Credit card of DKB or ING-DiBa better?

Not every person wants to switch the current account to a direct bank. For some people, it is enough to have a free credit card to the existing current account at the Sparkasse and the like.

The customer-richest direct banks DKB and ING-DiBa offer their free Visa Card only in combination with a free current account.

How you can optimally use the credit cards (without current account switch) – take full advantage of them – you will find out in this article.

Comparison ⇝ You can make a preselection

|

||

| DKB Visa Card | ING-DiBa Visa Card | |

| Annual fee per year | Euro 0.00 | Euro 0.00 |

| Withdraw cash in Euros | Euro 0,00 | Euro 0.00 |

| Withdraw cash in other currencies | Euro 0.00 | Euro 0.00 plus 1.75 % foreign transaction fee |

| Card payment in Euros | Euro 0.00 | Euro 0.00 |

| Card payment in other currencies | Euro 0.00 | Euro 0.00 plus 1,75 % foreign transaction fee |

| Credit line use | ||

| Maximum possible credit line | Euros 15,000.00 | Euros 10,000.00 |

| … Is achieved by? | actual salary transfer × 3 | submitting a salary slip × 3 |

| … Can be increased by deposit? | yes, up to millions | yes, up to millions |

| Interest-free days? | maximum of 30 (until the next settlement) | no |

| Loan interest? (after interest-free period) |

6.90 % | 6.99 % |

| Extras | ||

| Additional card? | V Pay Card, free of charge | Maestro Card, free of charge |

| Partner card? | Yes, free of charge Joint account or power of attorney |

Yes, free of charge Joint account or power of attorney |

| Emergency card and/or emergency cash? | Yes, free of charge | No |

| Supplement to the credit line? | No | Yes, framework credit up to Euros 25,000 |

| Application | ||

| Online application? | Yes, here: |

Yes, here: |

| Note: If you are willing to arrange to transfer your salary to the new bank, the DKB is the first choice in many cases. If the salary transfer should remain at your current bank, then the ING-DiBa is more meaningful, because you can already get a credit line by submitting the salary slip! | ||

Tips and tricks from my years of usage

If you are not yet sure of which of the two credit cards better fits your needs, then read the following sections with attention, in which you find advices for the optimal use. You are welcome to supplement them with your experiences and ideas through the comments feature at the end of the article. Many thanks!

Oh yes: My experiences with the DKB Visa Card date back to the year 2004 and with the ING-DiBa back to the year 2008.

a) For those, who want to use the interest-free period …

… should choose the DKB Visa Card, because the credit card transactions are booked in a separate credit card account. This account can go into the red up to the setup overdraft.

Around the 22nd of the month, it is automatically settled with the DKB current account. Up to this day, no loan interest applies. If there is not enough money in the current account, then the favourable overdraft facility interest rate of currently 6.9 per cent applies.

Up to 30 days interest-free!

If there is balance in the credit card account, then this is used before it goes into the red. Technically, one cannot have two balances in one account.

The debit entry from another account than the DKB current account is not possible at the DKB. This is only possible at sole credit card products, as usual e.g. at the Barclaycard.

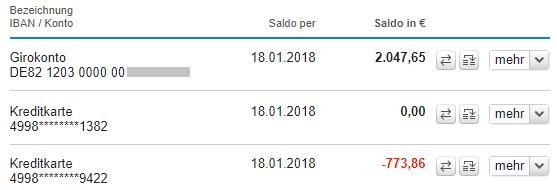

As a standard, you have a current account (1st line) at the DKB. No matter, if you want it or not, it is always included. In the 3rd line, you can see my DKB Visa Card, which I like to let go into the interest-free red, until it is automatically settled with the current account. In the line 2, there is another free credit card – more on that in the course of this article.

b) For those, who want to have more overview

… the ING-DiBa could be the better choice. Some people worry about losing the overview of their expenditures, if one account is going into the red and the other one has a nice balance.

At the ING-DiBa, there is no separate credit card account. All card payments and cash withdrawals are immediately booked on the current account. By this, the balance of the current account also immediately decreases or one immediately starts to use the overdraft facility which is subject to interest.

The credit card line is the overdraft facility line of the current account. If no ovedraft facility to the current account is arranged, the ING-DiBa Visa Card is a sole prepaid card. However, one cannot notice that, as it is high-embossed and on the back, one can find “Credit” next to the security code. Security deposits at rental car companies and hotels will work flawlessy.

