The best secondary accounts from our community ✅

What benefit can you get from this page?

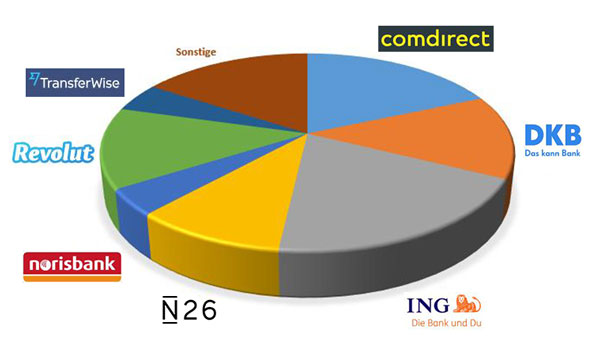

Double: You see at first sight for which bank the “croud” has decided for. Interestingly, these are exactly the three best current accounts of Germany, as we have selected them in this blog article in the year 2016.

That means for you: You can’t do wrong with the opening of one of these accounts!

It becomes truly thrilling, if you take a detailled look at the reasons for and experiences with partially exotic providers. A heartly thanks to each and every one of our community, who has taken such a committed part in this.

However, we were not able to include all postings into the article and some had to be shortened. Altogether, we could create a good overview with your help for all our readers. Please feel free to supplement it, as usual, using the comments feature at the end of this page. A heartly thanks!

The best secondary accounts in an overview:

| Provider | Accound management + cards | Notes by the editorial | Account opening |

|---|---|---|---|

| Top 3 providers | |||

ING ING

Position 1 |

|

Seat of the bank: Germany, but Dutch mother bank |

|

Comdirect Comdirect

Position 2 |

|

Seat of the bank: Germany |

|

DKB DKB

Position 3 |

|

Seat of the bank: Germany |

|

| Chasing pack | |||

Revolut Revolut

Position 4 |

|

Seat of the provider: Great Britain |

|

N26 N26

Position 5 |

|

Seat of the bank: Germany |

|

TransferWise TransferWise

Position 6 |

|

Seat of the provider: Great Britain |

|

| Far behind | |||

Norisbank Norisbank

Position 7 |

|

Seat of the bank: Germany |

|

Fidor Fidor

Position 8 |

|

Seat of the bank: Germany, but French mother bank |

|

1822direkt 1822direkt

Position 9 |

|

Seat of the bank: Germany |

|

| Outcasts | |||

Audibank Audibank

Position 10 |

|

Seat of the bank: Germany |

|

bunq bunq

Position 10 |

|

Seat of the bank: Netherlands |

|

Consorsbank Consorsbank

Position 10 |

|

Seat of the bank: Germany, but French mother bank |

|

Deutsche Bank Deutsche Bank

Position 10 |

|

Seat of the bank: Germany |

|

Deutsche Skatbank Deutsche Skatbank

Position 10 |

|

Seat of the bank: Germany |

|

Ferratum Ferratum

Position 10 |

|

Seat of the bank: Malta |

|

Mistertango Mistertango

Position 10 |

|

Seat of the provider: Lithuania | |

Moneyou Moneyou

Position 10 |

|

Seat of the provider: Netherlands ⇒ readers’ reports |

|

o2-Banking o2-Banking

Position 10 |

|

Seat of the provider: Germany, but French mother bank ⇒ readers’ reports |

|

Onlinekonto Onlinekonto

Position 10 |

|

Seat of the provider: Germany |

|

| Note of the editorial: It was no surprise to us that the first three positions were our favourites. They are Germany’s best direct banks with each outstanding account models, which can be used just as well as a secondary or sideline account. It was a surprise that two foreign (British) providers managed to get on the positions 4 and 6. In the meantime, we think that the trend of holding a secondary account abroad will become stronger. More about that soon in our Sunday mail. |

|||

How the ranking arose

The actual idea for the today’s article has been given by a frequent reader of our portal. Subsequently, we made a survey among our subscribers. Due to this fact and because there were less than 1,000 votings, the survey is not representative for Germany – but it is for our community!

One was able to add a personal note to the voting using the text field. Many took advantage of that. You can find extracts of them in the next section. Stating the name was not obligatory, so we do not have the author of every text. For many, the providing of ideas and experiences was more important in order to strengthen the quality of our smart-bank-customer-community and this is worthwhile for all and for the single person.

