Smart Asset Management

The ideas and instructions presented are suitable for the

The aim is to grow the assets against inflation using low risk as per the current situation. A preferred “state” security that is published in consumer magazines is not covered here.

The point is to ensure that the assets do not fall victim to any world crisis, but always benefit from the different winds on the capital markets, and thus can serve this and future generations.

The asset structures have been selected so that they are never obliterated. On the contrary: In a regular correction of the size of the investment field, one can make over proportional gains. This page shows how to do it.

The Concept

… is very simple, easy to understand and quickly explained:

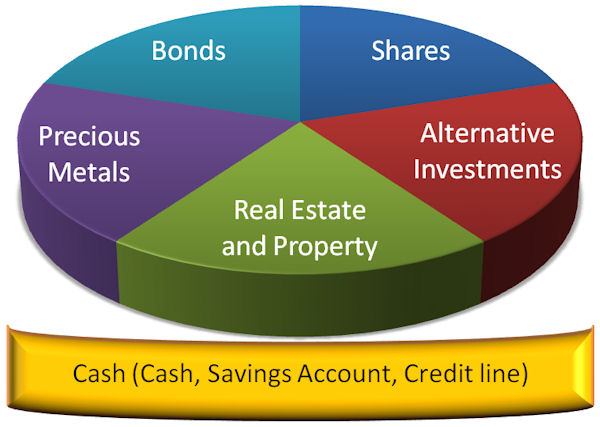

- There are various asset classes (the main asset classes are shown in the graphic).

- Sometimes asset classes develop in parallel, sometimes a few asset classes develop positively, while others develop negatively.

- These phases are called upswing to boom or downturn to recession.

- Since the beginning of time, the phases change irregularly.

- It makes sense to buy low and sell high.

- If you sell in a boom phase, you do so at a high price (expensive).

- If you buy in times of recession, you do so at a low price (cheap).

- Let’s suppose that at the start all investment fields are of equal size (in our example 5 × 20 percent). After one year, we check the account balances and note that stocks are performing well above average. This field is now 25%, while precious metals prices have fallen. This field accounts for only 15%. Now just the right amount of stocks are sold and with the proceeds just the right amount of precious metals are bought (the same applies to the other fields if they are no longer 20% in size) until all fields are exactly the same again.

- With this system, you automatically sell high during a boom phase and buy other asset classes low, during a recession phase.

- Even a crisis of enormous proportions is not able to wipe out the assets, as when one asset class performs badly (z. B. bonds at a national bankruptcy), another is doing well (in the outlined scenario, stocks and precious metals).

This concept can be implemented with a custodial deposit account!

The easiest way to solve this concept is with asset management through funds in a securities account. This way it is possible to see the development by date as well as switching from one asset class to another is just a matter of a few mouse clicks.

With which funds – or low-cost ETFs (yes, these are also funds) – this concept can be implemented will be shown in this specialized portal in subsequent articles over time.

Notification of future contents

Custodial deposit account in Germany

We will address the question as to why it makes sense to have this securities account in Germany. This should be especially interesting for Germans abroad or in general for people with residence abroad.

Investments outside the stock exchange

In addition, we will also present assets that ideally fit into this concept, however, since they cannot be traded on the stock exchange it is not possible to buy or follow them.

Innovative Ideas for Cash-Position

Also, we will show you ideas for the Cash-Position from foreign current accounts, to interest bearing savings accounts with daily access, to liquidity committed credit lines. Especially in times of low interest rates, it makes sense, to not leave cash lying around with a poor interest rate, but to use a convenient line of credit when needed.

Leave a Reply