Comdirect free Visa Debit Card

Being an existing customer, you automatically get another card free of charge to your free current account at the Comdirect:

Not a customer yet? You can change that – without minimum incoming money flow 1 – here:

Advantages of the Comdirect Visa Card Debit in connection with the free current account

The Comdirect (direct bank brand of the Commerzbank) is one of the few banks left with a fee-free current account – without minimum incoming money flow or salary transfer1. Therefore, it is suitable as a primary or secondary account.

The new Visa Card Debit is added automatically and also free of charge to the current account. It unites some advantages of the Girocard (which continues to be free with the current account) and the Visa Credit Card (in the future subject to a charge of Euro 1.90).

- 3 × per month withdrawing cash free of charge at (almost) all Visa-ATMs around the globe!

Without minimum withdrawal amount1. Depending on the ATM, Euros 0.01-1,000.00 would be possible per day. No foreign transaction fee is charged at withdrawals in other currencies. - pay cashless free of charge

There is a growing number of providers that charge a transaction fee for card payments. At payments in other currencies, a foreign transaction fee in the amount of 1.75 % applies. - PIN of your choice (can be determined by yourself within the online banking)

- mobile payments with Apple and Google Pay are possible

- as a matter of course, no annual card fee.

The yellow looks even better on the actual card. Order takes place with the opening of the free current account ► www.comdirect.de ✅

When you get the card by mail, you need to do the following:

1. Activate the Visa Card

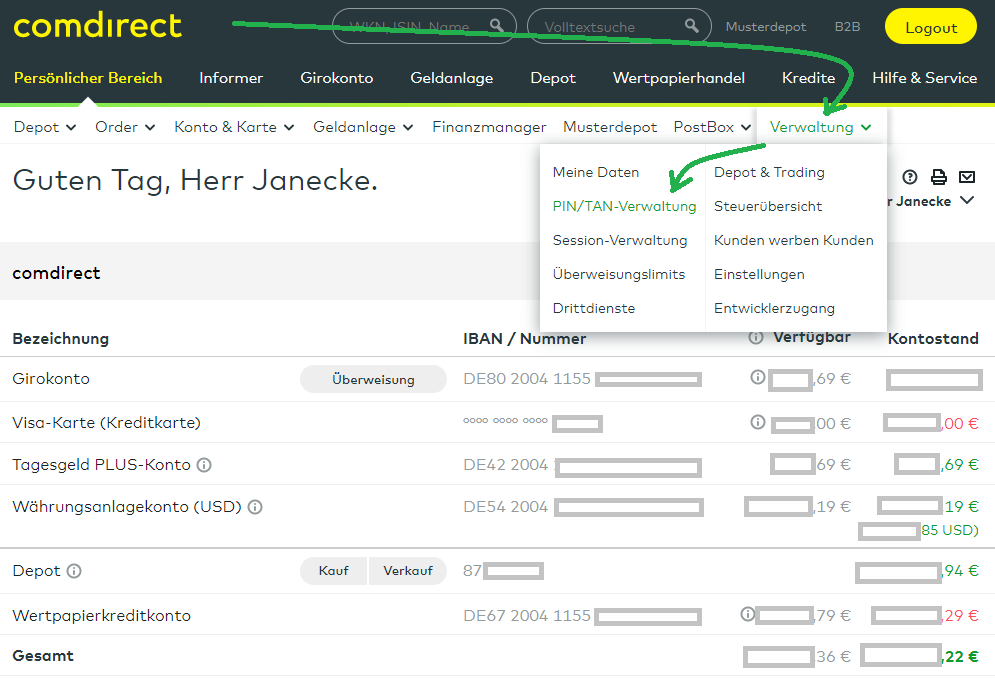

For this, log into the online banking:

For people, who are not with us since long, you can see in this screen shot that I use the Comdirect intensively.

Then, click forward to the Comdirect card data:

Self-explanatory, isn’t it?

