Deposit at BullionVault without fees of an international transfer (with a little detour)

Many people that read this article do not yet have an account at BullionVault and this is why I start out with a screenshot for your motivation:

Fair: BullionVault calculates the profit after all costs. In the past, purchase and storage fees have been the critique points of bank account savers compared to asset investments, such as BullionVault.

Storage fees for bank balances are more expensive than the high security vault for gold!

At the Commerzbank, new customers pay a storage fee of 0.5 per cent per year already for a balance from Euros 50,000, as the magazine Handelsblatt reported last week. We observe that a growing number of banks charge their customers with a negative interest and lower the “exemption limit” little by little.

We can even learn from some balance sheets that they charge us customers in total more fees through the negative interest than they themselves pay to the ECB. However, this is not the subject of this article.

The storage fees for precious metals remained the same at BullionVault throughout the past years with only 0.12 per cent for gold and 0.48 per cent for silver per year.

Interesting?

Some answer with a simple “yes” and they have already got themselves an account at BullionVault or plan to do so in the next days.

Challenge and solution

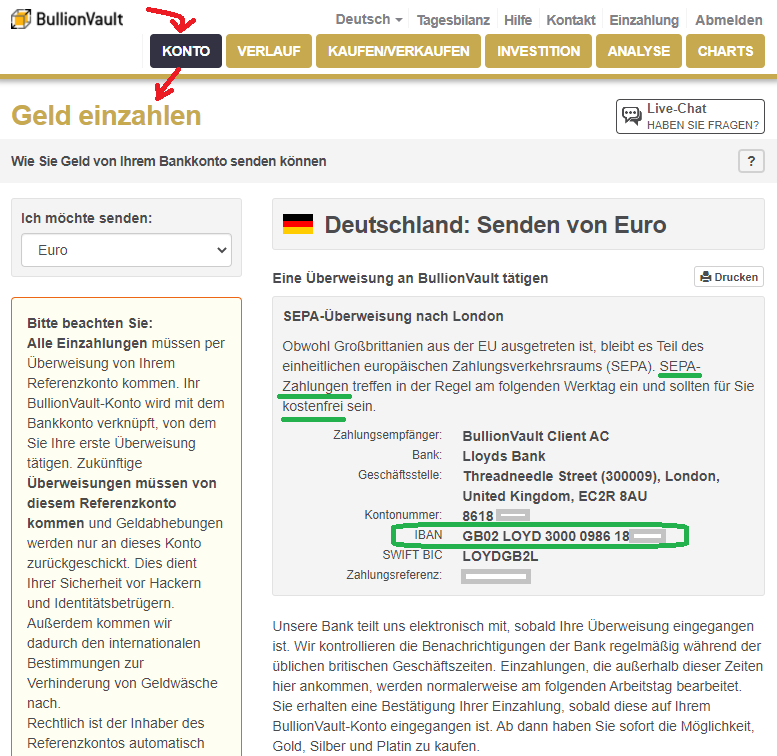

Deposit to the Euro-account in the UK

Information for the deposit (transfer) of Euros.

Surely many BullionVault-customers can make a SEPA-transfer from their current account without problems to London. In spite of the EU-exit, Great Britain remains part of the common payment area.

However, we have heard from some that their account holding bank took advantage of that situation and has charged the SEPA-transfer to the UK like an expensive international transfer. This is not necessary for a smart bank customer.

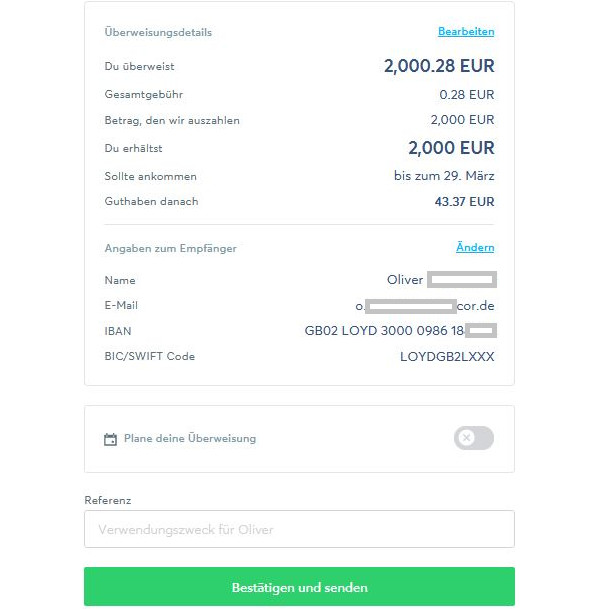

Oliver transfers to Wise first (Belgium) and then to London (UK)

Oliver decided to hold a part of his private savings at BullionVault in gold and silver. This is cheap through BullionVault – cheaper than holding higher amounts in an account, as we discussed earlier. However, the fees for the international transfer was a thorn in his side.

Thanks to our flag-theory, he already had a free account at Wise. Wise is a British provider, which specialized in cheap (international) payments. It offers local private and business accounts in different currency areas. Euro-accounts have a Belgian IBAN (BE-IBAN) since 2020.

He transferred free of charge from his German current account to Belgium and on the next day to London. He was only charged a cheap lump sum of 28 cents – instead of perhaps Euros 12.50 for an international transfer.

Instruction step-by-step in pictures:

You start a “completely normal” transfer in Euros.

The GB-IBAN is entered as the receiver account. It is important that you enter your BullionVault user name as a reference, so that your payment can be allocated accordingly.

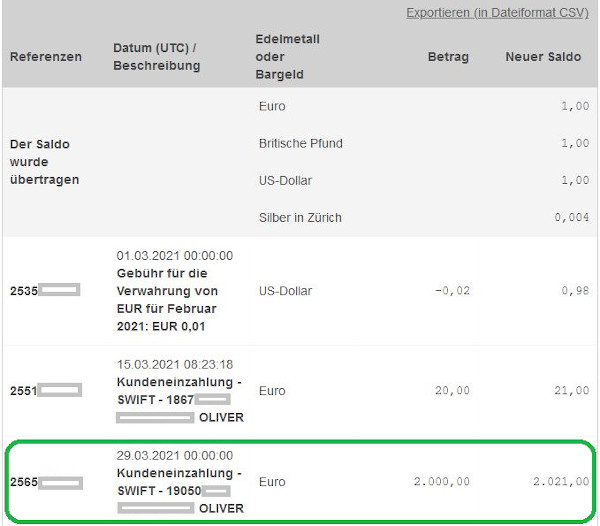

The transfer has been credited to the BullionVault-account without deducting fees.

Always interesting on the account statement is that you get EUR 1, GBP 1 and USD 1 as a gift when opening the account (to try it). You can also see that there is a negative interest of 0.75 % charged from the EUR-balance.

Also the suggestion here: The storage of precious metals is cheaper than the storage of Euros.

Do you already have a BullionVault-account?

Then I would be glad to read your responses to the following questions using the comments feature:

- Which bank do you use for depositing?

- Are there any fees charged and if yes, how much?

- What distribution have you chosen between gold, silver and platinum?

- Which storage site do you prefer?

Moreover, I am looking forward to read further experiences, also your questions on the account opening and use. A hearty thanks for your smart participation!

Do you already know …

- Open a secondary account abroad?

- Buy gold through BullionVault

- From “TransferWise” to only “Wise” – but the services grow!

PS: The BullionVault-account can also be opened in the name of a legal entity, such as a GmbH or UG. Perhaps an idea to think about for your reserves?

Leave a Reply