A heartly thanks for your great support!

Notes and experiences of our community (in alphabetical order)

Bunq

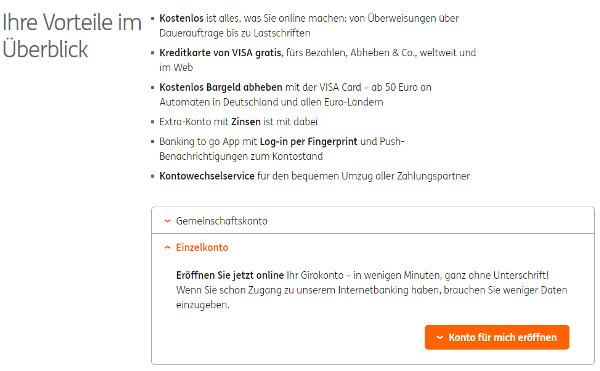

Comdirect

Note by Gregor: Yes, I felt just the same. When I opened my first Comdirect account many many years ago, I could not imagine how valuable this bank would become for me.

I use it today as my secondary bank with regard to the current account. It became my primary bank for depots and the customer service is by far the best in Germany. Perhaps you can read the article 3 secrets for Comdirect customers.

From time to time, there are financial incentives to open the account at the Comdirect. Do you want to check the current offer?

► https://www.comdirect.de/cms/lp/giro

DKB

The salary as well as the regular costs, such as rent, electricity, gas and insurances are paid through the main account at the ING. A monthly fixed amount (e.g. Euros 1,000) is automatically transferred to the DKB call money account. Another part (e.g. Euros 300) is automatically transferred to the DKB-broker for ETF savings plans. The remaining money (in the example it is Euros 400) are transferred by standing order to the DKB Visa Card.

I use the DKB Visa Card as my “allowance card” for my spare time and other activities. This is the optimal organisation of my finances.

The ING-account virtually runs by itself. The money is deposited and all bills are paid, without having to take care of anything. This way, the account is always funded, however, there is never not too much money in the current account pointlessly.

I build my savings at the DKB, because the total package is just great. The call money and the broker have fair conditions, the overview is great and everything is under one roof.

I have the best credit card, in my point of view it is the DKB Visa Card, always with me for my private pleasure. One can, of course, deliberately switch the banks for this system. I personally regard the ING for the solely current account at position 1, in contrast, the DKB is the position 1 as the “allrounder” that can do everything.

Daniel S.

Note by Gregor: Daniel guarantees himself the active status (= premium conditions) at the DKB with the standing orders. A very beautiful model!

– how many transactions do I have to make to make my account being “safe” of cancelling.

– we can see it in banks, such as the DKB, if the client has the main account somewhere else.

– Are there some tricks to get more from the accounts, than “only” using e.g. the ING as the account for the expenditure transactions?

Alex

All-clear: Whether the DKB nor the ING cancel current accounts, if they are used little or not at all. There were no transactions in my ING current account for 4 years and neverthless, everything remained free of charge, including the overdraft facility in the amount of € 4,700.

Did you know? The DKB is the German bank that has the highest number of Visa Cards in circulation!

► https://www.dkb.de/privatkunden/dkb_cash/

ING

Ideal secondary account!

The current account at the ING really is the ideal secondary account, as one can easily find out peeking into the conditions:

- free account management without any conditions, such as salary transfer or minimum incoming money flow

- permanently free Visa and Girocard

- withdraw cash free of charge

- up to Euros 10,000 overdraft facility without salary transfer + additional credit line of up to Euros 25,000

- account management possible as a joint account and/or with authorized persons

- easy online account opening.

This is the view of by far most people of our community, who have opened the ING account and use it as their secondary account.

Questions on the ING as a secondary account?

Please post them through the comments feature. At such a big use, you will surely receive good answers quickly!

The secondary account, which is most chosen by smart bank customers!

► https://www.ing.de/lp/girokonto

Ferratum Bank

Martin S.

You desire a free current account in the EU-abroad with management through the Smartphone?

► https://www.ferratumbank.com/de/

Fidor Bank

Note by Gregor: In the year 2015, we had several articles about the Fidor Bank and I myself hold a test account there. Altogether, the bank has never managed to convince me permanently. Since it has been sold to France, I have become even more reserved. However, this does not mean that it cannot be a great solution for others.

Is anyone willing to present the Fidor-account in detail in a guest article to us?

