DKB refunds foreign fees

Can you remember? At your account opening, the DKB promised you: “free cash withdrawals worldwide”.

From experience, you know that you can ignore the notes on fees at ATMs in Germany, as the DKB never charges your account with the indicated foreign fees. This also applies to the cash supply abroad.

Foreign fees of ATM operators abroad

However, there are some countries – especially popular among German tourists are the USA and Thailand – that have a different fee system for their ATMs.

In both countries, the customer is billed directly an ATM withdrawal fee. This is done in a way that the withdrawal amount increases. In the example that I will show you now, I have withdrawn US$ 60. US$ 62.75 were charged, because the American Bank added its ATM fee directly to the withdrawal amount (after the prior confirmation on the monitor of the ATM).

Other banks leave you with this fee!

Exactly this process is described by other banks as follows, “foreign banks/ATM operators may charge their own fee for cash withdrawals“. Usually, these costs will have to be paid by the bank customer. This is different at the DKB!

DKB is confirming its statement

The DKB has made a promise that its customers can withdraw cash free of charge with the Visa credit card worldwide. And it confirms that to 100 percent!

If out of technical reasons (usually there are two entries per cash withdrawal – one is the withdrawn amount and the other one is the fee – in the USA and Thailand, both are settled in one entry) it is not possible to separate the withdrawal amount from the fee, then the customer will be refunded the foreign fee.

This works unbureaucratically at the DKB. I myself have already used this refund option several times successfully on my trips. Please take my prime example of a cash withdrawal in Hawaii as instructions for your own refund.

Prime example of a refund at the DKB

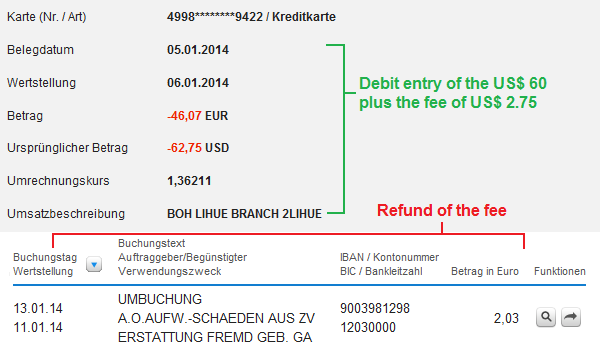

On Sunday, January 5, I walked into a branch office of the Bank of Hawaii (BOH) in Lihue, the capital of Kauai. There, I withdrew US$ 60 as part of my credit card test “Comdirect vs. DKB“.

During the withdrawal process, the ATM asked me, if I agree with the fee of US$ 2.75. I confirmed that by pressing a key, as there was otherwise no way to get the cash.

As soon as the ATM had issued the cash, it automatically printed out the receipt for the withdrawal and the fee. At best, you take a photo with your phone’s camera right away.

Take a photo of the receipt to send it as a proof by e-mail to the DKB. You do not have to take a photo of the withdrawn money.

Then, you send the photo by e-mail with the following text to info@dkb.de.

Sehr geehrte Damen und Herren, leider berechnete mir der ausländische Geldautomat eine Abhebegebühr (siehe Anlage: ATM-Quittung). Ich bitte um Erstattung auf mein Konto Nummer 12345678 (your account number). Vielen Dank und mit freundlichen Grüßen Ihr Name

Some days later, you will find a line on your bank statement of your DKB current account:

Above: credit card statement of the cash withdrawal

Below: current account statement of the refund. EUR 2.03 correspond to the amount of US$ 2.75 on the day of refund.

In the entry purpose “A.O. AUFW.-SCHAEDEN AUS ZV ERSTATTUNG FREMB GEB. GA” you can see that the DKB refunds this fee from its own resources. You will not find this refund option in a section of the price and service listings of the bank.

Legally, this is a reimbursement as a gesture of goodwill (these are third-party fees in another country!). However, the DKB performs this refund for every customer, because it has decided to keep its promise “withdraw cash worldwide for free with the VISA credit card” to 100%.

A request to you!

Use this option to refund wisely! At best, withdraw the necessary amount weekly, instead of producing fees at ATMs each evening. Even these would be refunded, as a reader commented happily. However, this cannot be the long-term interest of us being DKB customers!

For the sake of completeness …

Cash withdrawals with the Visa credit card are free of charge in any case. Even if you look at other potential fee-producing factors (that some other banks use to make earnings), one will see at the DKB: completely free!

| Conventional credit cards | DKB Visa Card | |

|---|---|---|

| Withdrawal fee | about € 5 | € 0 |

| Refund of foreign fees | not possible Exception: Comdirect |

100 % |

| Fees at currency exchange (in this example from USD to EUR) |

Fees between 0 und 3 % | no fees, 100 % transparent through firstdata |

| Foreign transaction fee | 1 to 2,5 % | 0 % |

Cash withdrawals are always free of charge with the DKB Visa credit card within Germany and abroad. No exceptions!

