Apply for credit line (Rahmenkredit in Germany) through another person?

If the use of the money from the credit line – as offered by the ING Bank – is absolutely free to choose, then you can also borrow this money to someone else. Can’t you?

Yes, absolutely correct!

This article is about the ideas and risks that are included. You, being an interested borrower, will learn about the possibilities that arise through the use of the creditworthiness of other people, and understand the risks as a possible used person in such a triangle-business.

Use the creditworthiness of other people!?

Let’s start with an example from our achiever-training:

Procurement of equity capital for the purchase of an appartment

Olaf* wants to buy a (another) condominium as a capital investment. He himself won’t live in it. He wants to rent it out. He receives a 100% financing on the part of the bank for this “real estate deal”. However, the ancillary costs (notary, taxes) of the real estate purchase cannot be financed. He needs equity capital for that.

He currently does not dispose of such equity capital (other investments are bound in shares and forrest). He does not want to open the credit line of the ING on his name due to the current situation, so he asks his mother, whether she would help him.

After initial worries that some mothers tend to have, she agreed and applied for the flexible credit line and this in the full amount of Euros 25,000 as described in this instruction. Her net salary of Euros 1,800 was enough to get it. Probably less would have worked out fine too.

Olaf has set up a private loan contract with her. He bears the monthy interest. For this purpose, he has set up a standing order to the current account of his mother. The repayment of the credit line is planned from the next year, because then he wants to tax-freely sell the appartment, in which he himself lives and which he has extended and renovated little by little in the course of the past 10 years. After that, he wants to repay the private loan or it will be free for new investments.

In which city do you think is Olaf’s condo?

Some perhaps wonder:

Is that legal?

The answer: Absolutely!

The use of the credit line is free and no one can keep the mother from giving the borrowed money to her son.

Are you allowed to conclude loan agreements among private persons?

Yes, of course!

We have done that for centuries. This is the main financing source in many immigrant families for weddings, business foundations, investments. However, many Germans have “surrendered” to the banking industry. 😉

Isn’t there a risk included?

Yes, of course!

We do not know, whether the real estate deals of Olaf will work out fine and if yes, if he really transfers the installments to his mother and then repays the private loan. In the worst case, the mother will have a dept of Euros 25,000 and a disappeared son.

No one of us “spectators” have to do the same. But we can respect that there are other people, who do so. In any case, they have my respect for the development of clever solutions.

It is entrepreneurs and investors, who have taken things into own hands with own and borrowed money, and have turned our country and our society to one of the leading nations. In the case of success, they have earned a lot of money – in a bad case, they went bankrupt. But would we have such a developed country, if there would not be people taking loans with confidence in the future and diligent hands?

The second example is similar, in which the credit line has successfully been applied for through another person.

Procurement of Euros 15,000 for an expensive device

Marta* became self-employed with a massage office last year. She managed to get a cheaper business start-up loan and further subsidies. The office started quite well, also thanks to her outstanding tutor!

Recently, she found a device on a trade fair, which would fit great into her office. Her current and future patients would stay 50 minutes there and regenerate and decelerate with the power of the hexagonal water, before she would start with the manual work.

Her customers would have a deep and long-lasting relaxation and Marta would earn money, even when her hands would have a pause (passive income).

Expensive, but good. How to finance and implement it (to improve the treatment for people)?

Although her office runs successfully and she was able to save some money every month, no bank wants to finance her being self-employed.

The requirements are as follows: Please submit the last two income tax assessments of your self-employment!

Unfortunately, Marta did not know my article of the year 2017, in which I strongly recommended to set up credit lines strategically. Especially, if you do not need them now. Times can change and you do not know, whether you will be in a great situation …?

Better: set up credit lines strategically ✅

In the year 2017, Marta still was an office administrator of a regional furniture store. However, it had to close its doors – due to the competitors from the Internet – and this is how she started her self-employment out of necessity. Of course, she was interested in it since long and has assisted several advanced training courses in the years before simultaneaously to her job.

Marta will be able to buy the expensive device anyway, because she plans to ask her family (her sister?) for help. Just like with Olaf, another person should apply for the credit line and if necessary, grant it as a private loan.

Whether Marta’s sister, also an office administrator, initially applies for the credit line of only Euros 15,000 or immediately goes for the full amount (as a reserve) will be the subject of a future conversation of these two ladies.

What do you think?

Can you respect the acting persons or just shake your head thinking of how to take such agreements? Feedback and questions are welcome using the comments feature. A heartly thanks to you!

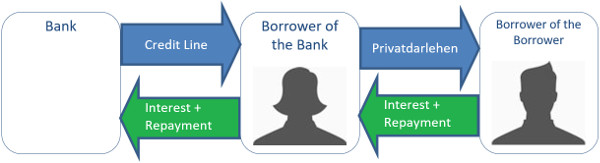

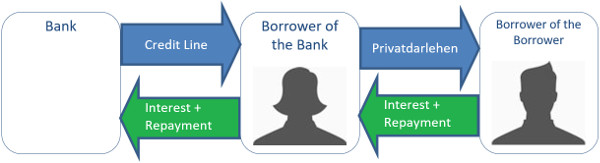

This overview is for your clarification:

|

||

| Advantages | ||

| good deal with a creditworthiness-strong customer | “good deed” | getting a credit line, which you otherwise would not get, implementing of a project, Schufa-free financing |

| Disadvantages | ||

| – | risk that the borrower fails (and you have to repay the credit line yourself!) | – |

Depending on what you think of such creativity in financing matters, you may use the following as a suggestion…

Private Loan agreement (sample contract)

Goldy Goose

Investor Alley 8, 82515 Wolfratshausen – subsequently called “investor”

and

John Smarty

Investment Road 4, 04357 Leipzig – subsequently called “capital site”

agree on the following private loan:

The investor invests Euros 25,000 for one year starting with the incoming payment at the capital site. A fixed interest rate of 8 per cent p. a. is agreed. This has to be paid on the third of the month in the amount of Euros 166.67 to the mentioned current account.

The repayment of the full investment amount plus the remaining interest will automatically take place after one year. If desired, a prolongation of another year can be agreed.

Signatures:

As you can see, this suggestion is kept very simple and comprehensive, different from common loan agreements. You can take the text suggestion as a sample and adjust it according to your desires and personal needs, if you want. For example, you could name a pledge. Be creative!

Ideas, suggestions, questions?

You already know it: Our comments box is available to all smart bank customers.

This could also be of your interest:

- Apply for a credit line or installment loan? (the differences)

- Apply for a credit line up to Euros 5,000

- Experiences with the credit line of the ING

*Name changed

Picture material head shape: Pekchar, fotolia.com

Leave a Reply