Overdraft facility immediately at account opening – even without incoming salary transfer!

I have this overdraft facility on my free current account of the ING-DiBa ► https://www.ing-diba.de/girokonto

Read the story of my own overdraft facility in the second part of this page!

For someone, who attaches importance to a good overdraft facility, the free current account of the ING-DiBa is an outstanding option, because:

- the amount of the overdraft facility is generally three times (!) the monthly salary payment

- the overdraft facility is valid to its full amount from the day of account opening (immediate overdraft facility)

- the actual salary transfer is not necessary (!)

- the ING-DiBa belongs to the banks with the lowest overdraft interestsince many years

- a later top up through further credit lines is possible (s. u.)

- the account management online and unconditionally is free of charge!

- Your way to the overdraft facility: Account opening online – print – sign – add the current salary slip as a copy – legitimate – done.

Start the account opening with immediate overdraft facility:

Information page of the ING-DiBa ► https://www.ing-diba.de/girokonto

Open the online application directly ► https://produkte.banking.ing-diba.de/pub/girokonto

For our readers ► step-by-step instruction

Done within 10 minutes!

Details on the overdraft facility of the ING-DiBa

1. Overdraft facility: three times the salary

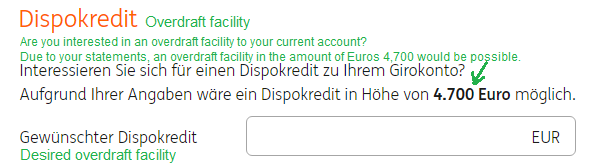

The credit line of the overdraft facility at the ING-DiBa is generally three times the amount of the monthly salary payment.

To avoid misunderstandings: a bank generally makes its calculations using the net-income. You can find this data on your salary slip in the field “Netto-Verdienst” (net-income).

However, the banks deducts shift and weekend-awards for your and the bank´s security. In the end, you only get them, if you work on these abnormal times. This is not ensured at all times and therefore, neither the payment of the award. This applies classically in the case of sickness.

Not deducted will be costs for building assets (capital-forming benefits savings) or a business car, because the bank assumes that you would do it also, if it would not be deducted directly from the salary.

Easily solved for you!

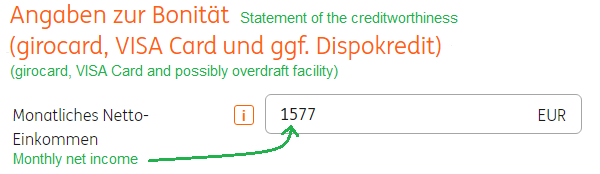

In the online account application, there is a field on page 2, in which you can enter your net-income:

On page 3, you get the approx. 3-times the amount (always rounded to whole hundreds) shown as the currently maximum possible overdraft facility suggestion:

You can enter this amount or a lower one in the field below. If the field remains empty, then no overdraft facility is applied for together with the account opening.

You can apply for the setup of an overdraft facility or change of it anytime after the account opening.

To which amount is the overdraft facility approved?

This depends entirely on the assessment of your current creditworthiness.

For this, the ING-DiBa queries online at the Schufa. If everything is alright and you have entered the exact amount at the net-income, which the bank can find then on the copy of the salary slip, you get the credit line in the amount you applied for.

If you made a mistake in the amount (there are people, who state the gross amount) or if there is negative data at the Schufa, then the ING-DiBa will suggest you a different credit line.

You can reject or agree to this suggestion.

Overdraft facility up to maximum of Euros 10,000 is possible

How you can increase the personal credit line at the ING-DiBa up to a maximum of Euros 35,000, you can find out in the course of this page!

2. Overdraft facility is available immediately to its full amount

In contrast to many other banks – also in contrast to the DKB – one does not have to wait months to show account movements until the bank agrees to the overdraft facility or increases the overdraft facility from an initial low amount.