Further information about the DKB Visa credit card ⇒ My 11 Tips for optimal use!

New: From the 1st of June 2016, the refund is cancelled!

After the Comdirect Bank has cancelled the refund option on the 15th of February 2016, many have opened an additional account at the DKB. Mainly in order to use the refund, but otherwise they had little activity on the account or are not interested in other banking services.

Within the last month alone, the requests on refund have caused a “damage“ of almost one million Euros at the DKB!

The existing condition model leads to an unsustainable use. In the second part of this article ► “DKB changes its conditions … and what can we do?” we discuss alternative condition models, which are useful for us bank customers, but also for the DKB. Keyword: changes of the foreign transaction fee.

You might want to take a look and participate? The results will be forwarded to the DKB with a request to give it great consideration!

For everyone, who still wants to receive a refund, there is a solution idea (thanks for the many letters from our readers!)

Alternative solution found for you:

The 1plusCard of the Santander Consumer Bank is the only remaining credit card with which one can withdraw cash free of charge and get a refund of foreign fees on request.

Take a look on their website for yourself https://www.santander.de/de/privatkunden/konto_und_karte/kreditkarten/1plus_visa-card/produktinfo_1plus_card.asp where it says in the small print:

**Geldautomatenbetreiber im Ausland können Entgelte erheben, die zusätzlich zu dem Auszahlungsbetrag der Kreditkarte belastet werden (Surcharge). Diese Entgelte werden dem Karteninhaber auf Antrag erstattet.

Our translation: ATM-operators abroad may charge fees that will be charged additionally to the payment amount of the credit card (surcharge). These fees will be refunded to the card holder on request.

Will you get this additional card?

Hi there, I am a German residing in the Philippines. I did had a NetBank card. Getting sick of paying fees to withdraw my hard earned pension I moved to DKB. I do now as of August 27- 2016 have to pay a fee of €3,65 per withdrawal?? Please give me the News if SANTADER is worth while. I do have always a Kontostand of 1000 € K

Cheers,

Gustav-Adolf Schildt

Hi!

Thank you for your clear explanation. After the changes in 01. December 2016, I am a DKB aktivekunde. In the website, DKB still promise free of charge money withdrawal. Currently I am in Peru (Southamerica) and I am trying to get money from an ATM machine. All ATM machines charges approx 5€. I am wondering whether DKB will reimburse this fee or no?

I would appreciate any information in this regard.

Thank you

Yes, that is right. DKB does not reimburse fees of other banks anymore. We have extensively reported about this in the German language version of this web portal.

The Santander 1Plus Visa Card is the only German card where such reimbursements are still being done: https://www.deutscheskonto.org/en/credit-card/santander/

But at least DKB does not charge any fees of their own for cash withdrawals or international service fee. In addition, the account is free of charge beyond that as well. Wishing you a good time in Peru!

Hello,

Sorry for replying to such an old post. I’ll be visiting the US next week and I’m still not sure with card I should use.

I have the VISA credit by DKB where I opened an account recently, hence I guess I am considered an “active customer”.

I also have credit and debit cards from another bank. They told me that for withdraws they would charge me like fixed amounts + a small porcentages on both cards, for paying in shops is only the porcentage. This is only what THEY are charging me, but the local bank could charge me as well.

At first this seems to mean that using the VISA from DKB is always better because the local charges would be in any case, but with DKB I avoid charges from my bank.

What I am not sure, and here is my question: when local charges apply, how can we know about them in advance, and are they the same for any bank? because I was thinking, maybe my other bank charges me but it has also a better deals with this X bank in the USA…. or they are usually fixed for any external card? How can I see this numbers and compare for both credit and debit cards?

Thanks in advance!

Regards,

Hello Jakob,

as an “active customer” at the DKB you have no foreign assignment fee.

But the local ATM will charge you a withdraw fee. The costs of this fee are different from area to area. Mostly they are between 3-5 Dollar.

The ATM will display you the costs before, so you can decide if you want to withdraw the money with this fee.

Also you have to consider, that the exchange rate is differently.

The DKB has a relatively good exchange rate.

They do reimburse the 1,75% fee for “Auslandseinsatz”.

My question is which banks do not charge for cash withdrawal in the USA? Would love some hints/we should make a list

You might like to have a look at this German language article: https://www.deutscheskonto.org/de/kostenlos-geld-abheben-ausland/ – One cannot determine one particular bank, since some ATMs of the same bank operate differently, and sometimes things change as well.