Current Account Comparison: N26 or Norisbank?

Today, we juxtapose two banks from the second row in a comparison. With second row, we refer to the fact that we do not present these two banks as frequently as e.g. the DKB, Comdirect and ING. As a consequence, it is notable that our community uses the N26 and Norisbank rather for a secondary account than a main account.

Perhaps this is different with you. Tell us about it at the end of this page using the comments feature and convince us to use one of the N-banks as a main account in the future. Thank you!

N26 |

Norisbank |

|

|---|---|---|

| Account management fee per month | free of charge | free of charge when complying with one of these requirements:

If no requirement is fulfilled, a fee of € 3.90 applies for the month. |

| Application | ► online | ► online |

| Cards | ||

| Mastercard credit card | no | yes, free of charge |

| Mastercard debit card | Yes, digital card is free of charge and the physical card is available for a shipping fee of € 10. | Yes, the first 12 months are free of charge. Afterwards, there is a yearly fee of € 24. |

| Maestro-Card | Yes, available for German, Austrian and Dutch customers; Costs: one-time fee of € 10 | Yes, free of charge |

| Overdraft facility / Credit line | ||

| Overdraft facility on the current account depending on the creditworthiness and application | € 0 up to 10,000 | € 0 up to 10,000 |

| Credit line on the Mastercard credit card | – | € 500 up to ? |

| Cash supply | ||

| With the Mastercard credit card abroad | – | free of charge at all ATMs with the Mastercard logo |

| With the Mastercard debit card within Germany | free of charge at every ATM | free of charge at all ATMs of the Deutsche Bank |

| Limits? | 3 withdrawals per month | – |

| With the Mastercard debit card around the globe | at the ATM paying an exchange fee of 1.7 % | free of charge at ATMs of the cooperation partners: Bank of America (USA), Barclays (Great Britain), BGL (Luxembourg), BNP Paribas (France), Scotiabank (Canada, Mexico), TEB (Turkey), Westpac (Australia, New Zealand). |

| With the Maestro-Card within Germany | fee of € 2 | free of charge at all ATMs of the Cash Group |

| Alternatives to the ATM? | free of charge with Cash26 in more than 11,500 partner shops in Germany | free of charge at 1,300 Shell gas stations and at the checkout in participating stores at more than 22,000 markets |

| Cash deposits | ||

| Depositing machines | – | free of charge at the machines in the branch offices of the Deutsche Bank |

| Alternatives? | through Cash26 in more than 11,500 partner shops within Germany for a fee of 1.5% | – |

| Storage fee | ||

| Storage fee | for balances above € 50,000 there is a 0.5 % fee per year | for balances above € 100,000 there is a 0.5 % fee per year |

| Account management and communication | ||

| Online-Banking | yes | |

| App-Banking | yes | |

| Telephone-Banking | no | yes Mon–Sun around the clock |

| Availability of the customer service | through chat Mon–Sun 7am-11pm |

through phone (030-310-66000), e-mail Mon–Sun around the clock |

| Supplementing services | ||

| Apple Pay | yes | |

| Google Pay | yes | no |

| Optional joint account or authorized persons | yes | |

| Call money (savings account with immediate availability) | yes | |

| Fixed deposit (savings account with term) | yes | |

| Securities account | no | yes |

| Installment Loan | yes, from € 1,000 up to 25,000 | yes, from € 1,000 up to 65,000 |

| Further financing possibilities | – |

|

| Account opening | ||

| Place of residence | Germany, Austria, Ireland, France, Spain, Italy, Netherlands, Belgium, Portugal, Finland, Luxembourg, Slovenia, Estonia, Greece, Slovakia, Switzerland, Poland, Schweden, Denmark, Norway, Liechtenstein, Iceland, USA | Germany |

| Legitimating | Online legitimating through Video-Ident or Post-Ident | |

| Start account opening |  (read further information) |

(read further information) |

Note regarding further account models

N26 has several account models for private and business clients. In our comparisons, we always compare the best current account without a monthly basic fee, because our community often combines bank services of several providers according to the flag theory.

Individual advantages of the corresponding bank

Leader at banking apps » https://n26.com ?

N26: Modern and powerful banking-app

N26 started six years ago – back then using the name “Number26” – at the German market and simultaneously at the Euro-European market to modernize banking for private customers. The Austrian-German start-up is far more popular outside Germany, because banks are often more expensive and more complicated than in Germany.

The heart-piece at N26 is the multi-functional app. When it started out, the provider was not a bank yet, but only an app that used the bank Wirecard in the background for their transactions. In wise foresight, the app-people have organized a banking licence and the rest of the requirements to operate a bank business.

In the Euro-European comparison, N26 still has one of the absolute best banking-apps for (young) people, who like doing their bank transaction through an app. So N26 is a wonderful choice for opening an account.

No matter of course at neo-banks, but offered at N26 since its beginnings, is the browser-banking. You can log into your bank account using a notebook or PC. Neverthless – and this is a point of critique since years – N26 is not particularly available for customers and interested persons apart from the app/online banking. For example, there are no branch offices and no telephone customer service. However, not every person needs that – but you should know that before the account opening.

Norisbank: using the ATMs and depositing machines of the Deutsche Bank

There are no depositing machines of the Norisbank since more than ten years. The customer service operates through telephone or typing on the keyboard.

However – and this is very dear to many people, who deal with cash – one can use the depositing machines and ATMs in the lobbies of the branch offices of the Deutsche Bank free of charge.

The Norisbank is a daughter company in the company group of the Deutsche Bank.

What further individual advantages are there?

Please supplement this article with more advantages that speak in favor of the account opening and use of N26 and Norisbank using the comments feature.

You are also welcome to post your questions and exchange your experiences among each other. We highly estimate this commitment and it has already brought a lot of positive feedback. A hearty thanks!

Do you already know …?

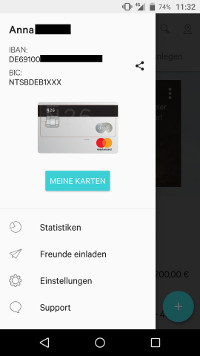

- Anna: the account opening at N26 was worthwhile for me

- Our three big current account banks in a comparison

- Norisbank and DKB in a comparison

Leave a Reply