At the ING-DiBa, the overdraft facility is granted to its full amount together with the account opening and is available immediately.

Theoretically, you could exploit the full credit line as soon as you get the access data for your online banking. For example, through a big transfer.

There are people, who do that. Classically, when they switch the current account and are using the overdraft facility at the former bank. They settle the former overdraft facility (often with a higher overdraft interest rate), so that they can close the account at the former bank.

This is especially meaningful, if the overdraft interest is higher at the former bank or the bank even charges account management fees or fees for the cards to the account. Unfortunately, this is increasingly the case in Germany!

You can discharge your former (expensive) overdraft facility with your new one!

On the other hand, there are people, who want to set up the highest possible credit line only to be financially flexible. You can implement this outstandingly at the ING-DiBa, as you can see in the further details.

3. Salary transfer is not necessary!

If the ING-DiBa has granted you an overdraft facility already with the account opening, then there is no point in waiting for a salary transfer. This is correct!

Also correct is that an actual transfer of your salary to the account at the ING-DiBa for getting the overdraft facility is not necessary at all! It is sufficient for the bank to know that you have a secure income and you have proven this with your salary slip.

A salary payment does not have to be handed in later on!

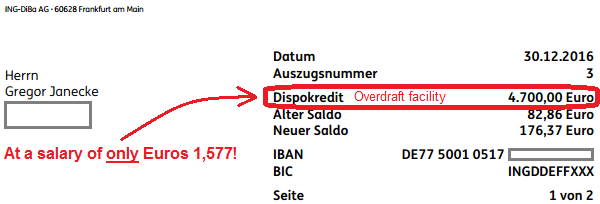

Since 2008, I have my own current account with overdraft facility at the ING-DiBa and never ever transferred my salary to this account – nevertheless, I can dispose of an unaffected credit line of Euros 4,700. More on my own story further below in this article.

Have you also come up with this idea?

Being a smart bank customer, you probably came up with the idea that one can set up a good overdraft facility at two banks with this knowledge: one, at a top-bank, such as the DKB that requires a salary transfer for a big overdraft facility, and one at the ING-DiBa.

If you want to find out more of such “secret advices”, then you should become a reader of our Sunday mail. In our group, we have quite a lot of people, who were able to improve their financial situation considerably through our inspiration and the instructions for copying!

4. Low overdraft interest

Currently, the interest rate at the ING-DiBa is at 6.99 %. Actually, I did not want to mention it at all, because I do not know, whether it will be outdated at the time of reading this article. However, you can check it here: https://www.ing-diba.de/girokonto.

Much more important is knowing, where the bank is situated from the point of interest politics, because the interest changes constantly – most often due to changes of the base rate of the European Central Bank.

The ING-DiBa is, since I observe it actively (so for more than 10 years), always in the more favourable third of all German banks. This is confirmed by the overviews of the Finanztest magazine.

There are German banks with a loan interest rate double as high. If you are a customer of such a bank, then switch today, not tomorrow!

Thanks to the immediate approval of the overdraft facility at the ING-DiBa, this is easily possible. You are welcome to write your feedback via the comments feature at the end of this page.

5. Further option: the credit line of the ING-DiBa

Being Germany´s biggest direct bank, the ING-DiBa offers a whole bunch of financing possibilities: classic instalment loan, car financing, real estate loan, overdraft facility and the credit line. Depending on the creditworthiness, one can combine several or even all loan types.

I want to present the credit line here briefly, because some of our readers really love it!

The credit line works similar to the overdraft facility, but without a current account at this bank!

If one needs money, one starts a transfer to the own current account at another bank. If one wants to pay it back, then one transfers money to the bank account at the ING-DiBa.

Credit line = 2nd overdraft facility

(also possible, if the current account is at another bank)

Once set up, the credit line will be valid unlimited. Moreover, it is completely free of charge – except for the time in which you use it.

Loan interest is always deducted at the 30th of the month from your current account. It does not matter, whether your current account is at the ING-DiBa or at another bank.

