The bank account for digital nomads

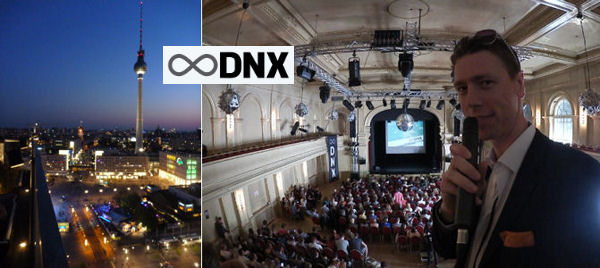

On the DNX-conference in Berlin, several hundred people, who live as “digital nomads” or want to live as such, gather every year.

Most people define this term as a location-independent online business, which allows them to travel and stay at different locations.

The DNX (www.dnx-berlin.de) inspired me to write this article. It is dedicated to all conference participants and travellers! 🙂

Which bank account is perfect for this lifestyle?

For you being a smart bank customer and regular reader of our Sunday e-mails, this is already clear!

At the conference, I asked people and was able to discover that the free current account of the DKB is by far the most popular bank account among digital nomads.

Digital nomads trust in the DKB

For those who do not yet live this style of life, that was not so clear. In this case, numerous other bank names were mentioned – also Sparkasse and Volksbank – that are unlikely to be the ideal financial centre for a frequent traveller or for people living mostly abroad, at intensive observation.

About the DKB, you can find so many articles, tutorials and videos on this special portal – just use the search slot on the top right of the page – so that we focus on a few crucial details on this blog article.

You are welcome to use the search function for your research …

… and if future digital nomads decide to change their current account or at least apply for the DKB account + Visa Card (included for free) as an additional account at the end of the article, then you have taken another important development step on your personal journey!

Where do “traditional” banks encounter their limits and cause issues to digital nomads?

- Often, poor availability

Problem: short opening hours, while you are in a different time zone. - Often, the following card or replacement card is not sent to the abroad

Problem: You do not have a (valid) credit card anymore on your journey. - Often, there is no emergency option

Problem: Do you need to interrupt your journey, because your wallet with credit cards has been stolen? - Often, expensive fees abroad

Problem: You pay more and higher fees than actually necessary and thus, do not live the lifestyle that you could. (For quite some withdrawal fees – one additionally charges the foreign transaction fee – you could buy a princely meal in some countries!)

Case study 1: Thea in Australia

Thea (21) travels since weeks through Australia and enjoys her special life as a digital nomad. As she knows that cash withdrawals always cost a fee of Euro 5 plus 2 per cent for the use abroad, she only withdraws little money and pays wherever she can with the card. Therefore, Thea’s cash stock is low.

Unfortunately, her only credit card gets inexplicably lost in the night from Friday to Saturday …

Through the general blocking emergency number +49-116-116, she manages to block it immediately by phone and thus, further damage is avoided!

Unfortunately, nobody there wants and can help her to get a new card. She is forwarded “friendly but firmly” to her account-holding branch office. This would be available for her from Monday at 9 am. From midday to 2 pm it is closed, but then again, there would be a three-hour time window of accessibility. Not so easy at such a time difference!

Card stolen, poor availability of the bank, no replacement abroad

With a little luck, Thea manages to find a counsellor by phone that really wants to help her, and due to her personal distress, she does not have to come to the branch office to apply for a new card. However, and the customer counsellor cannot do anything in this case, the new card is delivered to the home address in Germany. Delivery abroad? Not possible!

Of course, Thea has someone, who takes care of her mails during her absence. So the new card will arrive after about two weeks to her home address and then it takes another two weeks for the card to arrive by post in Australia.

But what can she do in these 4 weeks without card and without money?

The answer: she borrows money from her friend Maria. Maria has become a customer of the DKB in preparation for her life as a globetrotter!