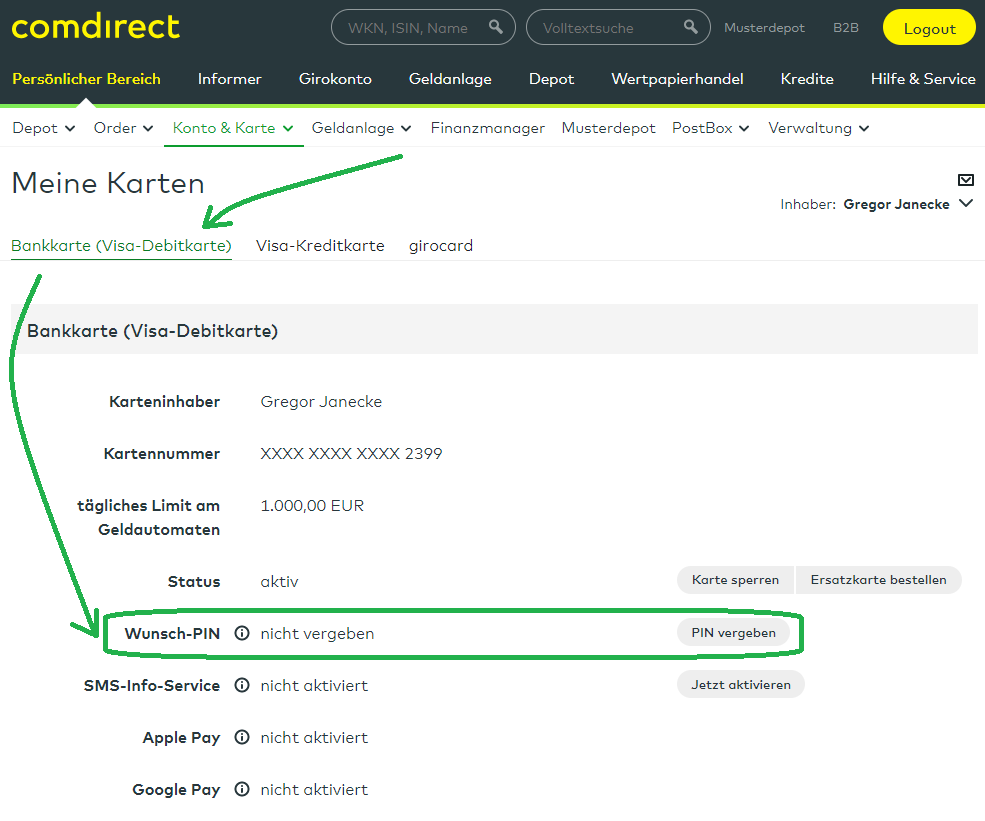

In principle, the card is activated by issuing the PIN of your choice:

It is interesting that the Visa Debit Card is first in the ranking and also called bank card. The new card apparently has priority from the perspective of the Comdirect.

This is obviously self-explanatory:

I consider the possibility of choosing the PIN as very comfortable.