A repayment does not take place automatically. If you want, you only pay the monthly interest for the loan (currently, this would be Euros 4.83 per Euros 1,000 loan per month).

However, you also have the possibility to set up a repayment. For example, you arrange to debit Euros 50 or more monthly from you current account. With this, you can build yourself a flexible instalment loan.

What good is an overdraft facility and what the credit line?

Recommendation of the ING-DiBa:

The ING-DiBa recommends the credit line even as a “permanent money reserve and alternative to the overdraft facility”.

The ING-DiBa is an outstanding bank for setting up credit lines!

6. Account management is free of charge without prerequisite!

Again in contrast to many common banks, the current account at the ING-DiBa is really free of charge. Completely without minimum incoming money or salary payments.

The ING-DiBa does not charge fees in the second line, as it has become a trend at other banks, where the Girocard now costs an annual fee or not immediately recognizable costs are charged.

In contrast: at the ING-DiBa, the Visa Card is also free of charge. With this card, withdrawals of cash in the whole Euro-area are free of charge (also at third-party ATMs!).

In this article, we focus on the overdraft facility. The best information about the current account can be found here.

7. Account opening including immediate overdraft facility

- The account opening at the ING-DiBa is applied for online.

- Then you print the account application and sign it.

If you do not have a printer, then you can let the pre-filled application documents after the online filling be sent to you per mail. - Add a copy of your salary slip.

- Do the legitimating (classically PostIdent or via webcam).

- Done: account is opened – overdraft facility is set up!

Ready to start?

“Open free current account with overdraft facility”

Questions?

Please use the comments box at the end of the page!

My experiences with the overdraft facility of the ING-DiBa

As you might know as a readers of our Sunday mail, I have a current account at the ING-DiBa since the year 2008. At the account opening back then, I have applied for the overdraft facility at once.

This was granted to me immediately in 3-times the amount of my then provable income!

… and the credit line has not changed until today! It remained constantly at Euros 4,700.

I would have been able to increase it, because my income increased since then. But I did not. This credit line is enough for me. Especially out of the reason that I hold this account as my reserve. Perhaps you have found out that fact on this page: My private accounts.

I can really recommend this!

I recommend the setup of a reserve account with credit line to smart bank customers. Who knows, for what I can need it? Moreover, the ING-DiBa does not cause problems, if the account is only used little or not at all. Just as it is in my case.

However, there was a time in which I had to bridge a financially challenging situaction for some weeks or months. I took advantage of the whole overdraft facility and repaid it little by little. This was very practical back then, because the money was at my immediate disposal.

Except for the interest back then and a few card uses, the ING-DiBa has not earned a lot through me. Therefore, I honestly recommend it to my readers today:

Here again the links for you:

- Information on the current account ► https://www.ing-diba.de/girokonto

- Open the online application ► https://produkte.banking.ing-diba.de/pub/girokonto

- Information on the credit line ► https://www.ing-diba.de/rahmenkredit

Please note that you need a place of residence or provable address in Germany for the account opening (and for setting up a credit line) at the ING-DiBa.

I have received immediately at the application an overdraft facility of € 500 and after receiving all the access data for the online banking, I immediately applied for the overdraft facility increase and sent the proof of salary to the ING-DiBa (whether it was by post or upload, I cannot remember exactly). After that, the overdraft facility was increased.

In the online application, I did not find any possibility of directly applying for a higher overdraft facility or to submit the proof of salary. However, I was already a customer of the ING (motor vehicle loan) and have applied for the current account online within the customer center. That worked paperless without having to submit additional proof, which I liked very much.

Greetings

Timo

That’s great Timo! If you want to tell us, how high your current overdraft facility is, then I would be grateful for this experience.

Yes, the ING has changed that a few months ago. In the online application, you can currently enter a maximum of € 500 for the overdraft facility. The increase works just like you have described it.