Case study 2: Maria, friend of Thea

Also Maria’s credit card got lost during the same Friday night. However, unlike Thea, she only needed to make one single call that night, because the DKB has a phone availability around the clock.

Here the phone number: + 49-30-12030000. Easy to remember, as it is the national bank code of the DKB.

Once the card has been blocked, an emergency card was immediately organized and it was agreed that this will be delivered by express courier to the Couchsurfing address, where Maria currently resides in Australia, within the next 48 hours.

Free emergency card

An emergency card is no DKB-Visa-Card. It is a grey card with magnetic stripe (no chip), which is produced by the nearest card issuing site of the Visa in emergency mode and has only limited functionality.

One can pay with this card cashless and withdraw cash at many bank counters, but not at the ATM.

As Maria would like to stay a few more weeks in Australia, it was agreed in the same telephone call that a replacement card is produced for her in Germany and this will be sent to her temporary address abroad.

Additionally, Maria had a cash reserve, because she can withdraw cash free of charge worldwide and also takes advantage of this feature.

Which variant would you prefer?

As long as there are no problems and one can use the account and card in everyday situations – and one does not care about exceptionally good conditions – it almost does not matter at which bank you are a customer.

It becomes exciting, when challenges arise!

If you are thinking to become a digital nomad or just like to travel around the globe, then you should prepare yourself well. And a good preparation also includes account and card. After all, it is always the finances that a permit a special lifestyle. Even if one only notices it, when difficulties happen.

Of course, a traveller always knows a way around. Only few would abort a trip due to card loss! However, it is a huge difference, if you can clarify everything through a phone call and then the mechanisms work or whether one has to find emergency solutions for weeks!

DKB for digital nomads

Before you might recommend this article to friends (if you are already a DKB-customer) or start the online procedure to open the account (if you are not yet a DKB-customer), we will have a look together at the most important facts:

- Free current account

- Free Visa Card

- Free Girocard (debit card)

- Free cash withdrawals (worldwide!)

- Telephone availability around the clock

- Free emergency card

- Free replacement card

The DKB generally charges Euros 25 for a courier, but you can arrange to let it be send by regular mail, which is free of charge! - Online application on account opening

You can even apply for the account, if you are already living abroad as a digital nomad. However, it is best to make the account opening before your departure.

“The worldwide most attractive account”

DKB will become even more attractive!

If you are following our blog already since some time, you know that we have proposed publically to the DKB to reduce the generally customary foreign transaction fee of banks or to completely abolish it. And we have substantiated it logically comprehensible through a causal chain. Find the article here.

In the meantime, I have heard that the DKB examines this proposal very seriously … at the end of this blog post, I would like to make the public bet that the DKB will make a decision in our favour this year!

Further articles that will help you to use the DKB (even) better:

- 3 mistakes that you should not commit at the account opening

- DKB Overdraft Facility: Can you get Euros 1,000 immediately?

- DKB Visa Card in the international use

Questions? Experiences?

Do you have a question about the account opening or use of the DKB account and the cards? Please ask them via the comments box and thus take advantage of my experience of many years!

You can also use the comments box to report about your experiences – also tips of course – with the DKB. That makes it even more valuable for future readers!

Also many thanks for the recommendations and links on this blog 🙂 THANK YOU!

This is the video to the article, which I have taken spontaneously on the way home from the DNX. I really like the background with the train tracks and was lucky that no train drove through the scenery at this moment 🙂

Video interview with Marcus Meurer, organizing officer of the DNX:

Video interview with the globetrotter Ben Strasser (Ben “adventured” from Iran to the DNX by hitch-hike):

Hi,

I thought DKB was no longer doing this:

– Free cash withdrawals (worldwide!)

Have they changed their mind?

Thanks!

Hi,

yes, that’s true. There have been misunderstandings with many people regarding the recent change of terms and conditions … and there has the occasional “semi-truth” going around on the internet ;-). Here is our article on that subject: https://www.deutscheskonto.org/en/dkb-changes-conditions/