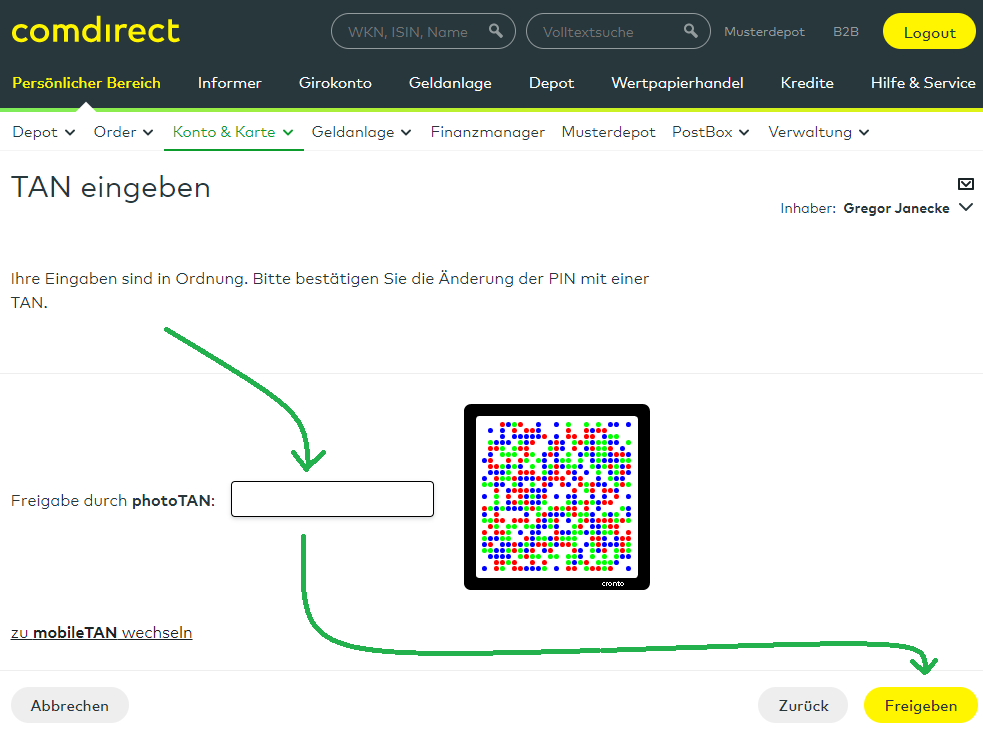

Confirmation with a TAN:

The photo-TAN is very nice. Alternatively, you could get sent a SMS-TAN (mobileTAN).

Finished

You can change the PIN at any point of time. The date of my last change is covered by the note regarding the SMS information service:

You can activate further services on this page.

Do you need further instructions?

Actually the activation of the SMS information service, Apple Pay and Google Pay are similarly self-explanatory like the just documented one. However, perhaps someone of our smart-bank-customer-community wants to contribute with an instruction? We are glad for the commitment and the exchange through the comments feature.

Note:

In contrast to the Visa credit card, there is no separate settlement account in the account overview. See third picture of above. All card transactions are – exactly as with the Girocard – immediately debited from the current account. That means: Your overdraft facility is the balance on the current account plus a possible setup overdraft credit line.

Some regard that as comprehensive – others don’t. What do you think? I am looking forward to reading your opinion in the comments feature at the end of this page.

Open the Comdirect-account today?

Many speaks in favor of the Comdirect as a main account or secondary account. Whether the Comdirect fits to your account system depends on which banks you already haveand what services you want to use.

I do not have to decide myself for choosing the Comdirect anymore, because I am already a customer since 13 years – and will remain to be a customer. The Comdirect is a crux of the matter in our big account system with its wonderful combination of securities account and securities credit line. I use the current account services as a secondary account.

If I wanted to have the current account (with the Visa Debit Card) today, I would open the securities account first (because the creditworthiness check is omitted = (almost) no rejections of the account opening) and open the current account directly through the online banking afterwards:

From my point of view to the world, you need a (free) securities account anyway with good possibilities for the capital investment with or without savings plans.

Screenshot of my Comdirect securities account. You know that I do not give investment advice, but I have used the four values that you can see here in past instruction articles and our years-long readers can see that I am still investing in what I used to show. In the “Achiever Training”, we have a format in which we exchange more openly about investments.

Wonderful current account + free cards are enough for you?

Who (currently) is not interest in this, can open only the current account with Visa Card and Girocard through this implementation button:

Questions?

Questions about the account opening and account usage are welcome through the comments feature. I am pleased to help as far as I can and am very grateful for our committed community that is always willing to help too!

Further articles

- Open secondary account abroad

- Open a “P-Konto” (account with seizure protection) in Germany

- A secret about loans in Germany

Leave a Reply