Complete Comdirect account opening

If you are facing the decision of opening a free current account at the Comdirect Bank – optionally with extras – then this article should be interesting for you.

Popular: depending on the creditworthiness either “true” Visa Card with credit line or the prepaid-variant – both free of charge!

Experiences of my own account opening at the Comdirect

Through this “landingpage”, I have started my account opening procedure: www.comdirect.de/cms/giro

You need about 7 minutes, if you apply for all extras at once.

Personal data

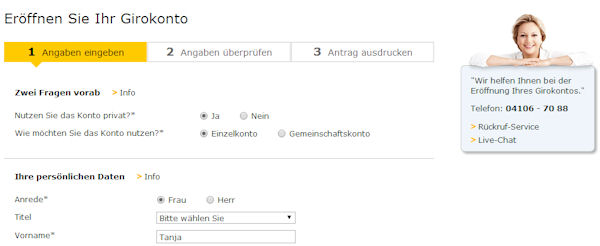

In only small 3 steps, you can complete the account application at the Comdirect!

All the usual personal data is gathered, which is stipulated by law for the identification of the customer: name and address, day and place of birth, citizenship, as well as the contact information, which is telephone number and e-mail address.

Moreover, there are four further questions: professional status, industry, current job and since when you perform it. Concrete statements are advantageous for the setup of the overdraft facility (optional customer requirement).

Free Visa Card

So that the bank can grant you a credit line for the Visa Card already, one can state the amount of your regular monthly net income here. The Comdirect grants a maximum of 3-times the sum of the monthly income, given a positive result at the Schufa-query.

Alternatively, you get the Visa Card as a prepaid-variant. You charge the credit and then you can pay with it or enjoy the fee-free cash supply through all Visa-ATMs abroad.

Moreover, you can register here with a tick for the “Wechselgeld-Sparen”(change money savings). The advantages for you are explained under Point 2 on the page “7 secrets of the Comdirect Visa Card“.

Currently, you can choose between three designs.

Overdraft facility up to 3-times the amount

One can apply for an overdraft facility already at the account opening. You can also do it later, when the account is already in complete use and the bank sees that one is a customer that knows how to deal with finances.

As this article is about applying for the current account with all extras, here are my advices for you!

If you want to get the overdraft facility of the Comdirect, then the bank expects from you to arrange to transfer your monthly income to this account. The bank computer recognizes through a key number at the transfer, whether it is a salary payment or state payment.

Just as with the Visa Card, the maximum credit line is three-times the sum of your regular monthly net incomes. You can also enter a lower loan amount, if you want.

If the bank thinks that your desired loan amount is too high – for example, due to an average rating at the Schufa and the fact that the bank has not made any own experiences with you as a customer –, the bank will make you a suggestion.

If you do not want to apply for an overdraft facility, then do not tick the box on the upper left.

Depot

A free securities depot can also be opened together with the account. For this, you must answer some questions about your former experiences with securities. This is stipulated by law.

Normally the current account serves as the settlement account for securities transactions. However, you can allow to create an additional free settlement account , if you feel that this is more comfortable for your purposes.

You can find further information about the depot of the Comdirect Bank here: Allrounder and specialist at the same time!

These questions about the former experiences with securities are stipulated by law, but can be answered easily and fast.

Done!

These were all things that can be applied for immediately at the account opening.

Now, you can choose to print the account opening documents immediately or let them be send by mail to you. This is particularly practical, if you started the account opening on the road and do not have a printer nearby. The sending by mail takes about two days.

If you choose the immediate printing, then there are only 6 pages, if you want to apply for all extras at once: current account application (1 page), application for the Visa Card (1 page), application for the Depot (1 page), terms and conditions (1 page), description of the PostIdent-procedure (1 page) and the form for the PostIdent (1 page).

You only have to sign once on page 4. Such a slender and completely optimized acocunt opening procedure is provided by a very small number of banks.

Last checking view at the account application: print – sign on page 4 – go to the post office or let send all documents free of charge by mail to you. You can choose freely!

Here you can trigger your own account opening now:

“Yes, I want the Comdirect-current account”

Annoucement: in further articles, I will report about the optimal use of the current account at the Comdirect Bank. I would be pleased to answer your questions about the account opening through the comments box at the end of this page!

Further articles in this Comdirect-series:

⇑ Comdirect-overview | Part 2 (immediate overdraft facility) ⇒

Is it open to residents in NL who are not EU citizens? Thanks.

Everybody can apply for the account. Whether it will actually be opened, depends from the credit check customary in Germany. Please note that for applications outside Germany the above linked online form will not work. You can order a PDF-application at Comdirect though. Best of luck!

I am living in Berlin and I am an EU resident, but I am not registered or have a job at the moment. Can I open an account at Comdirect?

An application for the account is always a possibility.

In Germany, there is a difference between providers that perform a credit check and those forgoing that. This means a difference in their business models: With one you pay fees for using the account and do not get a line of credit; with the other, the account does not have a monthly fee. In the best case, the bank makes money from the active use of the account (use of the Visa Card, use of the overdraft facility, use of other bank services like a securities account).

Comdirect is one of the banks that perform a credit check, for which a regular income is important.

You can find two other providers here. Maybe you’d like to try it at Comdirect (keep in mind that social service payments are income as well), and if this does not work out, you can transitionally open an account with a provider that charges fees?

Thanks for your reply.

Do I have higher posibility of account opening with Comdirect if I apply for a TagesGeld-PLUS (and maybe in future open a Girokonto also) as I have some cash that I would like to deposit.

And what is the disadvantage TagesGeld-PLUS compared to Girokonto?

That is the idea! Times is works, sometimes not.

The “Tagesgeld”-Account is saving account. You don’t can use it for payments. There is no bank card.

So do you suggest to apply for TagesGeld-PLUS or does it have the same difficulties like a Girokonto?

And can I withdraw any of my deposited money or is it prohibited for a certain amount of time?

Thanks!

For the opening of a savings account there is no credit check, which is why the account opening is easier. In Germany, a “Tagesgeld”-account is payable on a daily basis, i.e. the whole amount is available any time.

We seldom give individual recommendations for or against something. We do shop what is possible on the market, and how to cleverly use those options. Smart banking customers decide for themselves what to do. 😉

Hi — I am an Asian based in Krakow, Poland with a long term Polish residence card. I am working in Krakow, Poland. I am interested in opening a German bank account to use for paying an investment in Germany.

Given this situation, I have a few questions:

1) What do I need to do to open an account with comdirect?

2) What account is best to open given my needs?

3) I understand that a credit investigation will be conducted. What are the chances that I will be approved? – I have been living and working in Krakow for almost 1 year with relatively good income (EUR 4000 monthly).

Comdirect is a very good bank, especially the stock deposit! On the German language site Gregor even offers a special program for asset accumulation, in which Comdirect stock deposit is used.

Most important with Comdirect ist hat you can communicate with the bank in German – because they do not offer any English-language customer services, and the online banking is in German as well. If you at least speak some basic German, you can easily discuss the details regarding an account opening with Comdirect. As a web portal, we do not offer any consulting – we work journalistically.

Best of luck!

PS: In a few days we will have an article on our blog regarding the possibilities of opening an English-language Giro account in Germany.