Visa Card. All dealings are interest free until the monthly account statements are issued automatically.

In case your credit line initially is too low, you can expand your disposition range by internally transferring funds from your bank giro account to the credit card account.

Here you can find explanations for the 11 most importang functions: https://www.deutscheskonto.org/en/dkb/visa-card/

Dear Gregor,

I’ve just opened DKB cash. How can I receive interest of my saving?

In my on-line banking there are two accounts: -Giro, and -Visa. Which account receives interest?

Thanks,

Benjamin

Hi Benjamin,

the one with the interest, that you can use as a savings account, is the -Visa.

Dear Susanne,

After transferring my saving from Giro to Visa, is it possible to do the reverse action? I mean for a while, I get interest, and then do the reverse transfer (from Visa to Giro)

Best,

Hi Benjamin,

yes, that is possible 🙂 You can transfer previously deposited money from your Visa card back to your Giro account. This only works though if there actually is money on your Visa card – you can not use this method to access any potential credit line on the Visa card.

Dear Susanne,

I have transferred my saving to Visa Card, and every month receive the interest.

Now, I got another question. After receiving the interest, two amounts (Abgeltungsteuer, and Solidaritätszuschlag) are subtracted from the interest (Habenzinsen).

I know, I must pay the tax. However, I know if the total yearly interest is less than 801 Euro, I do not need to pay the tax. I work in Germany and pay tax and have tax number. Every year, I do the tax declaration.

I am sure that the total yearly interest is less than 801 Euro. Is there any way to ask the DKB bank, not to take those two amounts (Abgeltungsteuer, and Solidaritätszuschlag)? I will announce this income in my yearly tax declaration.

Best Regards,

Benjamin

I am student doing my masters here, I like to deposit money as savings and also need as a credit card option in case of emergency money. Is DKB student account suitable for it?

I am English, and have a DKB account and DKB VISA credit card. I use DKB online banking, but can’t see, even with Google translate, how I add money from my checking account to my DKB VISA credit card, so I can use it like a prepaid credit card. Can you explain to me how I do that?

Hi there,

thank you for the info. I am based in Germany, have an account and have transferred money from the girokonto to the kreditkard conto prior to my vacation. However, once I was there, I could not withdraw money using the credit card, only pay.

Why was that? If I must inform the bank of my travel plans, how can I do that? To whom should I send an email informing of my travel plans?

Many thanks

You have done everything right, great! I can only think of one reason why a withdrawal might not work: Have you maybe tried to withdraw an amount of (converted) less than 50 Euro? At DKB, cash withdrawals need to range between 50 and 1000 Euro. Please simply withdraw a higher amount. 🙂

Hi all, a Ukrainian here. We don’t say “the Ukraine” anymore, it’s just Ukraine 🙂

Thanks for this amazing portal!

Hi, do you think I can open a DKB account knowing that I have savings, but no salary, and I am also selling an apartment so I would like to put this money on the DKB account.

Does DKB accept the non-salary people?

If yes, which fees per month?

Thanks a lot

Private accounts at the DKB have been without monthly account management fee for more than 30 years. The DKB is interested in long-term business relationships, which is why it asks for the monthly income in the application to open an online account (without checking it). The bank is not interested in credit balances or a balance sheet. She only asks about the residential status. But the question is not that important.