Credit line = overdraft facility of the current account

If you do not have further products, such as a depot, call money or loans at the ING-DiBa, then you only have one line in the finances overview.

c) Which credit card is better for journeys?

Herein, it depends a little on where the journeys are going to. Within the Euro-area, the conditions of both cards are the same. You can:

- withdraw cash free of charge at every Visa-accepting ATM

- pay free of charge with the card at every Visa-accepting payment terminal.

One crucial difference is in the use of foreign currencies, e.g. when flying to America. The ING-DiBa charges a foreign transaction fee of 1.75 per cent for every card transaction outside the Euro-area. This makes every payment more expensive!

In the first 12 months after the account opening and afterwards permanently with incoming money transfers of monthly Euros 700, one is considered an active customer at the DKB, which results in the fact that the foreign transaction fee is refunded with the monthly credit card settlement! This can be quite a huge amount!

Moreover, one also is entitled on receiving help in an emergency being an active customer. At a card loss, the DKB helps within 48 hours with an emergency card. It is also possible to pick up emergency cash on the same day through a counter of Western Union.

This has already happened to me and the DKB has bailed me out wonderfully:

The emergency card arrived already on the next morning by express courier in Florida. I was able to pick up the emergency cash already on the same day in a supermarket. Article about this subject.

d) Which credit card is better for Internet purchases?

Basically, both cards are equally great for Internet purchases.

However, at the DKB, there is a small particularity that I want to share with you: You have the possibility to apply for a DKB VISA Tagesgeld. This is a call money account with monthly interest. Nevertheless, the current interest rate of 0.2 per cent is not exactly thrilling.

Perhaps interesting is that it is not a classic savings account, but a virtual credit card. That means that you get a credit card number, a card expiry date and a security code to the call money account. So everything that you have to enter at a credit card payment on the Internet.

Virtual credit card is possible free of charge as an addition!

As there is credit card data spying on the Internet from time to time – e.g. through card robbery in online shops – it can be meaningful to get an extra credit card only for Internet purchases. If you charge balance on the card, then you even get a little interest.

Of course, a credit line can also be agreed on for this virtual credit card. If the account is in the red, then it is also monthly settled, just like the plastic credit card.

For cases of credit card fraud, the legislator has set a deductible maximum amount of Euros 50. Active customers of the DKB do not have to bear this.

e) Combination of DKB and ING-DiBa with double credit line

In our smart banking community, there are not just a few, who have acquired both cards.

The clever knack works as follows: The salary is transferred to the current account at the DKB. By this, a credit line on the current account and in the same amount on the credit card is created. At the ING-DiBa, only the proof of salary is submitted. Due to the proof of salary, the bank also makes a credit line available to you.

Example: customer with Euros 2,500 net income

Credit line |

Credit line |

|

| Euros 15,000.00 in total | Euros 7,500.00 through actual salary transfer |

Euros 7,500.00 through submitting the salary slip |

| You can continue here… | www.dkb.de | www.ing-diba.de |

Further articles:

- Further ideas to the credit lines and overdraft facilities

- ING-DiBa overdraft facility without salary transfer

- DKB overdraft facility up to Euros 15,000

For those, who need a yellow button for further information or for applying, here they are:

Explanation as a video:

If you are already a subscriber, then you certainly know our YouTube-channel. Here you can find the video produced to the article:

… Got questions?

Please use the comments box and a 💗-ly thanks to our strong and smart community that supports us with advice and help at responding! 🙂

I just opened an account with ing-diba. I got the Visa Card as well. But I don’t know how to use the visa card now since my salary account is with Commerzbank. Example if I make a transaction with the visa card then I have to manually make a transfer to the to the ing-diba current account on the same day to have no extra interest.

Kind of still confused. It would be so nice of you if you can explain me a bit in more detail

Thanks

As shown in the table above, there is no separate credit card account at ING. Card transactions are deducted from the current account with a 2-3-day delay. This works like with the debit system. The line of credit would be the overdraft facility line on the checking account, if one was agreed (my recommendation). If not, the card will only work with a balance. Thus, no loan inter-est can be incurred. With the overdraft facility framework, the interest on pure credit cards is super cheap.

Thanks for your kind reply..