► https://www.fidor.de/personal-banking/smart-account

Moneyou

O2 Banking

How does it look like with advantages for mobile phone customers of O2?

► https://o2banking.fidor.de/kostenloses-girokonto

Revolut

Rounding off through DKB, ING and Revolut

I have convinced the administrator of our GEG Garageneigentümergemeinschaft (garage owner association), who we garage owners hired for the administration, to let all her objects, that she manages as the administrar, run through the DKB administrator plattform. I have gathered all possible information about it and have presented them to her comprehensibly, so that the administrator has switched to the DKB – coming from the Sparkasse – with all her managed objects. From the 1st of April 2019, this same administrator will take professional care also of our WEG Wohnungseigentümergemeinschaft (apartment owner association). From this point of time, also our apartment owner association will switch from the Sparkasse to the DKB administrator plattform. I assume that the administrator will recommend the DKB to other administrators, because the administrator is very satisfied with the DKB and the administrator plattform. All is done thanks to you Gregor, by your informations that I took and forwarded.

I would either recommend the ING or the Revolut as a secondary account. At Revolut, I am missing the possibility of being able to implement the online banking through the homepage through the browser. Moreover, we would need – as a precaution – a second Android Smartphone or an Android Tablett. Fire Tablett by AMAZON has no Revolut App, Windows Smartphone neither and unfortunately, you cannot use Revolut at the desktop computer or laptop. A Windows App for Windows PC does not exist. Additionally, some German companies require a German IBAN for payments. However, Revolut has a Lithuanian IBAN, there is also a Lithuanian banking licence for the whole EU. European banking licences with EU IBAN numbers must be accepted within the whole EU, but this is not the case. Very many companies have not yet realized that the fees for credit card transactions have been reduced. It is useless telling the companies about it, the companies do not believe it and do not change it. The same applies to the Lithuanian banking licences that are not accepted by all companies in Germany. Revolut is not to blame, but you cannot use Revolut to its full extense. Therefore, you can use Revolut only as a secondary account, as the primary account of course it is the DKB. As a replacement also the ING.

I do not recommend the Comdirekt and we do not want to use it, because it could very well be that the Commerzbank and Deutsche Bank will merge. The Comdirekt is a daughter company of the Commerzbank and would therefore also be affected. I have read that the politics desire the merging of the Commerzbank and Deutsche Bank. Revolut has quite a lot more individual settings possibilities, compared to N26. Moreover, I have repeatedly read in Internet forums that N26 cancels accounts and clients that are not profitable for N26, so N26 is out of the game. Since recently, TransferWise with the Mastercard surely is an alternative for many people, who travel a lot abroad. I only know few things about the Norisbank, so I cannot recommend the bank as a secondary account. My recommendation as the primary account obviously is DKB Cash, secondary account ING or Revolut.

Werner S.

Do you have a secondary account?

If not, I recommend to apply for one urgently today. You have received a lot of inspiration for choosing through the table as well as through the readers’ reports.

But why is it so important to have a good secondary account?

Can you imagine that your account is blocked. Now and immediately.

That cannot happen to you?

You are a well-behaving citizen and tax payer? Well done! It does not even have to be the well-known “mistake by the authority” – it can also be online fraud. You are the victim and your account is blocked immediately. Account number “burned”.

Or you have entered the wrong password three-times, just like it happened to me already.

You see, we do not even have to mention the advantages, such as expenditure allocation, withdrawing cash cheaper, cash deposit account or a two-accounts-model in order to create motivation!

Thousands of accounts are blocked in Germany day by day. Out of very different reasons, as we notice occationally in the editorial. From our point of view, it is urgently recommended to a smart and with foresight-acting bank customer to have a second current account and set it up, so that it can take the main features in an emergency.

You also sign insurance contracts, hoping that you do not need them. But if you need them, you are glad to have them. In contrast to insurances, almost all of the above mentioned secondary account-suggestions are permanently free of charge. What are you waiting for?

Questions and article supplements

You are welcome to use our comments feature to ask questions about the secondary accounts and their openings , as well as to report about your ideas and experiences. This will be possibly an impuls for a new big article – just like this article has been created due to a reader’s letter.

A heartly thanks for your commitment and your recommendation!

Explanation video by the author:

This could interest you too:

- Open DKB or ING account?

- Open ING as a joint account?

- Open a business account online in Germany for an abroad company

Leave a Reply