DKB account possible for self-employed?

In Internet forums, you can find some quite contradictory statements about obtaining a bank account at the DKB as a self-employed person and, if yes, whether you can use it as a business account … this site will enlighten you!

It is only possible for certain occupational groups to apply for the business account, DKB Business. However, being self-employed, you can use the account DKB Cash as a private current account. Read more in Part 2 of this site.

1. DKB Business

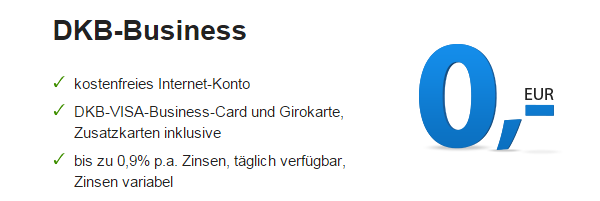

Yes, the DKB offers a business account. It is called “DKB Business“ and it basically has the same great conditions as the account “DKB Cash” for private bank customers:

- free account management

- free Visa Business Card including additional cards

- free cash withdrawals worldwide

- interest on credit

- customer service via phone all around the clock

- only business account: monthly account statement per mail;

the account opening can be made for natural persons, as well as for legal forms (GmbH, GbR, Ltd).

DKB business account – possible for whom?

Such a business account is desired by hundreds of thousands of hard-working self-employed, freelancer, business owners and other entrepreneurs … but there is the rub:

Only certain occupational groups are allowed!

The DKB offers its business account only to certain occupational groups, and these are: notaries, lawyers, insolvency administrators, tax consultants, auditors, certified accountants, health professionals and pharmacists, as well as property administrators.

Moreover, the bank offers accounts for local authorities, e.g. communities, cities or counties.

If you do not belong to the above mentioned occupational groups and if you are no local authority, then, at the moment, you cannot apply for the business account “DKB Business“.

Note on the current legal situation

In the economic order, in which we live, you can almost completely freely choose your contract (partner). Therefore, the bank can choose its customers … and there are special banks for certain occupational groups, such as the “Deutsche Apotheker- und Ärztebank“ (German Bank for Pharmacists and Physicians).

Previously, there were a whole lot of special banks, like e.g. the PSD banks. PSD stood for Post-Spar-Darlehensverein (Post, Savings and Loan Association). Formerly only postmen and their families could become customers of that bank. In several steps, the bank opened for the greater public. We hope the same will apply to the business account of the DKB.

We will inform you about changes on this special portal (Area for comments is at the bottom of this site).

2. Private account for self-employed people

It is true that the DKB does not set up business accounts for self-employed people (except for the occupational groups of point 1) – however, a private current account at the DKB can be opened by self-employed people without any problems.

But there is a particularity that you should know about:

By default, the DKB approves a credit line for the Visa credit card of Euro 100. This is, because the DKB optimized their credit assessment process for employees and retired persons.

In most cases, the credit line depends on the received salary or pension payments on the current account. At such payments, a key number is transmitted, which is recognized automatically by the bank. This way it knows what type of income the payment is.

This is not provided for self-employed people – unless they are in fact employed by their own company and receive a normal wage payment (like e.g. a managing shareholder).

In order to pay with the Visa credit card and take advantage of the worldwide free cash withdrawals as a self-employed person, you can apply the following trick:

Increasing the credit limit through a deposit

You transfer the credit of your DKB current account to your DKB credit card account, because your credit is always at your disposal. After all, it is your money.

Example:

- The DKB opens an account for a self-employed person and provides a credit line (overdraft) of Euro 100. Once you have a nice dinner, the money would be consumed and the card could not be used again.

- Now you transfer Euro 5,000 from your current account to the billing account of the Visa credit card (takes about 10 seconds in the online banking system), and your credit line will increase to Euro 5,100. With this, you can surely do something, right?

- Another advantage: The credit on the Visa credit card is paid a lot more interest (currently 0.9 %) than on the current account (currently 0.1 %).

Summary: DKB for Business people

The business account DKB Business is only available for a few occupational groups. As a self-employed person, you can set up a private current account at the DKB. It has the same conditions as for employees, officials or retired employees – only with one difference: the credit line is Euro 100.

However, the credit limit of the Visa credit card(s) can be increased.

- free account management

- free Girocard

- free VISA credit card

- free worldwide cash supply (!)

- good interest rates on credit

- favourable overdraft credit

- optional securities account

- account application is possible online,

from within Germany and from other countries

“Yes, I want to use the DKB privately”

… also possible for self-employed people!

PS: A sigh of relief!

As a self-employed person, you do not have to submit proof of income or tax statements of the last years when opening an account. The DKB trusts completely in your statements that you provide in the online form at the account opening.

So can I have customers pay into my private account without a problem? I will be expecting around 30 transactions a day.

I do not recommend this, as there is the danger that the bank may cancel your account. In the end, by using your private account as a business account, you violate the contract that you made with the bank.

How would you deal with customers, who constantly violate the agreed contract? This is, of course, a theoretical question!

Besides very few occupational groups, the DKB is a private customer bank.

In Germany, there is another provider with which you can open an online business account within a few minutes. You can find the article here: https://www.deutscheskonto.org/en/open-business-account-germany/